上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 05 Household Saving and Investment Decisions

Lecture 5: Household Saving and Investment Decisions Objective Households Financial decisions making over life cycle with or without government policy influence .THE COURSE OF FINANCE 2017 SPRING SJTU 1

Lecture 5: Household Saving and Investment Decisions •THE COURSE OF FINANCE 2017 SPRING SJTU •1 Objective • Households Financial decisions making over life cycle with or without government policy influence

Chapter 5 Contents 5.1 A Life-Cycle Model of Savings 5.2 Taking Account of Social Security 5.3 Deferring Taxes through Voluntary Retirement Plans 5.4 Should you Invest in a Professional Degree? 5.5 Should you Buy or Rent? .THE COURSE OF FINANCE 2017 SPRING SJTU 2

Chapter 5 Contents 5.1 A Life-Cycle Model of Savings 5.2 Taking Account of Social Security 5.3 Deferring Taxes through Voluntary Retirement Plans 5.4 Should you Invest in a Professional Degree? 5.5 Should you Buy or Rent? •THE COURSE OF FINANCE 2017 SPRING SJTU •2

Objectives How much to save for retirement Whether to defer taxes or pay them now Whether to get a professional degree Whether to buy or rent an apartment .THE COURSE OF FINANCE 2017 SPRING SJTU y

Objectives How much to save for retirement Whether to defer taxes or pay them now Whether to get a professional degree Whether to buy or rent an apartment •THE COURSE OF FINANCE 2017 SPRING SJTU •3

5.1 A Life-Cycle Model of Saving Assume that you are currently 35 years old,expect to retire in 30 years at 65,and then live for 15 more years until 80 Your real labor income is $30,000/year until age 65 Interest rates exceed inflation by 3%/year .THE COURSE OF FINANCE 2017 SPRING SJTU

5.1 A Life-Cycle Model of Saving Assume that you are currently 35 years old, expect to retire in 30 years at 65, and then live for 15 more years until 80 Your real labor income is $30,000/year until age 65 Interest rates exceed inflation by 3%/ year •THE COURSE OF FINANCE 2017 SPRING SJTU •4

How Much Should I Save and Consume? Two approaches are suggested: 1.Target replacement rate of pre-retirement income 2.Maintain the same level of consumption spending .THE COURSE OF FINANCE 2017 SPRING SJTU 5

How Much Should I Save and Consume? Two approaches are suggested: 1. Target replacement rate of pre-retirement income 2. Maintain the same level of consumption spending •THE COURSE OF FINANCE 2017 SPRING SJTU •5

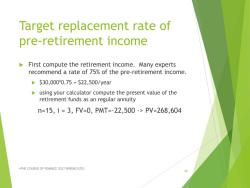

Target replacement rate of pre-retirement income First compute the retirement income.Many experts recommend a rate of 75%of the pre-retirement income. $30,000*0.75=522,500/year using your calculator compute the present value of the retirement funds as an regular annuity n=15,i=3,V=0,PMT=-22,500->PV=268,604 .THE COURSE OF FINANCE 2017 SPRING SJTU 6

Target replacement rate of pre-retirement income First compute the retirement income. Many experts recommend a rate of 75% of the pre-retirement income. $30,000*0.75 = $22,500/year using your calculator compute the present value of the retirement funds as an regular annuity n=15, i = 3, FV=0, PMT=-22,500 -> PV=268,604 •THE COURSE OF FINANCE 2017 SPRING SJTU •6

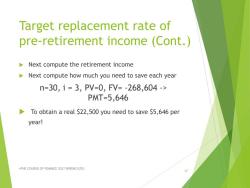

Target replacement rate of pre-retirement income (Cont. Next compute the retirement income Next compute how much you need to save each year n=30,i=3,PV=0,FV=-268,604-> PMT=5,646 To obtain a real $22,500 you need to save $5,646 per year! .THE COURSE OF FINANCE 2017 SPRING SJTU

Target replacement rate of pre-retirement income (Cont.) Next compute the retirement income Next compute how much you need to save each year n=30, i = 3, PV=0, FV= -268,604 -> PMT=5,646 To obtain a real $22,500 you need to save $5,646 per year! •THE COURSE OF FINANCE 2017 SPRING SJTU •7

Target replacement rate Conclusion You will have noticed that your pre-retirement consumption is $30,000-$5,646 24,354;but the real retirement income is only $22,500 The next method equates consumption .THE COURSE OF FINANCE 2017 SPRING SJTU 8

Target replacement rate Conclusion You will have noticed that your pre-retirement consumption is $30,000 - $5,646 = 24,354; but the real retirement income is only $22,500 The next method equates consumption •THE COURSE OF FINANCE 2017 SPRING SJTU •8

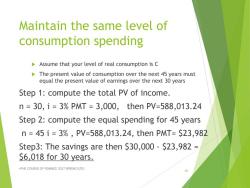

Maintain the same level of consumption spending Assume that your level of real consumption is C The present value of consumption over the next 45 years must equal the present value of earnings over the next 30 years Step 1:compute the total PV of income. n=30,i=3%PMT=3,000,then PV=588,013.24 Step 2:compute the equal spending for 45 years n=45i=3%,PV=588,013.24,then PMT=S23,982 Step3:The savings are then $30,000-$23,982 S6,018 for 30 years. .THE COURSE OF FINANCE 2017 SPRING SJTU 9

Maintain the same level of consumption spending Assume that your level of real consumption is C The present value of consumption over the next 45 years must equal the present value of earnings over the next 30 years Step 1: compute the total PV of income. n = 30, i = 3% PMT = 3,000, then PV=588,013.24 Step 2: compute the equal spending for 45 years n = 45 i = 3% , PV=588,013.24, then PMT= $23,982 Step3: The savings are then $30,000 - $23,982 = $6,018 for 30 years. •THE COURSE OF FINANCE 2017 SPRING SJTU •9

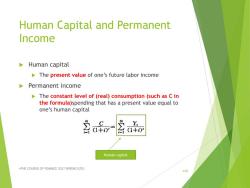

Human Capital and Permanent Income Human capital The present value of one's future labor income Permanent income The constant level of(real)consumption (such as C in the formula)spending that has a present value equal to one's human capital 5 30 C (1+2)= (1+) Human capital .THE COURSE OF FINANCE 2017 SPRING SJTU 10

Human Capital and Permanent Income Human capital The present value of one’s future labor income Permanent income The constant level of (real) consumption (such as C in the formula)spending that has a present value equal to one’s human capital •THE COURSE OF FINANCE 2017 SPRING SJTU •10 Human capital

按次数下载不扣除下载券;

注册用户24小时内重复下载只扣除一次;

顺序:VIP每日次数-->可用次数-->下载券;

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 04 Allocating Resources Over Time.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 03 Managing Financial Health and Performance.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 02 Financial Markets and Institutions.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 01 Introduction of Financial Economics(唐宗明).ppt

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Fourteen Forward and Futures Markets.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Thirteen Capital Market Equilibrium.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Twelve Portfolio Opportunities and Choice.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Eleven Hedging, Insuring, and Diversifying.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Ten Principles of Risk Management.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Nine Valuation of Common Stocks.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Eight Valuation of Known Cash Flows:Bonds.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Seven Principles of Market Valuation.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Six The Analysis of Investment Projects.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Five Household Savings and Investment Decisions.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Four Allocating Resources Over Time.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Three Managing Financial Health and Performance.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Two Financial Markets and Institutions.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter One Financial Economics.pdf

- 上海交通大学:《国际政治经济学的源与流》选修课程PPT教学课件_自由主义.ppt

- 上海交通大学:《国际政治经济学的源与流》选修课程PPT教学课件_课程简介与绪论(陈鹏).ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 06 The Analysis of Investment projects(capital budgeting).ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 07 Principles of Market Valuation.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 08 Valuation of Known Cash Flows:Bonds.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 09 Valuation of Common Stocks.pdf

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 09 Valuation of Common Stocks.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 10 Principles of Risk Management.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 12 Portfolio Opportunities and Choice.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 13 Capital Market Equilibrium.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 14 Forward and Futures Markets.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 11 Hedging, Insuring, and Diversifying.ppt

- 上海交通大学:《金融学原理》教学资源(重点难点)前五章的重点难点.docx

- 上海交通大学:《金融学原理》教学资源(重点难点)金融学原理重点和难点.docx

- 对外经济贸易大学:《宏微观经济学 Microeconomics》课程教学资源(教学大纲,共十三章).pdf

- 对外经济贸易大学:《宏微观经济学 Microeconomics》课程教学资源(授课教案,共十四章).pdf

- 对外经济贸易大学:《会计学原理 Introduction to Financial Accounting》课程教学资源(教学大纲).pdf

- 对外经济贸易大学:《会计学原理 Introduction to Financial Accounting》课程教学资源(授课教案,共十二章).pdf

- 对外经济贸易大学:《中国经济概论 Introduction to Chinese Economy》课程教学资源(教学大纲).pdf

- 对外经济贸易大学:《中国经济概论 Introduction to Chinese Economy》课程教学资源(授课教案).pdf

- 对外经济贸易大学:《成本管理会计 Cost and Management Accounting》课程教学资源(教学大纲).pdf

- 对外经济贸易大学:《成本管理会计 Cost and Management Accounting》课程教学资源(授课教案).pdf