上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 02 Financial Markets and Institutions

lecture 2: Financial Markets and Institutions Objectives Understanding the functions of the financial system Knowing financial markets Knowing financial institutions Knowing rates of return THE COURSE OF FINANCE 2017 SPRING SJTU

lecture 2: Financial Markets and Institutions THE COURSE OF FINANCE 2017 SPRING SJTU 1 Objectives Understanding the functions of the financial system Knowing financial markets Knowing financial institutions Knowing rates of return

Chapter 2 Contents 2.1 What is a 2.7 Financial Intermediaries Financial System? 2.8 Financial Infrastructure 2.2 The Flow of Funds and Regulation 2.3 The Functional 2.9 Governmental Quasi Perspective Governmental Organizations 2.4 Financial Innovation the “Invisible Hand” 2.5 Financial Markets 2.6 Financial Market Rates THE COURSE OF FINANCE 2017 SPRING SJTU 2

Chapter 2 Contents 2.1 What is a Financial System? 2.2 The Flow of Funds 2.3 The Functional Perspective 2.4 Financial Innovation & the “Invisible Hand” 2.5 Financial Markets 2.6 Financial Market Rates 2.7 Financial Intermediaries 2.8 Financial Infrastructure and Regulation 2.9 Governmental & Quasi- Governmental Organizations THE COURSE OF FINANCE 2017 SPRING SJTU 2

The Financial System Financial decisions are made within the context of a financial system The financial system both constrains and enables the decision maker This chapter provides a framework for understanding how financial systems work. THE COURSE OF FINANCE 2017 SPRING SJTU 3

The Financial System Financial decisions are made within the context of a financial system The financial system both constrains and enables the decision maker This chapter provides a framework for understanding how financial systems work. THE COURSE OF FINANCE 2017 SPRING SJTU 3

2.1 What is the Financial System? A Financial System is comprised of Markets Intermediaries service firms Regulating institutions Financial activities such as the financial decisions of households,business firms,and governments are implemented in financial systems. THE COURSE OF FINANCE 2017 SPRING SJTU 4

2.1 What is the Financial System? A Financial System is comprised of Markets Intermediaries service firms Regulating institutions Financial activities such as the financial decisions of households, business firms, and governments are implemented in financial systems. THE COURSE OF FINANCE 2017 SPRING SJTU 4

Geography of Financial Markets some markets for a particular market instrument may have a well defined geographic location other market instruments are traded on over-the-counter or off-exchange markets for bonds,stocks,and foreign exchange Example:NASDAQ(National Association of Securities Dealers Automated Quotations);NEEQ(National Equities Exchange and Quotations新三板) THE COURSE OF FINANCE 2017 SPRING SJTU 5

Geography of Financial Markets some markets for a particular market instrument may have a well defined geographic location other market instruments are traded on over-the-counter or off-exchange markets for bonds, stocks, and foreign exchange Example: NASDAQ(National Association of Securities Dealers Automated Quotations); NEEQ(National Equities Exchange and Quotations新三板) THE COURSE OF FINANCE 2017 SPRING SJTU 5

Financial Institutions Financial intermediaries(全融中介) a firm whose primary business is to provide financial services and financial products Examples: bank(checking accounts支票存款,demand deposit话期存款,time deposit定期存 款loans贷款,CDs大额存单) investment company(mutual funds共同基金.) insurance company (term life insurance...) Financial service firms Accounting firms Financial advisory firms Regulatory bodies:govern all of the financial institutions SEC;China Securities Regulatory Commission NYSE New York Stock exchange;Shanghai Stock exchange Federal reserve bank;People's bank of china The Course of Finance 6

The Course of Finance 6 Financial Institutions Financial intermediaries(金融中介) a firm whose primary business is to provide financial services and financial products Examples: bank (checking accounts支票存款, demand deposit 活期存款,time deposit 定期存 款loans贷款, CDs大额存单 …) investment company (mutual funds 共同基金…) insurance company (term life insurance …) Financial service firms Accounting firms Financial advisory firms Regulatory bodies: govern all of the financial institutions SEC; China Securities Regulatory Commission NYSE New York Stock exchange; Shanghai Stock exchange Federal reserve bank; People’s bank of china

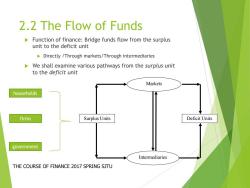

2.2 The Flow of Funds Function of finance:Bridge funds flow from the surplus unit to the deficit unit Directly /Through markets/Through intermediaries We shall examine various pathways from the surplus unit to the deficit unit Markets households firms Surplus Units Deficit Units government Intermediaries THE COURSE OF FINANCE 2017 SPRING SJTU

2.2 The Flow of Funds Function of finance: Bridge funds flow from the surplus unit to the deficit unit Directly /Through markets/Through intermediaries We shall examine various pathways from the surplus unit to the deficit unit THE COURSE OF FINANCE 2017 SPRING SJTU Markets Intermediaries Surplus Units Deficit Units households firms government

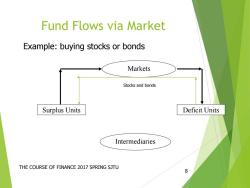

Fund Flows via Market Example:buying stocks or bonds Markets Stocks and bonds Surplus Units Deficit Units Intermediaries THE COURSE OF FINANCE 2017 SPRING SJTU 8

Fund Flows via Market THE COURSE OF FINANCE 2017 SPRING SJTU 8 Markets Intermediaries Surplus Units Deficit Units Example: buying stocks or bonds Stocks and bonds

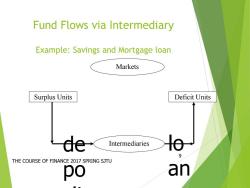

Fund Flows via Intermediary Example:Savings and Mortgage loan Markets Surplus Units Deficit Units de Intermediaries 9 THE COURSE OF FINANCE 2017 SPRING SJTU po an

Fund Flows via Intermediary Example: Savings and Mortgage loan THE COURSE OF FINANCE 2017 SPRING SJTU 9 Markets Intermediaries Surplus Units Deficit Units de po sit s lo an s

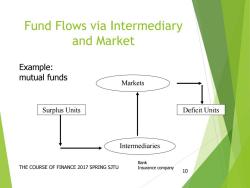

Fund Flows via Intermediary and Market Example: mutual funds Markets Surplus Units Deficit Units Intermediaries Bank THE COURSE OF FINANCE 2017 SPRING SJTU Insurance company 10

Fund Flows via Intermediary and Market THE COURSE OF FINANCE 2017 SPRING SJTU 10 Markets Intermediaries Surplus Units Deficit Units Example: mutual funds Bank Insurance company

按次数下载不扣除下载券;

注册用户24小时内重复下载只扣除一次;

顺序:VIP每日次数-->可用次数-->下载券;

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 01 Introduction of Financial Economics(唐宗明).ppt

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Fourteen Forward and Futures Markets.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Thirteen Capital Market Equilibrium.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Twelve Portfolio Opportunities and Choice.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Eleven Hedging, Insuring, and Diversifying.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Ten Principles of Risk Management.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Nine Valuation of Common Stocks.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Eight Valuation of Known Cash Flows:Bonds.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Seven Principles of Market Valuation.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Six The Analysis of Investment Projects.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Five Household Savings and Investment Decisions.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Four Allocating Resources Over Time.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Three Managing Financial Health and Performance.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Two Financial Markets and Institutions.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter One Financial Economics.pdf

- 上海交通大学:《国际政治经济学的源与流》选修课程PPT教学课件_自由主义.ppt

- 上海交通大学:《国际政治经济学的源与流》选修课程PPT教学课件_课程简介与绪论(陈鹏).ppt

- 上海交通大学:《国际政治经济学的源与流》选修课程PPT教学课件_现实主义(下).ppt

- 上海交通大学:《国际政治经济学的源与流》选修课程PPT教学课件_现实主义(上).ppt

- 上海交通大学:《国际政治经济学的源与流》选修课程PPT教学课件_建构主义.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 03 Managing Financial Health and Performance.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 04 Allocating Resources Over Time.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 05 Household Saving and Investment Decisions.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 06 The Analysis of Investment projects(capital budgeting).ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 07 Principles of Market Valuation.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 08 Valuation of Known Cash Flows:Bonds.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 09 Valuation of Common Stocks.pdf

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 09 Valuation of Common Stocks.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 10 Principles of Risk Management.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 12 Portfolio Opportunities and Choice.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 13 Capital Market Equilibrium.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 14 Forward and Futures Markets.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 11 Hedging, Insuring, and Diversifying.ppt

- 上海交通大学:《金融学原理》教学资源(重点难点)前五章的重点难点.docx

- 上海交通大学:《金融学原理》教学资源(重点难点)金融学原理重点和难点.docx

- 对外经济贸易大学:《宏微观经济学 Microeconomics》课程教学资源(教学大纲,共十三章).pdf

- 对外经济贸易大学:《宏微观经济学 Microeconomics》课程教学资源(授课教案,共十四章).pdf

- 对外经济贸易大学:《会计学原理 Introduction to Financial Accounting》课程教学资源(教学大纲).pdf

- 对外经济贸易大学:《会计学原理 Introduction to Financial Accounting》课程教学资源(授课教案,共十二章).pdf

- 对外经济贸易大学:《中国经济概论 Introduction to Chinese Economy》课程教学资源(教学大纲).pdf