《西方经济学》课程PPT教学课件(微观经济学)Chapter 05 Choice under Uncertainty

Chapter 5 Choice under Uncertainty Chapter Outline >Describing Risk Preferences Toward Risk >Reducing Risk >The Demand for Risky Assets

Chapter 5 Choice under Uncertainty Chapter Outline ➢ Describing Risk ➢ Preferences Toward Risk ➢ Reducing Risk ➢ The Demand for Risky Assets

So far,we have assumed that prices,incomes,and other variables are known with certainty. However,many of the choices that people make involve considerable uncertainty. Most people,for example,borrow to finance large purchases,such as a house or a college education,and plan to pay for them out of future income

So far, we have assumed that prices, incomes, and other variables are known with certainty. However, many of the choices that people make involve considerable uncertainty. Most people, for example, borrow to finance large purchases, such as a house or a college education, and plan to pay for them out of future income

But for most of us,future incomes are uncertain.Our earnings can go up or down;we can be promoted or demoted,or even lose our jobs.And if we delay buying a house or investing in a college education,we risk price rise increases that could make such purchases less affordable(担负得起的). How should we take these uncertainties into account when making major consumption or investment decisions?

But for most of us, future incomes are uncertain. Our earnings can go up or down; we can be promoted or demoted, or even lose our jobs. And if we delay buying a house or investing in a college education, we risk price rise increases that could make such purchases less affordable(担负得起的). How should we take these uncertainties into account when making major consumption or investment decisions?

Sometimes we must choose how much risk to bear() What,for example,should you do with your savings? Should you invest your money in something safe,such as a savings account(储蓄存款帐户),or something riskier but potentially more lucrative(有利的,赚钱的),such as the stock market?

Sometimes we must choose how much risk to bear(承担). What, for example, should you do with your savings? Should you invest your money in something safe, such as a savings account(储蓄存款帐户), or something riskier but potentially more lucrative (有利的,赚钱的),such as the stock market?

We will answer such questions by taking the following steps: In order to compare the riskiness of alternative choices,we need to quantify(量化)risk. We will examine people's preferences toward risk.Most people find risk undesirable(不受欢迎的,but some people find it more undesirable than others. We will see how people can sometimes reduce or eliminate risk.Sometimes risk can be reduced by diversification,by buying insurance,or by investing in additional information

We will answer such questions by taking the following steps: ✓ In order to compare the riskiness of alternative choices, we need to quantify (量化) risk. ✓ We will examine people's preferences toward risk. Most people find risk undesirable(不受欢迎的), but some people find it more undesirable than others. ✓ We will see how people can sometimes reduce or eliminate risk. Sometimes risk can be reduced by diversification, by buying insurance, or by investing in additional information

In some situations,people must choose the amount of risk they wish to bear.A good example is investing in stocks or bonds.We will see that such investments involve tradeoffs between the monetary gain that one can expect and the riskiness of that gain

✓ In some situations, people must choose the amount of risk they wish to bear. A good example is investing in stocks or bonds. We will see that such investments involve tradeoffs between the monetary gain that one can expect and the riskiness of that gain

5.1 Describing Risk Probability-Likelihood that a given outcome will occur. Economist Frank Knight distinguished between uncertainty and risk some 60 years ago. Uncertainty can refer to situations in which many outcomes are possible but their likelihoods unknown. Risk then refers to situations in which we can list all possible outcomes and know the likelihood of each occurring ()

5.1 Describing Risk ❑ Probability-Likelihood that a given outcome will occur. ❑ Economist Frank Knight distinguished between uncertainty and risk some 60 years ago. ✓ Uncertainty can refer to situations in which many outcomes are possible but their likelihoods unknown. ✓ Risk then refers to situations in which we can list all possible outcomes and know the likelihood of each occurring (事件)

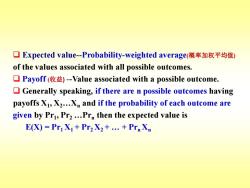

▣Expected value-Probability-weighted average(概率加权平均值) of the values associated with all possible outcomes. ▣Payoff(收益)-Value associated with a possible outcome. Generally speaking,if there are n possible outcomes having payoffs X1,X2.Xn and if the probability of each outcome are given by Pr,Pr2.Prn then the expected value is E(X)=PriX1+Pr2X2+.+PrnXn

❑ Expected value-Probability-weighted average(概率加权平均值) of the values associated with all possible outcomes. ❑ Payoff (收益) -Value associated with a possible outcome. ❑ Generally speaking, if there are n possible outcomes having payoffs X1 , X2.Xn and if the probability of each outcome are given by Pr1 , Pr2 .Prn then the expected value is E(X) = Pr1 X1 + Pr2 X2 + . + Prn Xn

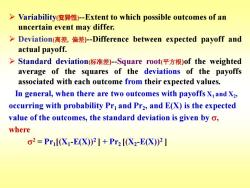

>Variability变异性)-Extent to which possible outcomes of an uncertain event may differ. >Deviation(离差,偏差)-Difference between expected payoff and actual payoff. >Standard deviation(标准差)-Square root平方根)of the weighted average of the squares of the deviations of the payoffs associated with each outcome from their expected values. In general,when there are two outcomes with payoffs X and X2, occurring with probability Pr and Pr2,and E(X)is the expected value of the outcomes,the standard deviation is given by o, where σ2=Pr[X1-E(X)2]+Pr2[X2-EX)2]

➢ Variability(变异性)-Extent to which possible outcomes of an uncertain event may differ. ➢ Deviation(离差, 偏差)-Difference between expected payoff and actual payoff. ➢ Standard deviation(标准差)-Square root(平方根)of the weighted average of the squares of the deviations of the payoffs associated with each outcome from their expected values. In general, when there are two outcomes with payoffs X1 and X2 , occurring with probability Pr1 and Pr2 , and E(X) is the expected value of the outcomes, the standard deviation is given by , where 2 = Pr1 [(X1 -E(X)) 2 ] + Pr2 [(X2 -E(X)) 2 ]

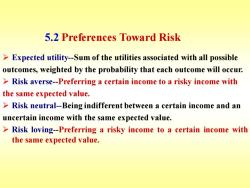

5.2 Preferences Toward Risk Expected utility-Sum of the utilities associated with all possible outcomes,weighted by the probability that each outcome will occur. Risk averse-Preferring a certain income to a risky income with the same expected value. Risk neutral-Being indifferent between a certain income and an uncertain income with the same expected value. Risk loving-Preferring a risky income to a certain income with the same expected value

➢ Expected utility-Sum of the utilities associated with all possible outcomes, weighted by the probability that each outcome will occur. ➢ Risk averse-Preferring a certain income to a risky income with the same expected value. ➢ Risk neutral-Being indifferent between a certain income and an uncertain income with the same expected value. ➢ Risk loving-Preferring a risky income to a certain income with the same expected value. 5.2 Preferences Toward Risk

按次数下载不扣除下载券;

注册用户24小时内重复下载只扣除一次;

顺序:VIP每日次数-->可用次数-->下载券;

- 《西方经济学》课程PPT教学课件(微观经济学)Chapter 04 Individual and Market Demand.ppt

- 《西方经济学》课程PPT教学课件(微观经济学)Chapter 03 Consumer Behavior.ppt

- 《西方经济学》课程PPT教学课件(微观经济学)Chapter 02 The Basics of Supply and Demand.ppt

- 《西方经济学》课程PPT教学课件(微观经济学)Chapter 01 Preliminaries.ppt

- 《西方经济学》课程PPT教学课件(宏观经济学)Chapter 19 Advances in Business Cycle theory.ppt

- 《西方经济学》课程PPT教学课件(宏观经济学)Chapter 17 Investment.ppt

- 《西方经济学》课程PPT教学课件(宏观经济学)Chapter 18 Money supply and monetary Policy.ppt

- 《西方经济学》课程PPT教学课件(宏观经济学)Chapter 16 Consumption.ppt

- 《西方经济学》课程PPT教学课件(宏观经济学)Chapter 15Government Debt and Budget Deficits.ppt

- 《西方经济学》课程PPT教学课件(宏观经济学)Chapter 14 Stabilization Policy.ppt

- 《西方经济学》课程PPT教学课件(宏观经济学)Chapter 13 Aggregate supply.ppt

- 《西方经济学》课程PPT教学课件(宏观经济学)Chapter 12 Aggregate demand in open economy.ppt

- 《西方经济学》课程PPT教学课件(宏观经济学)Chapter 11 Application of IS-LM model.ppt

- 《西方经济学》课程PPT教学课件(宏观经济学)Chapter 10 The IS-LM model.ppt

- 《西方经济学》课程PPT教学课件(宏观经济学)Chapter 09 Introduction to AS-AD model.ppt

- 《西方经济学》课程PPT教学课件(宏观经济学)Chapter 07 Economic growth(1/2).ppt

- 《西方经济学》课程PPT教学课件(宏观经济学)Chapter 08 Economic growth(2/2).ppt

- 《西方经济学》课程PPT教学课件(宏观经济学)Chapter 06 Unemployment.ppt

- 《西方经济学》课程PPT教学课件(宏观经济学)Chapter 05 The open economy.ppt

- 《西方经济学》课程PPT教学课件(宏观经济学)Chapter 04 Money and inflation.ppt

- 《西方经济学》课程PPT教学课件(微观经济学)Chapter 06 Production.ppt

- 《西方经济学》课程PPT教学课件(微观经济学)Chapter 07 The Cost of Production.ppt

- 《西方经济学》课程PPT教学课件(微观经济学)Chapter 08 Profit Maximization and Competitive Supply.ppt

- 《西方经济学》课程PPT教学课件(微观经济学)Chapter 09 The Analysis of Competitive Markets.ppt

- 《西方经济学》课程PPT教学课件(微观经济学)Chapter 10 Market Power.ppt

- 《西方经济学》课程PPT教学课件(微观经济学)Chapter 11 Pricing with Market Power.ppt

- 《西方经济学》课程PPT教学课件(微观经济学)Chapter 12 Monopolistic Competition.ppt

- 《西方经济学》课程PPT教学课件(微观经济学)Chapter 13 Game Theory.ppt

- 《西方经济学》课程PPT教学课件(微观经济学)Chapter 14 Markets for Factor Inputs.ppt

- 《西方经济学》课程PPT教学课件(微观经济学)Chapter 15 Investment, Time, and Capital.ppt

- 《西方经济学》课程PPT教学课件(微观经济学)Chapter 16 General Equilibrium and Economic Efficiency.ppt

- 《西方经济学》课程PPT教学课件(微观经济学)Chapter 17 Markets with Asymmetric Information.ppt

- 《西方经济学》课程PPT教学课件(微观经济学)Chapter 18 Externalities.ppt

- 《西方经济学》课程PPT教学课件(微观经济学)Chapter 17 Microeconomics.ppt

- 海南大学:《成本会计》课程课程教学大纲 COST ACCOUNTING.pdf

- 海南大学:《成本会计》课程教学资源(教案讲义)第一章 总论.doc

- 海南大学:《成本会计》课程教学资源(教案讲义)第三章 成本汇集与分配.doc

- 海南大学:《成本会计》课程教学资源(教案讲义)第二章 成本核算方法体系.doc

- 海南大学:《成本会计》课程教学资源(教案讲义)第五章 分步成本计算.doc

- 海南大学:《成本会计》课程教学资源(教案讲义)第六章 分类法.doc