上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 13 Capital Market Equilibrium

Lecture I5 Capital Market Equilibriu Refer to chapter THE COURSE OF FINANCE 2017 SPRING SJTU

Lecture 13: Capital Market Equilibrium Refer to chapter13 THE COURSE OF FINANCE 2017 SPRING SJTU 1

Objectives .The Theory of the CAPM .Use of CAPM in benchmarking .Using CAPM to determine correct rate for discounting THE COURSE OF FINANCE 2017 SPRING SJTU 2

Objectives THE COURSE OF FINANCE 2017 SPRING SJTU 2 •The Theory of the CAPM •Use of CAPM in benchmarking •Using CAPM to determine correct rate for discounting

Chapter 13 Contents 13.1 The Capital Asset Pricing Model in Brief 13.2 Determining of the Risk Premium on the Market Portfolio 13.3 Beta and Risk Premiums on Individual Securities 13.4 Using the CAPM in Portfolio Selection 13.5 Valuation Regulating Rates of Return THE COURSE OF FINANCE 2017 SPRING SJTU 3

Chapter 13 Contents 13.1 The Capital Asset Pricing Model in Brief 13.2 Determining of the Risk Premium on the Market Portfolio 13.3 Beta and Risk Premiums on Individual Securities 13.4 Using the CAPM in Portfolio Selection 13.5 Valuation & Regulating Rates of Return THE COURSE OF FINANCE 2017 SPRING SJTU 3

CAPM in bri CAPM is a theory about equilibrium prices in the markets for risky assets It is important because it provides a justification for the widespread practice of passive investing called indexing a way to estimate expected rates of return for use in evaluating stocks and projects THE COURSE OF FINANCE 2017 SPRING SJTU 4

CAPM in bri CAPM is a theory about equilibrium prices in the markets for risky assets It is important because it provides a justification for the widespread practice of passive investing called indexing a way to estimate expected rates of return for use in evaluating stocks and projects THE COURSE OF FINANCE 2017 SPRING SJTU 4

13.1 The Capital Asset Pricing Model in Brief Developed in the 1960's by Sharp,and independently by Lintner,and Mossin It answers the question What would equilibrium risk premiums be if people had the same set of forecasts of expected returns,risk,and correlations and all chose their portfolios according the principles of efficient diversification (Refer to chapter12) THE COURSE OF FINANCE 2017 SPRING SJTU

13.1 The Capital Asset Pricing Model in Brief Developed in the 1960’s by Sharp, and independently by Lintner, and Mossin It answers the question What would equilibrium risk premiums be if people had the same set of forecasts of expected returns, risk, and correlations and all chose their portfolios according the principles of efficient diversification (Refer to chapter12) THE COURSE OF FINANCE 2017 SPRING SJTU 5

Two Assumptions Investors forecasts agree with respect to expectations,standard deviations,and correlations of the returns of risky securities. Therefore all investors hold risky assets in the same relative proportions Investors behave optimally In equilibrium,prices adjust so that aggregate demand for each security is equal to its supply THE COURSE OF FINANCE 2017 SPRING SJTU 6

Two Assumptions Investors forecasts agree with respect to expectations, standard deviations, and correlations of the returns of risky securities. Therefore all investors hold risky assets in the same relative proportions Investors behave optimally :In equilibrium, prices adjust so that aggregate demand for each security is equal to its supply THE COURSE OF FINANCE 2017 SPRING SJTU 6

CML and Market Portfolio Since every investor's relative holdings of the risky security is the same,the only way the asset market can clear is if those optimal relative proportions are the proportions in which they are valued in the market place that proportions are called Market Portfolio THE COURSE OF FINANCE 2017 SPRING SJTU

CML and Market Portfolio Since every investor’s relative holdings of the risky security is the same, the only way the asset market can clear is if those optimal relative proportions are the proportions in which they are valued in the market place ,that proportions are called Market Portfolio THE COURSE OF FINANCE 2017 SPRING SJTU 7

CML and the CAPM CAPM says that in equilibrium, any investor's relative holding of risky assets will be the same as in the market portfolio Depending on their risk aversions, different investors hold portfolios with different mixes of riskless asset and the market portfolio THE COURSE OF FINANCE 2017 SPRING SJTU 8

CML and the CAPM CAPM says that in equilibrium, any investor’s relative holding of risky assets will be the same as in the market portfolio Depending on their risk aversions, different investors hold portfolios with different mixes of riskless asset and the market portfolio THE COURSE OF FINANCE 2017 SPRING SJTU 8

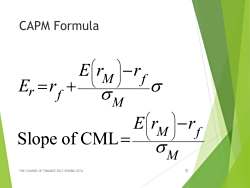

CAPM Formula En=rf十 M Slope of CML= M THE COURSE OF FINANCE 2017 SPRING SJTU 9

CAPM Formula THE COURSE OF FINANCE 2017 SPRING SJTU 9 Slope of CML M f r f M M f M E r r E r E r r

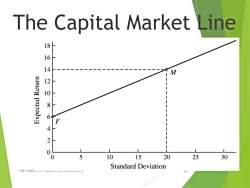

The Capital Market Line 18 16 1 M uImed panoadxy 120 8 6 4 2 5 10 15 20 25 30 Standard Deviation THE COUROL Ur FLNMINCL ZUL Fo

The Capital Market Line THE COURSE OF FINANCE 2017 SPRING SJTU 10

按次数下载不扣除下载券;

注册用户24小时内重复下载只扣除一次;

顺序:VIP每日次数-->可用次数-->下载券;

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 12 Portfolio Opportunities and Choice.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 10 Principles of Risk Management.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 09 Valuation of Common Stocks.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 09 Valuation of Common Stocks.pdf

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 08 Valuation of Known Cash Flows:Bonds.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 07 Principles of Market Valuation.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 06 The Analysis of Investment projects(capital budgeting).ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 05 Household Saving and Investment Decisions.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 04 Allocating Resources Over Time.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 03 Managing Financial Health and Performance.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 02 Financial Markets and Institutions.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 01 Introduction of Financial Economics(唐宗明).ppt

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Fourteen Forward and Futures Markets.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Thirteen Capital Market Equilibrium.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Twelve Portfolio Opportunities and Choice.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Eleven Hedging, Insuring, and Diversifying.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Ten Principles of Risk Management.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Nine Valuation of Common Stocks.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Eight Valuation of Known Cash Flows:Bonds.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Seven Principles of Market Valuation.pdf

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 14 Forward and Futures Markets.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 11 Hedging, Insuring, and Diversifying.ppt

- 上海交通大学:《金融学原理》教学资源(重点难点)前五章的重点难点.docx

- 上海交通大学:《金融学原理》教学资源(重点难点)金融学原理重点和难点.docx

- 对外经济贸易大学:《宏微观经济学 Microeconomics》课程教学资源(教学大纲,共十三章).pdf

- 对外经济贸易大学:《宏微观经济学 Microeconomics》课程教学资源(授课教案,共十四章).pdf

- 对外经济贸易大学:《会计学原理 Introduction to Financial Accounting》课程教学资源(教学大纲).pdf

- 对外经济贸易大学:《会计学原理 Introduction to Financial Accounting》课程教学资源(授课教案,共十二章).pdf

- 对外经济贸易大学:《中国经济概论 Introduction to Chinese Economy》课程教学资源(教学大纲).pdf

- 对外经济贸易大学:《中国经济概论 Introduction to Chinese Economy》课程教学资源(授课教案).pdf

- 对外经济贸易大学:《成本管理会计 Cost and Management Accounting》课程教学资源(教学大纲).pdf

- 对外经济贸易大学:《成本管理会计 Cost and Management Accounting》课程教学资源(授课教案).pdf

- 对外经贸大学:《高级经贸文章选读》课程教学资源(电子教案)第一单元 The New Economy.doc

- 对外经贸大学:《高级经贸文章选读》课程教学资源(电子教案)第二单元 China in the Market Place.doc

- 对外经贸大学:《高级经贸文章选读》课程教学资源(电子教案)第三单元 The Economic Scene:A Global Perspective.doc

- 对外经贸大学:《高级经贸文章选读》课程教学资源(电子教案)第四单元 Japan Says No.doc

- 对外经贸大学:《高级经贸文章选读》课程教学资源(电子教案)第五单元 Soft Drink Wars:the Next Battle.doc

- 对外经贸大学:《高级经贸文章选读》课程教学资源(电子教案)第六单元 The Long March.doc

- 对外经贸大学:《高级经贸文章选读》课程教学资源(电子教案)第七单元 M & A:Companies Shopped – Now They’ve Dropped.doc

- 对外经贸大学:《高级经贸文章选读》课程教学资源(电子教案)第八单元 Lessons for Europe from the Quebec Trade Summit.doc