上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 06 The Analysis of Investment projects(capital budgeting)

Lecture 6.: The Analysis of Investment projects (capital budgeting) Refer to ch.4&ch.6

Lecture 6: The Analysis of Investment projects (capital budgeting) 1 Refer to ch.4&ch.6

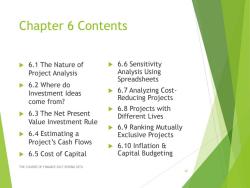

Chapter 6 Contents 6.1 The Nature of 6.6 Sensitivity Project Analysis Analysis Using Spreadsheets 6.2 Where do Investment ldeas 6.7 Analyzing Cost- come from? Reducing Projects 6.8 Projects with 6.3 The Net Present Different Lives Value Investment Rule 6.9 Ranking Mutually 6.4 Estimating a Exclusive Projects Project's Cash Flows 6.10 Inflation 6.5 Cost of Capital Capital Budgeting THE COURSE OF FINANCE 2017 SPRING SJTU ●2

Chapter 6 Contents 6.1 The Nature of Project Analysis 6.2 Where do Investment Ideas come from? 6.3 The Net Present Value Investment Rule 6.4 Estimating a Project’s Cash Flows 6.5 Cost of Capital 6.6 Sensitivity Analysis Using Spreadsheets 6.7 Analyzing Cost- Reducing Projects 6.8 Projects with Different Lives 6.9 Ranking Mutually Exclusive Projects 6.10 Inflation & Capital Budgeting THE COURSE OF FINANCE 2017 SPRING SJTU •2

Objective To show how to use discounted cash flow analysis to make investment decisions in business firms. THE COURSE OF FINANCE 2017 SPRING SJTU 3

Objective To show how to use discounted cash flow analysis to make investment decisions in business firms. THE COURSE OF FINANCE 2017 SPRING SJTU 3

Selected Contents 1.Firm's Investment Decision making rule: The Net Present Value (NPV,required) Internal Rate of Return (IRR,optional) 2.Cost of Capital D 3.Inflation Capital Budgeting The above contents are corresponding to 6.3/6.5/6.10 THE COURSE OF FINANCE 2017 SPRING SJTU 4

Selected Contents 1. Firm’s Investment Decision making rule: The Net Present Value (NPV, required) Internal Rate of Return (IRR, optional) 2.Cost of Capital 3.Inflation & Capital Budgeting The above contents are corresponding to 6.3/6.5/6.10 THE COURSE OF FINANCE 2017 SPRING SJTU 4

Firm's Investment Long term assets such as plant,equipment et. Most of them fall into three categories: New products Cost reduction Replacement THE COURSE OF FINANCE 2017 SPRING SJTU 5

Firm’s Investment Long term assets such as plant, equipment et. Most of them fall into three categories: New products Cost reduction Replacement THE COURSE OF FINANCE 2017 SPRING SJTU 5

Recall the objective of a firm Maximization of the market value of shareholders'equity In order to make it,Compute the net present value of the project's expected cash flows,and undertake only those with positive NPV THE COURSE OF FINANCE 2017 SPRING SJTU 6

Recall the objective of a firm Maximization of the market value of shareholders’ equity In order to make it, Compute the net present value of the project’s expected cash flows, and undertake only those with positive NPV THE COURSE OF FINANCE 2017 SPRING SJTU 6

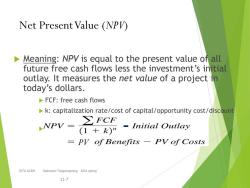

Net Present Value (NPV) Meaning:NPV is equal to the present value of all future free cash flows less the investment's initial outlay.It measures the net value of a project in today's dollars. FCF:free cash flows k:capitalization rate/cost of capital/opportunity cost/discount WPV=,之PCF (1kn -Initial Outlay =py of Benefits -PV of Costs SJTU ACEM Instructor:Tangzongming 2014 spring 11-7

Net PresentValue (NPV) Meaning: NPV is equal to the present value of all future free cash flows less the investment’s initial outlay. It measures the net value of a project in today’s dollars. FCF: free cash flows k: capitalization rate/cost of capital/opportunity cost/discount rate n: number of years SJTU ACEM Instructor:Tangzongming 2014 spring 11-7 - PV

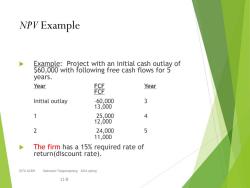

NPV Example Example:Project with an initial cash outlay of S60,000 with following free cash flows for 5 years. Year FCF Year FCF Initial outlay -60,000 3 13,000 1 25,000 4 12,000 2 24,000 5 11,000 The firm has a 15%required rate of return(discount rate). SJTU ACEM Instructor:Tangzongming 2014 spring 11-8

NPV Example Example: Project with an initial cash outlay of $60,000 with following free cash flows for 5 years. Year FCF Year FCF Initial outlay –60,000 3 13,000 1 –25,000 4 12,000 2 –24,000 5 11,000 The firm has a 15% required rate of return(discount rate). SJTU ACEM Instructor:Tangzongming 2014 spring 11-8

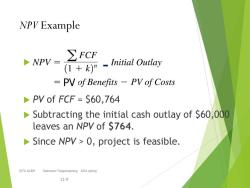

NPV Example ∑FCF NPV= Initial Outlay (1+k) PV of Benefits -PV of Costs PV of FCF S60,764 Subtracting the initial cash outlay of $60,000 leaves an NPV of $764. Since NPV 0,project is feasible. SJTU ACEM Instructor:Tangzongming 2014 spring 11-9

NPV Example PV of FCF = $60,764 Subtracting the initial cash outlay of $60,000 leaves an NPV of $764. Since NPV > 0, project is feasible. SJTU ACEM Instructor:Tangzongming 2014 spring 11-9 - PV

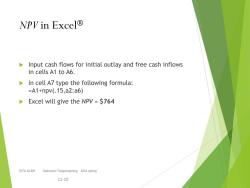

VPV in Excel® Input cash flows for initial outlay and free cash inflows in cells A1 to A6. In cell A7 type the following formula: =A1+npv(.15,a2:a6) Excel will give the NPV $764 SJTU ACEM Instructor:Tangzongming 2014 spring 11-10

NPV in Excel Input cash flows for initial outlay and free cash inflows in cells A1 to A6. In cell A7 type the following formula: =A1+npv(.15,a2:a6) Excel will give the NPV = $764 SJTU ACEM Instructor:Tangzongming 2014 spring 11-10

按次数下载不扣除下载券;

注册用户24小时内重复下载只扣除一次;

顺序:VIP每日次数-->可用次数-->下载券;

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 05 Household Saving and Investment Decisions.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 04 Allocating Resources Over Time.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 03 Managing Financial Health and Performance.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 02 Financial Markets and Institutions.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 01 Introduction of Financial Economics(唐宗明).ppt

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Fourteen Forward and Futures Markets.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Thirteen Capital Market Equilibrium.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Twelve Portfolio Opportunities and Choice.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Eleven Hedging, Insuring, and Diversifying.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Ten Principles of Risk Management.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Nine Valuation of Common Stocks.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Eight Valuation of Known Cash Flows:Bonds.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Seven Principles of Market Valuation.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Six The Analysis of Investment Projects.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Five Household Savings and Investment Decisions.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Four Allocating Resources Over Time.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Three Managing Financial Health and Performance.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Two Financial Markets and Institutions.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter One Financial Economics.pdf

- 上海交通大学:《国际政治经济学的源与流》选修课程PPT教学课件_自由主义.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 07 Principles of Market Valuation.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 08 Valuation of Known Cash Flows:Bonds.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 09 Valuation of Common Stocks.pdf

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 09 Valuation of Common Stocks.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 10 Principles of Risk Management.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 12 Portfolio Opportunities and Choice.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 13 Capital Market Equilibrium.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 14 Forward and Futures Markets.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 11 Hedging, Insuring, and Diversifying.ppt

- 上海交通大学:《金融学原理》教学资源(重点难点)前五章的重点难点.docx

- 上海交通大学:《金融学原理》教学资源(重点难点)金融学原理重点和难点.docx

- 对外经济贸易大学:《宏微观经济学 Microeconomics》课程教学资源(教学大纲,共十三章).pdf

- 对外经济贸易大学:《宏微观经济学 Microeconomics》课程教学资源(授课教案,共十四章).pdf

- 对外经济贸易大学:《会计学原理 Introduction to Financial Accounting》课程教学资源(教学大纲).pdf

- 对外经济贸易大学:《会计学原理 Introduction to Financial Accounting》课程教学资源(授课教案,共十二章).pdf

- 对外经济贸易大学:《中国经济概论 Introduction to Chinese Economy》课程教学资源(教学大纲).pdf

- 对外经济贸易大学:《中国经济概论 Introduction to Chinese Economy》课程教学资源(授课教案).pdf

- 对外经济贸易大学:《成本管理会计 Cost and Management Accounting》课程教学资源(教学大纲).pdf

- 对外经济贸易大学:《成本管理会计 Cost and Management Accounting》课程教学资源(授课教案).pdf

- 对外经贸大学:《高级经贸文章选读》课程教学资源(电子教案)第一单元 The New Economy.doc