《西方经济学》课程PPT教学课件(微观经济学)Chapter 15 Investment, Time, and Capital

Chapter 15 Investment,Time, and Capital Markets Chapter Outline >Stocks versus Flows >Present Discounted Value >The value of a Bond >The Net Present Value Criterion for Capital Investment Decisions >Adjustments for Risk >Investment Decisions by Consumers >Intertemporal Production Decisions- Depletable Resources >How Are Interest Rates Determined?

Chapter 15 Investment, Time, and Capital Markets Chapter Outline ➢ Stocks versus Flows ➢ Present Discounted Value ➢ The value of a Bond ➢ The Net Present Value Criterion for Capital Investment Decisions ➢ Adjustments for Risk ➢ Investment Decisions by Consumers ➢ Intertemporal Production Decisions— Depletable Resources ➢ How Are Interest Rates Determined?

2 1.9 12 MOId ySe Jo ACd 54321096 0.6 0.5 0 0.05 0.10 0.15 0.20 Interest Rate Present Value of the Cash Flow from a Bond

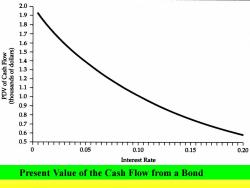

Present Value of the Cash Flow from a Bond

Because most of the bond's payments occur in the future,the present Discounted value declines as the interest rare increases. For example,when the interest rate is 5 percent,the PDV of a 10-year bond paying $100 per year on a principal of $1000 is $1386

Because most of the bond's payments occur in the future, the present Discounted va1ue declines as the interest rare increases. For example, when the interest rate is 5 percent, the PDV of a 10-year bond paying $100 per year on a principal of $1000 is $l386

2.0 1.9 1.8 1.7 (puog jo anten)squawAed Jo ACd (sIellop jo spuesnoyl) 06 0 0.4十n t 0 0.05 0.10 0.15 0.20 Interest Rate Effective Yield on a Bond

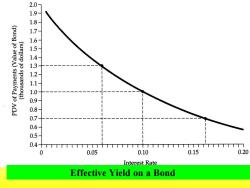

Effective Yield on a Bond

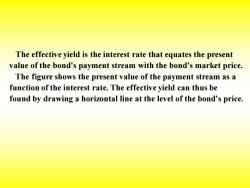

The effective yield is the interest rate that equates the present value of the bond's payment stream with the bond's market price. The figure shows the present value of the payment stream as a function of the interest rate.The effective yield can thus be found by drawing a horizontal line at the level of the bond's price

The effective yield is the interest rate that equates the present value of the bond's payment stream with the bond's market price. The figure shows the present value of the payment stream as a function of the interest rate. The effective yield can thus be found by drawing a horizontal line at the level of the bond's price

For example,if the price of this bond were $1000,its effective yield would be about 10 percent.If the price were $1300,the effective yield would be about 6 percent;if the price were $700, it would be 16.2 percent

For example, if the price of this bond were $1000, its effective yield would be about 10 percent. If the price were $1300, the effective yield would be about 6 percent; if the price were $700, it would be 16.2 percent

(sIellop jo suo!ll!u) 198765492101234 -5 6十TTTT 0 0.05 R* 0.10 0.15 0.20 Interest Rate,R Net Present Value of a Factory

Net Present Value of a Factory

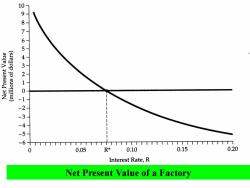

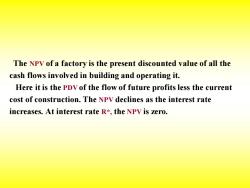

The NPV of a factory is the present discounted value of all the cash flows involved in building and operating it. Here it is the PDV of the flow of future profits less the current cost of construction.The NPV declines as the interest rate increases.At interest rate R*,the NPV is zero

The NPV of a factory is the present discounted value of all the cash flows involved in building and operating it. Here it is the PDV of the flow of future profits less the current cost of construction. The NPV declines as the interest rate increases. At interest rate R*, the NPV is zero

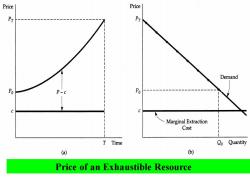

Price Price PT PT Demand Po Po Marginal Extraction Cost T Time Qo Quantity (a) (b) Price of an Exhaustible Resource

Price of an Exhaustible Resource

按次数下载不扣除下载券;

注册用户24小时内重复下载只扣除一次;

顺序:VIP每日次数-->可用次数-->下载券;

- 《西方经济学》课程PPT教学课件(微观经济学)Chapter 14 Markets for Factor Inputs.ppt

- 《西方经济学》课程PPT教学课件(微观经济学)Chapter 13 Game Theory.ppt

- 《西方经济学》课程PPT教学课件(微观经济学)Chapter 12 Monopolistic Competition.ppt

- 《西方经济学》课程PPT教学课件(微观经济学)Chapter 11 Pricing with Market Power.ppt

- 《西方经济学》课程PPT教学课件(微观经济学)Chapter 10 Market Power.ppt

- 《西方经济学》课程PPT教学课件(微观经济学)Chapter 09 The Analysis of Competitive Markets.ppt

- 《西方经济学》课程PPT教学课件(微观经济学)Chapter 08 Profit Maximization and Competitive Supply.ppt

- 《西方经济学》课程PPT教学课件(微观经济学)Chapter 07 The Cost of Production.ppt

- 《西方经济学》课程PPT教学课件(微观经济学)Chapter 06 Production.ppt

- 《西方经济学》课程PPT教学课件(微观经济学)Chapter 05 Choice under Uncertainty.ppt

- 《西方经济学》课程PPT教学课件(微观经济学)Chapter 04 Individual and Market Demand.ppt

- 《西方经济学》课程PPT教学课件(微观经济学)Chapter 03 Consumer Behavior.ppt

- 《西方经济学》课程PPT教学课件(微观经济学)Chapter 02 The Basics of Supply and Demand.ppt

- 《西方经济学》课程PPT教学课件(微观经济学)Chapter 01 Preliminaries.ppt

- 《西方经济学》课程PPT教学课件(宏观经济学)Chapter 19 Advances in Business Cycle theory.ppt

- 《西方经济学》课程PPT教学课件(宏观经济学)Chapter 17 Investment.ppt

- 《西方经济学》课程PPT教学课件(宏观经济学)Chapter 18 Money supply and monetary Policy.ppt

- 《西方经济学》课程PPT教学课件(宏观经济学)Chapter 16 Consumption.ppt

- 《西方经济学》课程PPT教学课件(宏观经济学)Chapter 15Government Debt and Budget Deficits.ppt

- 《西方经济学》课程PPT教学课件(宏观经济学)Chapter 14 Stabilization Policy.ppt

- 《西方经济学》课程PPT教学课件(微观经济学)Chapter 16 General Equilibrium and Economic Efficiency.ppt

- 《西方经济学》课程PPT教学课件(微观经济学)Chapter 17 Markets with Asymmetric Information.ppt

- 《西方经济学》课程PPT教学课件(微观经济学)Chapter 18 Externalities.ppt

- 《西方经济学》课程PPT教学课件(微观经济学)Chapter 17 Microeconomics.ppt

- 海南大学:《成本会计》课程课程教学大纲 COST ACCOUNTING.pdf

- 海南大学:《成本会计》课程教学资源(教案讲义)第一章 总论.doc

- 海南大学:《成本会计》课程教学资源(教案讲义)第三章 成本汇集与分配.doc

- 海南大学:《成本会计》课程教学资源(教案讲义)第二章 成本核算方法体系.doc

- 海南大学:《成本会计》课程教学资源(教案讲义)第五章 分步成本计算.doc

- 海南大学:《成本会计》课程教学资源(教案讲义)第六章 分类法.doc

- 海南大学:《成本会计》课程教学资源(教案讲义)第四章 单步骤成本计算方法.doc

- 海南大学:《成本会计》课程教学资源(教案讲义)第七章 作业成本计算.doc

- 海南大学:《成本会计》课程教学资源(教案讲义)第九章 标准成本法.doc

- 海南大学:《成本会计》课程教学资源(教案讲义)第十章 成本报表与成本分析.doc

- 海南大学:《成本会计》课程教学资源(试卷习题)各章题库(含参考答案).doc

- 海南大学:《成本会计》课程教学资源(PPT课件)Chapter 01 成本的涵义、分类和作用(主讲:董建华).ppt

- 海南大学:《成本会计》课程教学资源(PPT课件)Chapter 02 产品成本核算概述.ppt

- 海南大学:《成本会计》课程教学资源(PPT课件)Chapter 03 要素费用的归集与分配.ppt

- 海南大学:《成本会计》课程教学资源(PPT课件)Chapter 04 辅助生产成本与制造费用的核算.ppt

- 海南大学:《成本会计》课程教学资源(PPT课件)Chapter 05 成本计算品种法.ppt