《西方经济学》课程PPT教学课件(宏观经济学)Chapter 04 Money and inflation

CHAPTER FOUR Money and Inflation macroeconomics N.Gregory Mankiw College of Management,HUST

macroeconomics N. Gregory Mankiw macro College of Management, HUST CHAPTER FOUR Money and Inflation

In this chapter you will learn -The classical theory of inflation causes effects social costs "Classical"-assumes prices are flexible markets clear. Applies to the long run. CHAPTER 7 Money and Inflation slide 1

CHAPTER 7 Money and Inflation slide 1 In this chapter you will learn ▪ The classical theory of inflation – causes – effects – social costs ▪ “Classical” - assumes prices are flexible & markets clear. ▪ Applies to the long run

Content 1.Money and money supply 2.The quantity theory of money 3.The Fisher effect 4.The money demand function 5.The social costs of inflation 6.Hyperinflation 7.The Classical Dichotomy 8.Chapter summary CHAPTER 7 Money and Inflation slide 2

CHAPTER 7 Money and Inflation slide 2 Content 1. Money and money supply 2. The quantity theory of money 3. The Fisher effect 4. The money demand function 5. The social costs of inflation 6. Hyperinflation 7. The Classical Dichotomy 8. Chapter summary

1 Money:definition Money is the stock of assets that can be @ AL11695679A readily used to make transactions. CHAPTER 7 Money and Inflation slide 3

CHAPTER 7 Money and Inflation slide 3 Money: definition Money is the stock of assets that can be readily used to make transactions. 1

Money:functions 1. medium of exchange we use it to buy stuff 2.store of value transfers purchasing power from the present to the future 3.unit of account the common unit by which everyone measures prices and values CHAPTER 7 Money and Inflation slide 4

CHAPTER 7 Money and Inflation slide 4 Money: functions 1. medium of exchange we use it to buy stuff 2. store of value transfers purchasing power from the present to the future 3. unit of account the common unit by which everyone measures prices and values 1

1 Money:types 1.fiat money has no intrinsic value example:the paper currency we use 2.commodity money ·has intrinsic value ·examples.gold coins, cigarettes in P.O.W.camps CHAPTER 7 Money and Inflation slide 5

CHAPTER 7 Money and Inflation slide 5 Money: types 1. fiat money • has no intrinsic value • example: the paper currency we use 2. commodity money • has intrinsic value • examples: gold coins, cigarettes in P.O.W. camps 1

1 Discussion Question Which of these are money? a.Currency b.Checks c.Deposits in checking accounts (called demand deposits) d.( Credit cards e. Certificates of deposit (called time deposits) CHAPTER 7 Money and Inflation slide 6

CHAPTER 7 Money and Inflation slide 6 Discussion Question Which of these are money? a. Currency b. Checks c. Deposits in checking accounts (called demand deposits) d. Credit cards e. Certificates of deposit (called time deposits) 1

The money supply monetary policy -The money supply is the quantity of money available in the economy. -Monetary policy is the control over the money supply. CHAPTER 7 Money and Inflation slide 7

CHAPTER 7 Money and Inflation slide 7 The money supply & monetary policy ▪ The money supply is the quantity of money available in the economy. ▪ Monetary policy is the control over the money supply. 1

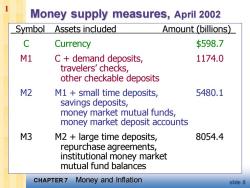

Money supply measures,April 2002 Symbol Assets included Amount (billions) C Currency $598.7 M1 C demand deposits, 1174.0 travelers'checks, other checkable deposits M2 M1 small time deposits, 5480.1 savings deposits, money market mutual funds, money market deposit accounts M3 M2 large time deposits, 8054.4 repurchase agreements, institutional money market mutual fund balances CHAPTER 7 Money and Inflation slide 8

CHAPTER 7 Money and Inflation slide 8 Money supply measures, April 2002 _Symbol Assets included Amount (billions)_ C Currency $598.7 M1 C + demand deposits, 1174.0 travelers’ checks, other checkable deposits M2 M1 + small time deposits, 5480.1 savings deposits, money market mutual funds, money market deposit accounts M3 M2 + large time deposits, 8054.4 repurchase agreements, institutional money market mutual fund balances 1

1 The central bank Monetary policy is conducted by a country's central bank. In the U.S., the central bank is called the Federal Reserve ("the Fed"). The Federal Reserve Building Washington,DC Return CHAPTER 7 Money and Inflation slide 9

CHAPTER 7 Money and Inflation slide 9 The central bank ▪ Monetary policy is conducted by a country’s central bank. ▪ In the U.S., the central bank is called the Federal Reserve (“the Fed”). The Federal Reserve Building Washington, DC Return 1

按次数下载不扣除下载券;

注册用户24小时内重复下载只扣除一次;

顺序:VIP每日次数-->可用次数-->下载券;

- 《西方经济学》课程PPT教学课件(宏观经济学)Chapter 03 Where NI comes from and goes.ppt

- 《西方经济学》课程PPT教学课件(宏观经济学)Chapter 02 The Data of Macroeconomics.ppt

- 《西方经济学》课程PPT教学课件(宏观经济学)Chapter 01 The Science of Macroeconomics.ppt

- 海南大学:《西方经济学》课程试卷解答(微观经济学)2009-2010微观经济学(A)试卷.doc

- 海南大学:《西方经济学》课程试卷解答(微观经济学)2009-2010微观经济学(B)试卷.doc

- 海南大学:《西方经济学》课程试卷解答(微观经济学)2009-2010微观经济学(B)答案.doc

- 海南大学:《西方经济学》课程试卷解答(微观经济学)2008-2009学年度第1学期微观经济学(B)试卷.doc

- 海南大学:《西方经济学》课程试卷解答(微观经济学)2008-2009学年度第1学期微观经济学(B)答案.doc

- 海南大学:《西方经济学》课程试卷解答(微观经济学)2006-2007学年度第1学期微观经济学(B)试卷.doc

- 海南大学:《西方经济学》课程试卷解答(微观经济学)2006-2007学年度第1学期微观经济学(B)答案.doc

- 海南大学:《西方经济学》课程试卷解答(微观经济学)2006-2007微观经济学(A)试卷.doc

- 海南大学:《西方经济学》课程试卷解答(微观经济学)2006-2007微观经济学(A)答案.doc

- 海南大学:《西方经济学》课程试卷解答(微观经济学)名词解释(英文).doc

- 海南大学:《西方经济学》课程试卷解答(微观经济学)2009-2010微观经济学(A)答案.doc

- 海南大学:《西方经济学》课程试卷解答(微观经济学)2008-2009微观经济学期终考试(A)试卷.doc

- 海南大学:《西方经济学》课程试卷解答(微观经济学)2008-2009微观经济学期终考试(A)答案.doc

- 海南大学:《西方经济学》课程试卷解答(微观经济学)2007-2008微观经济学期终考试(B)试卷.doc

- 海南大学:《西方经济学》课程试卷解答(微观经济学)2007-2008微观经济学期终考试(A)答案.doc

- 海南大学:《西方经济学》课程试卷解答(微观经济学)2007-2008微观经济学期终考试(A)试卷.doc

- 海南大学:《西方经济学》课程试卷解答(微观经济学)2007-2008微观经济学期终考试(B)答案.doc

- 《西方经济学》课程PPT教学课件(宏观经济学)Chapter 05 The open economy.ppt

- 《西方经济学》课程PPT教学课件(宏观经济学)Chapter 06 Unemployment.ppt

- 《西方经济学》课程PPT教学课件(宏观经济学)Chapter 08 Economic growth(2/2).ppt

- 《西方经济学》课程PPT教学课件(宏观经济学)Chapter 07 Economic growth(1/2).ppt

- 《西方经济学》课程PPT教学课件(宏观经济学)Chapter 09 Introduction to AS-AD model.ppt

- 《西方经济学》课程PPT教学课件(宏观经济学)Chapter 10 The IS-LM model.ppt

- 《西方经济学》课程PPT教学课件(宏观经济学)Chapter 11 Application of IS-LM model.ppt

- 《西方经济学》课程PPT教学课件(宏观经济学)Chapter 12 Aggregate demand in open economy.ppt

- 《西方经济学》课程PPT教学课件(宏观经济学)Chapter 13 Aggregate supply.ppt

- 《西方经济学》课程PPT教学课件(宏观经济学)Chapter 14 Stabilization Policy.ppt

- 《西方经济学》课程PPT教学课件(宏观经济学)Chapter 15Government Debt and Budget Deficits.ppt

- 《西方经济学》课程PPT教学课件(宏观经济学)Chapter 16 Consumption.ppt

- 《西方经济学》课程PPT教学课件(宏观经济学)Chapter 18 Money supply and monetary Policy.ppt

- 《西方经济学》课程PPT教学课件(宏观经济学)Chapter 17 Investment.ppt

- 《西方经济学》课程PPT教学课件(宏观经济学)Chapter 19 Advances in Business Cycle theory.ppt

- 《西方经济学》课程PPT教学课件(微观经济学)Chapter 01 Preliminaries.ppt

- 《西方经济学》课程PPT教学课件(微观经济学)Chapter 02 The Basics of Supply and Demand.ppt

- 《西方经济学》课程PPT教学课件(微观经济学)Chapter 03 Consumer Behavior.ppt

- 《西方经济学》课程PPT教学课件(微观经济学)Chapter 04 Individual and Market Demand.ppt

- 《西方经济学》课程PPT教学课件(微观经济学)Chapter 05 Choice under Uncertainty.ppt