上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 01 Introduction of Financial Economics(唐宗明)

.Self-Introduction .Join SJTU in 1996 .PhD.In 2002 Research area:Corporate finance/corporate governance .Course taught:Corporate finance Finance; Economics;Intermediate microeconomics;managerial economics The course information 1-2

The course information •1-2 •Self-Introduction •Join SJTU in 1996 •PhD. In 2002 •Research area:Corporate finance/corporate governance •Course taught:Corporate finance ;Finance; • Economics;Intermediate microeconomics;managerial economics

.The Goals of This Course ●are: To help you develop a financial way of thinking > To enrich your financial knowledge To introduce you to basic financial concepts such as the time value of money, valuation models,and risk and return. >To help you prepare for the advanced financial courses such as corporate finance,investments and financial engineering. Finance Corporate Financial Investments finance Enginering The course information 1-3

The course information •1-3 •The Goals of This Course •are: Ø To help you develop a financial way of thinking Ø To enrich your financial knowledge Ø To introduce you to basic financial concepts such as the time value of money, valuation models, and risk and return. Ø To help you prepare for the advanced financial courses such as corporate finance , investments and financial engineering. Finance Corporate finance Investments Financial Enginering

.Course Materials Textbook:Financial Economics 2e by Zvi Bodie,Robert C.Merton and David L.Cleeton,Pearson publishing house. 。 Reference book:Foundations of finance 7e by Keown.Martin.Petty,Pearson publishing house.You can borrow from School Foundations of finance Materials from the instructor: ·Syllabus ·PPT 。Handouts The Course Information 1-4

The Course Information •1-4 • Textbook: Financial Economics 2e by Zvi Bodie, Robert C. Merton and David L. Cleeton, Pearson publishing house. • Reference book: Foundations of finance 7e by Keown.Martin.Petty, Pearson publishing house. You can borrow from School Foundations of finance • Materials from the instructor: • Syllabus • PPT • Handouts •Course Materials

The Course Schedule 1.Introduction:Finance and Financial system (week1~4) 2.Time and resource allocation (week 5~8 one of the three pillars 3.Valuation models (week9~10 one of the three pillars 4.Risk and risk management (week11~13 one of the three pillars) 5.Asset Pricing (week14~16 extended part) The course of finance

The Course Schedule 1. Introduction: Finance and Financial system (week1~4) 2. Time and resource allocation(week 5~8 one of the three pillars ) 3. Valuation models(week9~10 one of the three pillars ) 4. Risk and risk management(week11~13 one of the three pillars) 5. Asset Pricing(week14~16 extended part) The course of finance

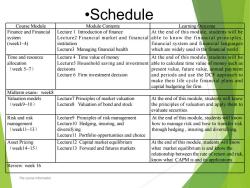

.Schedule Course Module Module Contents Learning Outcome Finance and Financial Lecture 1 Introduction of finance At the end of this module,students will be system Lecture2 Financial market and financial able to know the financial principles, (week1~4) institution financial system and financial languages Lecture3 Managing financial health which are widely used in the financial world Time and resource Lecture 4 Time value of money At the end of this module,students will be allocation Lecture5 Household saving and investment able to calculate time value of money such as (week 5~7) decisions present value,future value,annual payment Lecture 6 Firm investment decision and periods and use the DCF approach to make their life cycle financial plans and capital budgeting for firm. Midterm exam:week8 Valuation models Lecture7 Principles of market valuation At the end of this module,students will know (week9~10) Lecture8 Valuation of bond and stock the principles of valuation and apply them to evaluate securities. Risk and risk Lecture9 Principles of risk management At the end of this module,students will know management Lecture10 Hedging,insuring,and how to manage risk and how to transfer risk (week11~13) diversifying through hedging,insuring and diversifying. Lecture11 Portfolio opportunities and choice Asset Pricing Lecture12 Capital market equilibrium At the end of this module,students will know (week14~15) Lecture13 Forward and futures markets what market equilibrium is and know the relationship between the rate of return and risk. know what CAPM is and its applications Review:week 16 The course information

Course Module Module Contents Learning Outcome Finance and Financial system (week1~4) Lecture 1 Introduction of finance Lecture2 Financial market and financial institution Lecture3 Managing financial health At the end of this module, students will be able to know the financial principles, financial system and financial languages which are widely used in the financial world Time and resource allocation (week 5~7) Lecture 4 Time value of money Lecture5 Household saving and investment decisions Lecture 6 Firm investment decision At the end of this module, students will be able to calculate time value of money such as present value, future value, annual payment and periods and use the DCF approach to make their life cycle financial plans and capital budgeting for firm. Midterm exam:week8 Valuation models (week9~10) Lecture7 Principles of market valuation Lecture8 Valuation of bond and stock At the end of this module, students will know the principles of valuation and apply them to evaluate securities. Risk and risk management (week11~13) Lecture9 Principles of risk management Lecture10 Hedging, insuring, and diversifying Lecture11 Portfolio opportunities and choice At the end of this module, students will know how to manage risk and how to transfer risk through hedging , insuring and diversifying. Asset Pricing (week14~15) Lecture12 Capital market equilibrium Lecture13 Forward and futures markets At the end of this module, students will know what market equilibrium is and know the relationship between the rate of return and risk, know what CAPM is and its applications Review: week 16 •Schedule The course information

●Grading composition 1.Group work,30% 2.Midterm exam,30% 3.Final Examination,40% The course information 1-7

The course information •1-7 •Grading composition 1. Group work, 30% 2. Midterm exam, 30% 3. Final Examination, 40%

lecture 1: Introduction of Financia Economics Objective To Define Finance 5 financial principles vers and their fin ions THE COURSE OF FINANCE 2017 SPRING

lecture 1: Introduction of Financial Economics THE COURSE OF FINANCE 2017 SPRING •8 Objective To Define Finance 5 financial principles 2 Financial Players and their financial decisions

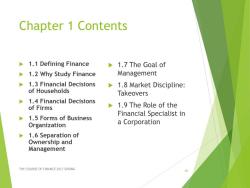

Chapter 1 Contents 1.1 Defining Finance 1.7 The Goal of 1.2 Why Study Finance Management 1.3 Financial Decisions 1.8 Market Discipline: of Households Takeovers 1.4 Financial Decisions of Firms 1.9 The Role of the Financial Specialist in 1.5 Forms of Business Organization a Corporation 1.6 Separation of Ownership and Management THE COURSE OF FINANCE 2017 SPRING

Chapter 1 Contents 1.1 Defining Finance 1.2 Why Study Finance 1.3 Financial Decisions of Households 1.4 Financial Decisions of Firms 1.5 Forms of Business Organization 1.6 Separation of Ownership and Management 1.7 The Goal of Management 1.8 Market Discipline: Takeovers 1.9 The Role of the Financial Specialist in a Corporation THE COURSE OF FINANCE 2017 SPRING •9

Introduction I'm saving for retirement.Should I use a bank CD,mutual fund,direct stock market investment? I want that new car.Should I use saved cash,lease,borrow? I'm thinking about starting a new business will it reward me adequately? The company is looking to expand into telecommunications. how should you advise the CFO? A Latin American country has asked for major project financing should my organization provide the funds? THE COURSE OF FINANCE 2017 SPRING 10

Introduction I’m saving for retirement. Should I use a bank CD, mutual fund, direct stock market investment? I want that new car. Should I use saved cash, lease, borrow? I’m thinking about starting a new business will it reward me adequately? The company is looking to expand into telecommunications. how should you advise the CFO? A Latin American country has asked for major project financing should my organization provide the funds? THE COURSE OF FINANCE 2017 SPRING •10

1.1 Defining Finance Finance is the study of how people allocate scarce resources over time costs and benefits are distributed over time but the actual timing and size of future cash flows are often known only probabilistically Examples:saving;mortgage loan;capital budgeting Understanding finance helps you evaluate these uncertain cash flows THE COURSE OF FINANCE 2017 SPRING 11

1.1 Defining Finance Finance is the study of how people allocate scarce resources over time costs and benefits are distributed over time but the actual timing and size of future cash flows are often known only probabilistically Examples: saving; mortgage loan; capital budgeting Understanding finance helps you evaluate these uncertain cash flows THE COURSE OF FINANCE 2017 SPRING •11

按次数下载不扣除下载券;

注册用户24小时内重复下载只扣除一次;

顺序:VIP每日次数-->可用次数-->下载券;

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Fourteen Forward and Futures Markets.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Thirteen Capital Market Equilibrium.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Twelve Portfolio Opportunities and Choice.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Eleven Hedging, Insuring, and Diversifying.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Ten Principles of Risk Management.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Nine Valuation of Common Stocks.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Eight Valuation of Known Cash Flows:Bonds.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Seven Principles of Market Valuation.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Six The Analysis of Investment Projects.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Five Household Savings and Investment Decisions.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Four Allocating Resources Over Time.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Three Managing Financial Health and Performance.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Two Financial Markets and Institutions.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter One Financial Economics.pdf

- 上海交通大学:《国际政治经济学的源与流》选修课程PPT教学课件_自由主义.ppt

- 上海交通大学:《国际政治经济学的源与流》选修课程PPT教学课件_课程简介与绪论(陈鹏).ppt

- 上海交通大学:《国际政治经济学的源与流》选修课程PPT教学课件_现实主义(下).ppt

- 上海交通大学:《国际政治经济学的源与流》选修课程PPT教学课件_现实主义(上).ppt

- 上海交通大学:《国际政治经济学的源与流》选修课程PPT教学课件_建构主义.ppt

- 《公司金融》课程教学资源(阅读材料)洛阳钼业定增折价率逾 45%,8家基金认购180亿元.docx

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 02 Financial Markets and Institutions.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 03 Managing Financial Health and Performance.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 04 Allocating Resources Over Time.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 05 Household Saving and Investment Decisions.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 06 The Analysis of Investment projects(capital budgeting).ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 07 Principles of Market Valuation.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 08 Valuation of Known Cash Flows:Bonds.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 09 Valuation of Common Stocks.pdf

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 09 Valuation of Common Stocks.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 10 Principles of Risk Management.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 12 Portfolio Opportunities and Choice.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 13 Capital Market Equilibrium.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 14 Forward and Futures Markets.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 11 Hedging, Insuring, and Diversifying.ppt

- 上海交通大学:《金融学原理》教学资源(重点难点)前五章的重点难点.docx

- 上海交通大学:《金融学原理》教学资源(重点难点)金融学原理重点和难点.docx

- 对外经济贸易大学:《宏微观经济学 Microeconomics》课程教学资源(教学大纲,共十三章).pdf

- 对外经济贸易大学:《宏微观经济学 Microeconomics》课程教学资源(授课教案,共十四章).pdf

- 对外经济贸易大学:《会计学原理 Introduction to Financial Accounting》课程教学资源(教学大纲).pdf

- 对外经济贸易大学:《会计学原理 Introduction to Financial Accounting》课程教学资源(授课教案,共十二章).pdf