《西方经济学》课程PPT教学课件(微观经济学)Chapter 17 Markets with Asymmetric Information

Chapter 17-Markets with Asymmetric Information Chapter Outline Quality Uncertainty and the Market for Lemons ▣Market Signaling ▣Moral Hazard The Principal-Agent Problem Managerial Incentives in an Integrated Firm Asymmetric Information in Labor Markets: Efficiency Wage Theory

Chapter 17 — Markets with Asymmetric Information Chapter Outline ❑ Quality Uncertainty and the Market for Lemons ❑ Market Signaling ❑ Moral Hazard ❑ The Principal-Agent Problem ❑ Managerial Incentives in an Integrated Firm ❑ Asymmetric Information in Labor Markets: Efficiency Wage Theory

1 Quality Uncertainty and the Market for Lemons Asymmetric Information-situation in which a buyer and seller possess different information about a transaction. George A.Akerlof:The Market for 'Lemons': Quality Uncertainty and the Market Mechanism published by Quarterly Journal of Economics(1970)

1 Quality Uncertainty and the Market for Lemons Asymmetric Information — situation in which a buyer and seller possess different information about a transaction. George A. Akerlof: The Market for ‘Lemons’: Quality Uncertainty and the Market Mechanism published by Quarterly Journal of Economics(1970)

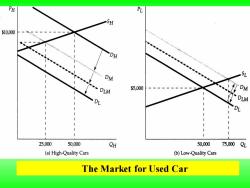

PH SH $10,000 DH DM $5,000 PL DLM 25,000 50,000 QH 50,000 75,000QL (a)High-Quality Cars (b)Low-Quality Cars The Market for Used Car

The Market for Used Car

When sellers of products have better information about product quality than buyers,a "lemons problem"may arise in which low-quality goods drive out high-quality goods. In (a)the demand curve for high-quality cars is DH.However, as buyers lower their expectations about the average quality of cars on the market,their perceived demand shifts to Dv

When sellers of products have better information about product quality than buyers, a “lemons problem” may arise in which low-quality goods drive out high-quality goods. In (a) the demand curve for high-quality cars is DH. However, as buyers lower their expectations about the average quality of cars on the market, their perceived demand shifts to DM

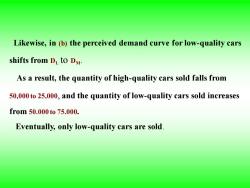

Likewise,in (b)the perceived demand curve for low-quality cars shifts from DL to DM. As a result,the quantity of high-quality cars sold falls from 50,000 to 25,000,and the quantity of low-quality cars sold increases from50.000to75.000. Eventually,only low-quality cars are sold

Likewise, in (b) the perceived demand curve for low-quality cars shifts from DL to DM. As a result, the quantity of high-quality cars sold falls from 50,000 to 25,000, and the quantity of low-quality cars sold increases from 50.000 to 75.000. Eventually, only low-quality cars are sold

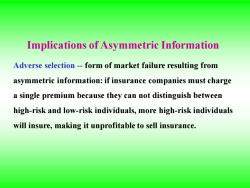

Implications of Asymmetric Information Adverse selection-form of market failure resulting from asymmetric information:if insurance companies must charge a single premium because they can not distinguish between high-risk and low-risk individuals,more high-risk individuals will insure,making it unprofitable to sell insurance

Implications of Asymmetric Information Adverse selection - form of market failure resulting from asymmetric information: if insurance companies must charge a single premium because they can not distinguish between high-risk and low-risk individuals, more high-risk individuals will insure, making it unprofitable to sell insurance

2 Market Signaling Market Signaling-Process by which sellers send signals to buyers conveying information about product quality. Note:Michael Spence:Market Signaling(1974)

2 Market Signaling Market Signaling– Process by which sellers send signals to buyers conveying information about product quality. Note: Michael Spence: Market Signaling(1974)

$200000 $20,000 C1)=$40,00y S100000 000 $10,000 CT)=$20,000y B(w) By) 0 123 45 Years of Colleg Optimal Choice of y for group I Optimal Choice ofy for group II Signaling

$200000 $100000 Optimal Choice of y for group I Optimal Choice of y for group II y* Years of College y* Signaling

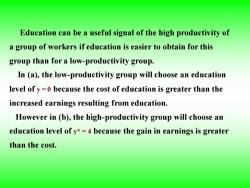

Education can be a useful signal of the high productivity of a group of workers if education is easier to obtain for this group than for a low-productivity group. In (a),the low-productivity group will choose an education level of y=0 because the cost of education is greater than the increased earnings resulting from education. However in (b),the high-productivity group will choose an education level of y*=4 because the gain in earnings is greater than the cost

Education can be a useful signal of the high productivity of a group of workers if education is easier to obtain for this group than for a low-productivity group. In (a), the low-productivity group will choose an education level of y = 0 because the cost of education is greater than the increased earnings resulting from education. However in (b), the high-productivity group will choose an education level of y* = 4 because the gain in earnings is greater than the cost

3 Moral hazard Moral hazard-when an insured party whose actions are unobserved can affect the probability or magnitude of a payment associated with an event

3 Moral hazard Moral hazard – when an insured party whose actions are unobserved can affect the probability or magnitude of a payment associated with an event

按次数下载不扣除下载券;

注册用户24小时内重复下载只扣除一次;

顺序:VIP每日次数-->可用次数-->下载券;

- 《西方经济学》课程PPT教学课件(微观经济学)Chapter 16 General Equilibrium and Economic Efficiency.ppt

- 《西方经济学》课程PPT教学课件(微观经济学)Chapter 15 Investment, Time, and Capital.ppt

- 《西方经济学》课程PPT教学课件(微观经济学)Chapter 14 Markets for Factor Inputs.ppt

- 《西方经济学》课程PPT教学课件(微观经济学)Chapter 13 Game Theory.ppt

- 《西方经济学》课程PPT教学课件(微观经济学)Chapter 12 Monopolistic Competition.ppt

- 《西方经济学》课程PPT教学课件(微观经济学)Chapter 11 Pricing with Market Power.ppt

- 《西方经济学》课程PPT教学课件(微观经济学)Chapter 10 Market Power.ppt

- 《西方经济学》课程PPT教学课件(微观经济学)Chapter 09 The Analysis of Competitive Markets.ppt

- 《西方经济学》课程PPT教学课件(微观经济学)Chapter 08 Profit Maximization and Competitive Supply.ppt

- 《西方经济学》课程PPT教学课件(微观经济学)Chapter 07 The Cost of Production.ppt

- 《西方经济学》课程PPT教学课件(微观经济学)Chapter 06 Production.ppt

- 《西方经济学》课程PPT教学课件(微观经济学)Chapter 05 Choice under Uncertainty.ppt

- 《西方经济学》课程PPT教学课件(微观经济学)Chapter 04 Individual and Market Demand.ppt

- 《西方经济学》课程PPT教学课件(微观经济学)Chapter 03 Consumer Behavior.ppt

- 《西方经济学》课程PPT教学课件(微观经济学)Chapter 02 The Basics of Supply and Demand.ppt

- 《西方经济学》课程PPT教学课件(微观经济学)Chapter 01 Preliminaries.ppt

- 《西方经济学》课程PPT教学课件(宏观经济学)Chapter 19 Advances in Business Cycle theory.ppt

- 《西方经济学》课程PPT教学课件(宏观经济学)Chapter 17 Investment.ppt

- 《西方经济学》课程PPT教学课件(宏观经济学)Chapter 18 Money supply and monetary Policy.ppt

- 《西方经济学》课程PPT教学课件(宏观经济学)Chapter 16 Consumption.ppt

- 《西方经济学》课程PPT教学课件(微观经济学)Chapter 18 Externalities.ppt

- 《西方经济学》课程PPT教学课件(微观经济学)Chapter 17 Microeconomics.ppt

- 海南大学:《成本会计》课程课程教学大纲 COST ACCOUNTING.pdf

- 海南大学:《成本会计》课程教学资源(教案讲义)第一章 总论.doc

- 海南大学:《成本会计》课程教学资源(教案讲义)第三章 成本汇集与分配.doc

- 海南大学:《成本会计》课程教学资源(教案讲义)第二章 成本核算方法体系.doc

- 海南大学:《成本会计》课程教学资源(教案讲义)第五章 分步成本计算.doc

- 海南大学:《成本会计》课程教学资源(教案讲义)第六章 分类法.doc

- 海南大学:《成本会计》课程教学资源(教案讲义)第四章 单步骤成本计算方法.doc

- 海南大学:《成本会计》课程教学资源(教案讲义)第七章 作业成本计算.doc

- 海南大学:《成本会计》课程教学资源(教案讲义)第九章 标准成本法.doc

- 海南大学:《成本会计》课程教学资源(教案讲义)第十章 成本报表与成本分析.doc

- 海南大学:《成本会计》课程教学资源(试卷习题)各章题库(含参考答案).doc

- 海南大学:《成本会计》课程教学资源(PPT课件)Chapter 01 成本的涵义、分类和作用(主讲:董建华).ppt

- 海南大学:《成本会计》课程教学资源(PPT课件)Chapter 02 产品成本核算概述.ppt

- 海南大学:《成本会计》课程教学资源(PPT课件)Chapter 03 要素费用的归集与分配.ppt

- 海南大学:《成本会计》课程教学资源(PPT课件)Chapter 04 辅助生产成本与制造费用的核算.ppt

- 海南大学:《成本会计》课程教学资源(PPT课件)Chapter 05 成本计算品种法.ppt

- 海南大学:《成本会计》课程教学资源(PPT课件)Chapter 06 产品计算分批法.ppt

- 海南大学:《成本会计》课程教学资源(PPT课件)Chapter 07 废品、返工品和残料 Spoilage, Rework and Scrap.ppt