海南大学:《西方经济学》课程试卷解答(微观经济学)2006-2007微观经济学(A)试卷

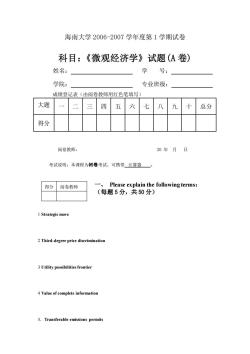

海南大学2006-2007学年度第1学期试卷 科目:《微观经济学》试题(A卷) 姓名: 学号: 学院: 专业班级: 成绩登记表(由阅卷教师用红色笔填写) 大题 四 六 八 九 总分 得分 阅卷教师: 20年月日 考试说明:本课程为闭卷考试,可携带计算器一。 得分阅卷教师 Please explain the following terms: (每题5分,共50分) Strategic move 2 Third-degree price discrimination 3Utility possibilities frontier 4 Value of complete information 5.Transferable emissions permits

海南大学 2006-2007 学年度第 1 学期试卷 科目:《微观经济学》试题(A 卷) 姓名: 学 号: 学院: 专业班级: 成绩登记表(由阅卷教师用红色笔填写) 大题 号 一 二 三 四 五 六 七 八 九 十 总分 得分 阅卷教师: 20 年 月 日 考试说明:本课程为闭卷考试,可携带 计算器 。 一、 Please explain the following terms: (每题 5 分,共 50 分) 1 Strategic move 2 Third-degree price discrimination 3 Utility possibilities frontier 4 Value of complete information 5.Transferable emissions permits 得分 阅卷教师

6Substitution effec 7 Sunk cos 8 Stackelberg model 9Shirking model 10 Prospective sunk cos 得分阅卷教师 二、简答题:(共10分) 1.You are in the market for a new house and have decided to bid for a house at auction.You believe that the value ofthe house is between $125,000 and $150,000 but you are uncertain as to where in the range it might be.You do know,however, that the seller has reserved the right to withdraw the house from the market if the winning bid is not satisfactory. a.Should you bid in this auction?Why or why not? contracto Yon plan to mprove the bowean How does this situat affect your nswer to(a)? Does it depend on the extent to which your skills are uniquely suitable to improving this particular house? 得分阅卷教师 三、Calculation:(每题20分,共40分) 1.We can think of the U.S.and Japanese trade policies as a prisoners'dilemma The two countries are conside ering policie es to open or close their import markets

6 Substitution effect 7 Sunk cost 8 Stackelberg model 9 Shirking model 10 Prospective sunk cost 二、简答题:(共 10 分) 1. You are in the market for a new house and have decided to bid for a house at auction. You believe that the value of the house is between $125,000 and $150,000, but you are uncertain as to where in the range it might be. You do know, however, that the seller has reserved the right to withdraw the house from the market if the winning bid is not satisfactory. a. Should you bid in this auction? Why or why not? b. Suppose you are a building contractor. You plan to improve the house and then to resell it at a profit. How does this situation affect your answer to (a)? Does it depend on the extent to which your skills are uniquely suitable to improving this particular house? 三、Calculation:(每题 20 分,共 40 分) 1. We can think of the U.S. and Japanese trade policies as a prisoners’ dilemma. The two countries are considering policies to open or close their import markets. 得分 阅卷教师 得分 阅卷教师

Suppose the payoffmatrix is: Japan Open Close Open 10,10 6,5 U.S. Close -100.5 1,1 a.Assume that each country knows the payoffmatrix and believes that the other country will act in its own interest.Does either country have a dominant strategy?What will be the equilibrium policies if each country acts rationally to maximize its welfare? b.Now assume that Japan is not certain that the U.S.will behave rationally.In particular,Japan is concerned that U.S.politicians may want to penalize Japan even if that does not maximize U.S.welfare.How might this affect Japan's choice of strategy?How might this change the equilibrium? 2.Consider two firms facing the demand curve P=50-5Q where Q=+ The firms'cost functions are C(Q)=20+10Q and Ca(Q)=10+12Q a.Suppose both firms have entered the industry.What is the joint profit maximizing level of output?How much will each firm produce?How w ould your answer change if the firms have not yet entered the industry? b.What is each firm's equilibrium output and profit if they behave noncooperatively?Use the Cournot model.Draw the firms'reaction curves and show the equilibrium. e.How much should Firm 1 be willing to pay to purchase Firm 2 if collusion is illegal but the takeover is not?

Suppose the payoff matrix is: Japan Open Close Open 10, 10 5, 5 U.S. Close -100, 5 1, 1 a.Assume that each country knows the payoff matrix and believes that the other country will act in its own interest. Does either country have a dominant strategy? What will be the equilibrium policies if each country acts rationally to maximize its welfare? b. Now assume that Japan is not certain that the U.S. will behave rationally. In particular, Japan is concerned that U.S. politicians may want to penalize Japan even if that does not maximize U.S. welfare. How might this affect Japan’s choice of strategy? How might this change the equilibrium? 2. Consider two firms facing the demand curve P = 50 - 5Q, where Q = Q1 + Q2 . The firms’ cost functions are C1 (Q1 ) = 20 + 10Q1 and C2 (Q2 ) = 10 + 12Q2 . a.Suppose both firms have entered the industry. What is the joint profit maximizing level of output? How much will each firm produce? How would your answer change if the firms have not yet entered the industry? b.What is each firm’s equilibrium output and profit if they behave noncooperatively? Use the Cournot model. Draw the firms’ reaction curves and show the equilibrium. c.How much should Firm 1 be willing to pay to purchase Firm 2 if collusion is illegal but the takeover is not?

按次数下载不扣除下载券;

注册用户24小时内重复下载只扣除一次;

顺序:VIP每日次数-->可用次数-->下载券;

- 海南大学:《西方经济学》课程试卷解答(微观经济学)2006-2007微观经济学(A)答案.doc

- 海南大学:《西方经济学》课程试卷解答(微观经济学)名词解释(英文).doc

- 海南大学:《西方经济学》课程试卷解答(微观经济学)2009-2010微观经济学(A)答案.doc

- 海南大学:《西方经济学》课程试卷解答(微观经济学)2008-2009微观经济学期终考试(A)试卷.doc

- 海南大学:《西方经济学》课程试卷解答(微观经济学)2008-2009微观经济学期终考试(A)答案.doc

- 海南大学:《西方经济学》课程试卷解答(微观经济学)2007-2008微观经济学期终考试(B)试卷.doc

- 海南大学:《西方经济学》课程试卷解答(微观经济学)2007-2008微观经济学期终考试(A)答案.doc

- 海南大学:《西方经济学》课程试卷解答(微观经济学)2007-2008微观经济学期终考试(A)试卷.doc

- 海南大学:《西方经济学》课程试卷解答(微观经济学)2007-2008微观经济学期终考试(B)答案.doc

- 海南大学:《西方经济学》课程试卷解答(宏观经济学)2008-2009宏观经济学(B)试卷.doc

- 海南大学:《西方经济学》课程试卷解答(宏观经济学)2008-2009宏观经济学(A)试卷.doc

- 海南大学:《西方经济学》课程试卷解答(宏观经济学)2008-2009宏观经济学(B)答案.doc

- 海南大学:《西方经济学》课程试卷解答(宏观经济学)2008-2009宏观经济学(A)答案.doc

- 海南大学:《西方经济学》课程试卷解答(宏观经济学)2007-2008(B)试卷.doc

- 海南大学:《西方经济学》课程试卷解答(宏观经济学)2007-2008(A)试卷.doc

- 海南大学:《西方经济学》课程试卷解答(宏观经济学)2007-2008(B)答案.doc

- 海南大学:《西方经济学》课程试卷解答(宏观经济学)2007-2008(A)答案.doc

- 海南大学:《西方经济学》课程试卷解答(宏观经济学)2006-2007宏观经济学(B)试卷.doc

- 海南大学:《西方经济学》课程试卷解答(宏观经济学)2006-2007宏观经济学(A)试卷.doc

- 海南大学:《西方经济学》课程试卷解答(宏观经济学)2006-2007宏观经济学(B)答案.doc

- 海南大学:《西方经济学》课程试卷解答(微观经济学)2006-2007学年度第1学期微观经济学(B)答案.doc

- 海南大学:《西方经济学》课程试卷解答(微观经济学)2006-2007学年度第1学期微观经济学(B)试卷.doc

- 海南大学:《西方经济学》课程试卷解答(微观经济学)2008-2009学年度第1学期微观经济学(B)答案.doc

- 海南大学:《西方经济学》课程试卷解答(微观经济学)2008-2009学年度第1学期微观经济学(B)试卷.doc

- 海南大学:《西方经济学》课程试卷解答(微观经济学)2009-2010微观经济学(B)答案.doc

- 海南大学:《西方经济学》课程试卷解答(微观经济学)2009-2010微观经济学(B)试卷.doc

- 海南大学:《西方经济学》课程试卷解答(微观经济学)2009-2010微观经济学(A)试卷.doc

- 《西方经济学》课程PPT教学课件(宏观经济学)Chapter 01 The Science of Macroeconomics.ppt

- 《西方经济学》课程PPT教学课件(宏观经济学)Chapter 02 The Data of Macroeconomics.ppt

- 《西方经济学》课程PPT教学课件(宏观经济学)Chapter 03 Where NI comes from and goes.ppt

- 《西方经济学》课程PPT教学课件(宏观经济学)Chapter 04 Money and inflation.ppt

- 《西方经济学》课程PPT教学课件(宏观经济学)Chapter 05 The open economy.ppt

- 《西方经济学》课程PPT教学课件(宏观经济学)Chapter 06 Unemployment.ppt

- 《西方经济学》课程PPT教学课件(宏观经济学)Chapter 08 Economic growth(2/2).ppt

- 《西方经济学》课程PPT教学课件(宏观经济学)Chapter 07 Economic growth(1/2).ppt

- 《西方经济学》课程PPT教学课件(宏观经济学)Chapter 09 Introduction to AS-AD model.ppt

- 《西方经济学》课程PPT教学课件(宏观经济学)Chapter 10 The IS-LM model.ppt

- 《西方经济学》课程PPT教学课件(宏观经济学)Chapter 11 Application of IS-LM model.ppt

- 《西方经济学》课程PPT教学课件(宏观经济学)Chapter 12 Aggregate demand in open economy.ppt

- 《西方经济学》课程PPT教学课件(宏观经济学)Chapter 13 Aggregate supply.ppt