同济大学:《应用统计学》课程电子教案(课件讲稿)Chapter 12 Time series based Demand Management

Chapter 12 Time series based Demand Management Session 12-1

McGraw-Hill/Irwin Session 12-1 Chapter 12 Time series based Demand Management

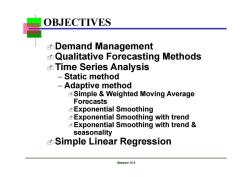

OBJECTIVES Demand Management 动 Qualitative Forecasting Methods n Time Series Analysis Static method -Adaptive method Simple Weighted Moving Average Forecasts Exponential Smoothing Exponential Smoothing with trend Exponential Smoothing with trend seasonality Simple Linear Regression Session 12-2

McGraw-Hill/Irwin Session 12-2 Demand Management Qualitative Forecasting Methods Time Series Analysis – Static method – Adaptive method Simple & Weighted Moving Average Forecasts Exponential Smoothing Exponential Smoothing with trend Exponential Smoothing with trend & seasonality Simple Linear Regression OBJECTIVES

Demand Management Where does demand for a firm's product or service come from? What can a firm to do manage it? Independent Demand: Finished Goods A Dependent Demand: Raw Materials, Component parts, C(2) Sub-assemblies,etc. D(2) E(1) D(3) F(2) Session 12-3

McGraw-Hill/Irwin Session 12-3 Demand Management A B(4) C(2) D(2) E(1) D(3) F(2) Dependent Demand: Raw Materials, Component parts, Sub-assemblies, etc. Independent Demand: Finished Goods Where does demand for a firm’s product or service come from? What can a firm to do manage it?

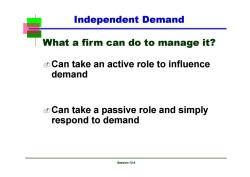

Independent Demand What a firm can do to manage it? Can take an active role to influence demand Can take a passive role and simply respond to demand Session 12-4

McGraw-Hill/Irwin Session 12-4 Independent Demand What a firm can do to manage it? Can take an active role to influence demand Can take a passive role and simply respond to demand

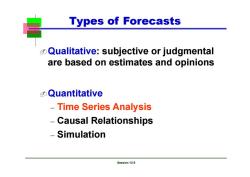

Types of Forecasts Qualitative:subjective or judgmental are based on estimates and opinions Quantitative Time Series Analysis Causal Relationships Simulation Session 12-5

McGraw-Hill/Irwin Session 12-5 Types of Forecasts Qualitative: subjective or judgmental are based on estimates and opinions Quantitative – Time Series Analysis – Causal Relationships – Simulation

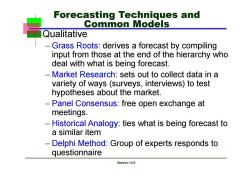

Forecasting Techniques and Common Models Qualitative Grass Roots:derives a forecast by compiling input from those at the end of the hierarchy who deal with what is being forecast. Market Research:sets out to collect data in a variety of ways (surveys,interviews)to test hypotheses about the market. Panel Consensus:free open exchange at meetings. Historical Analogy:ties what is being forecast to a similar item Delphi Method:Group of experts responds to questionnaire Session 12-6

McGraw-Hill/Irwin Session 12-6 Forecasting Techniques and Common Models Qualitative – Grass Roots: derives a forecast by compiling input from those at the end of the hierarchy who deal with what is being forecast. – Market Research: sets out to collect data in a variety of ways (surveys, interviews) to test hypotheses about the market. – Panel Consensus: free open exchange at meetings. – Historical Analogy: ties what is being forecast to a similar item – Delphi Method: Group of experts responds to questionnaire

Delphi Method I.Choose the experts to participate representing a variety of knowledgeable people in different areas 2.Through a questionnaire (or E-mail),obtain forecasts(and any premises or qualifications for the forecasts)from all participants 3.Summarize the results and redistribute them to the participants along with appropriate new questions 4.Summarize again,refining forecasts and conditions,and again develop new questions 5.Repeat Step 4 as necessary and distribute the final results to all participants Session 12-7

McGraw-Hill/Irwin Session 12-7 Delphi Method l. Choose the experts to participate representing a variety of knowledgeable people in different areas 2. Through a questionnaire (or E-mail), obtain forecasts (and any premises or qualifications for the forecasts) from all participants 3. Summarize the results and redistribute them to the participants along with appropriate new questions 4. Summarize again, refining forecasts and conditions, and again develop new questions 5. Repeat Step 4 as necessary and distribute the final results to all participants

Forecasting Techniques and Common Models (Cont'd】 Time Series Analysis Simple Moving Average:a time period containing a number of data points is averaged by dividing the sum of the point values by the number of points. Weighted Moving Average:specific points may be weighted more or less than the others,as seen fit by experience Exponential Smoothing:recent data points are weighted more with weighting declining exponentially as data become older. Regression analysis:fits a straight line to past data generally relating the data value to time. Box Jenkins Technique:Relates a class of statistical models to data and fits the model to the time series by using Bayesian posterior distributions Session 12-8

McGraw-Hill/Irwin Session 12-8 Time Series Analysis – Simple Moving Average: a time period containing a number of data points is averaged by dividing the sum of the point values by the number of points. – Weighted Moving Average: specific points may be weighted more or less than the others, as seen fit by experience – Exponential Smoothing: recent data points are weighted more with weighting declining exponentially as data become older. – Regression analysis: fits a straight line to past data generally relating the data value to time. – Box Jenkins Technique: Relates a class of statistical models to data and fits the model to the time series by using Bayesian posterior distributions Forecasting Techniques and Common Models (Cont’d)

Forecasting Techniques and Common Models (Cont'd) Causal Relationships Regression Analysis:similar to least squares method in times series but may contain multiple variables 一 Econometric Models:attempts to describe some sector of the economy by a series of interdependent equations 一 Input/output Models:focuses on sales of each industry to other firms and governments.Indicates the changes in sales that a producer industry might expect because of purchasing changes by another industry Leading Indicators:Statistics that move in the same direction as the series being forecast but move before the series. Session12-9

McGraw-Hill/Irwin Session 12-9 Causal Relationships – Regression Analysis: similar to least squares method in times series but may contain multiple variables – Econometric Models: attempts to describe some sector of the economy by a series of interdependent equations – Input/output Models: focuses on sales of each industry to other firms and governments. Indicates the changes in sales that a producer industry might expect because of purchasing changes by another industry – Leading Indicators: Statistics that move in the same direction as the series being forecast but move before the series. Forecasting Techniques and Common Models (Cont’d)

Forecasting Techniques and Common Models (Cont'd) Simulation Models:Dynamic models, usually computer-based,that allow the forecaster to make assumptions about the internal variables and external environment in the model. -Depending on the variables in the model,the forecaster may ask such questions as.What would happen to my forecast if price increased by 10 percent?What effect would a mild national recession have on my forecast? Session 12-10

McGraw-Hill/Irwin Session 12-10 Simulation Models: Dynamic models, usually computer-based, that allow the forecaster to make assumptions about the internal variables and external environment in the model. – Depending on the variables in the model, the forecaster may ask such questions as. What would happen to my forecast if price increased by 10 percent? What effect would a mild national recession have on my forecast? Forecasting Techniques and Common Models (Cont’d)

按次数下载不扣除下载券;

注册用户24小时内重复下载只扣除一次;

顺序:VIP每日次数-->可用次数-->下载券;

- 同济大学:《应用统计学》课程电子教案(课件讲稿)Chapter 11 Simple Linear Regression.pdf

- 同济大学:《应用统计学》课程电子教案(课件讲稿)Chapter 10 Analysis of Variance(ANOVA).pdf

- 同济大学:《应用统计学》课程电子教案(课件讲稿)Chapter 9 Two-Sample Tests with Numerical Data.pdf

- 同济大学:《应用统计学》课程电子教案(课件讲稿)Chapter 8 Fundamentals of Hypothesis Testing(One-Sample Tests).pdf

- Chapter 7 Confidence Interval Estimation.pdf

- 同济大学:《应用统计学》课程电子教案(课件讲稿)Chapter 6 The Normal Distribution and Other Continuous Distributions.pdf

- 同济大学:《应用统计学》课程电子教案(课件讲稿)Chapter 4 Basic Probability(主讲:王世进).pdf

- 同济大学:《应用统计学》课程电子教案(课件讲稿)Chapter 3 Numerical Descriptive Measures.pdf

- 同济大学:《应用统计学》课程电子教案(课件讲稿)Chapter 2 Presenting Data in Tables and Charts.pdf

- 同济大学:《应用统计学》课程电子教案(课件讲稿)Chapter 1 Introduction and Data Collection(Applied Statistics).pdf

- 同济大学:《应用统计学》课程教学资源(试卷习题)考核试卷(B卷)2011-2012学年第2学期(无答案).pdf

- 同济大学:《应用统计学》课程教学资源(试卷习题)考核试卷(A卷)2011-2012学年第2学期(无答案).pdf

- 新乡医学院:《卫生统计学》课程教学资源(课件讲稿,打印版)实验五 统计表与统计图.pdf

- 新乡医学院:《卫生统计学》课程教学资源(教案讲义,打印版)实验五 统计表与统计图.pdf

- 新乡医学院:《卫生统计学》课程教学资源(课件讲稿,打印版)实验四 卡方检验.pdf

- 新乡医学院:《卫生统计学》课程教学资源(教案讲义,打印版)实验四 卡方检验(教师:晁灵).pdf

- 新乡医学院:《卫生统计学》课程教学资源(课件讲稿,打印版)实验三 方差分析实验.pdf

- 新乡医学院:《卫生统计学》课程教学资源(教案讲义,打印版)实验三 方差分析.pdf

- 新乡医学院:《卫生统计学》课程教学资源(课件讲稿,打印版)实验二 总体均数的区间估计假设检验(t检验).pdf

- 新乡医学院:《卫生统计学》课程教学资源(教案讲义,打印版)实验二 总体均数的区间估计假设检验(t检验).pdf

- 同济大学:《应用统计学》课程电子教案(课件讲稿)Chapter 13 Statistical Applications in Quality Management.pdf

- 同济大学:《应用统计学》课程电子教案(课件讲稿)Chapter 5 The Normal Distribution and Sampling Distributions.ppt

- 《概率论与数理统计》课程教学资源(整理资料)Matlab在统计方面的应用.pdf

- 《概率论与数理统计》课程教学资源(整理资料)正态分布的前世今生.pdf

- 《概率论与数理统计》课程教学资源(PPT讲稿)概率论与数理统计知识点总结.pptx

- 西安电子科技大学:《随机过程概论》课程教学资源(课件讲稿)Chapter 4 随机过程通过线性系统.pdf

- 西安电子科技大学:《随机过程概论》课程教学资源(课件讲稿)Chapter 9 检测理论.pdf

- 沈阳航空航天大学:自动化学院《误差理论及数据处理》课程教学大纲.pdf

- 吉林大学:《医学统计学》课程电子教案(PPT课件)第一章 医学统计中的基本概念、第二章 平均水平(集中趋势)的统计描述(主讲:田迎春).ppt

- 吉林大学:《医学统计学》课程电子教案(PPT课件)第三章 离散趋势的统计描述、第四章 抽样误差与假设检验.ppt

- 吉林大学:《医学统计学》课程电子教案(PPT课件)第五章 t检验、第六章 方差分析、第七章 相对数及其应用.ppt

- 吉林大学:《医学统计学》课程电子教案(PPT课件)第六章 方差分析、第七章 相对数及其应用.ppt

- 吉林大学:《医学统计学》课程电子教案(PPT课件)第八章 卡方检验、第九章 非参数检验方法.ppt

- 吉林大学:《医学统计学》课程电子教案(PPT课件)第十章 线性相关与回归.ppt

- 农业院校《试验设计与分析》课程参考资料(多变量分析方法)DUDE - A User-Friendly Crop Information System.pdf

- 农业院校《试验设计与分析》课程参考资料(多变量分析方法)GGE Biplot vs. AMMI Analysis of Genotype-by-Environment Data.pdf

- 农业院校《试验设计与分析》课程参考资料(多变量分析方法)Logistic模型的参数估计.pdf

- 农业院校《试验设计与分析》课程参考资料(多变量分析方法)Logistic模型配合家禽生长资料参数估计方法比较的MonteCarlo研究.pdf

- 农业院校《试验设计与分析》课程参考资料(多变量分析方法)Logistic模型配合家禽生长资料参数估计方法比较的MonteCarlo研究.pdf

- 农业院校《试验设计与分析》课程参考资料(多变量分析方法)Two Types of GGE Biplots for Analyzing Multi-Environment Trial Data.pdf