上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 08 Valuation of Known Cash Flows:Bonds

Lecture 8 Valuation of Known Cash Flows:Bonds refer to Ch.8 THE COURSE OF FINANCE 2017 SPRING SJTU

Lecture 8 Valuation of Known Cash Flows: Bonds refer to Ch.8 THE COURSE OF FINANCE 2017 SPRING SJTU 1

Objectives To show how to value bonds To understand how bond prices and yields change over time THE COURSE OF FINANCE 2017 SPRING SJTU

Objectives n To show how to value bonds n To understand how bond prices and yields change over time THE COURSE OF FINANCE 2017 SPRING SJTU 2

Chapter 8 Contents 8.1 Using Present Value Formulas to Value Known Flows 8.2 The Basic Building Blocks:Pure Discount Bonds 8.3 Coupon Bonds,Current Yield,and Yield-to-Maturity 8.4 Reading Bond Listings 8.5 Why Yields for the same Maturity Differ 8.6 The Behavior of Bond Prices Over Time THE COURSE OF FINANCE 2017 SPRING SJTU

Chapter 8 Contents 8.1 Using Present Value Formulas to Value Known Flows 8.2 The Basic Building Blocks: Pure Discount Bonds 8.3 Coupon Bonds, Current Yield, and Yield-to-Maturity 8.4 Reading Bond Listings 8.5 Why Yields for the same Maturity Differ 8.6 The Behavior of Bond Prices Over Time THE COURSE OF FINANCE 2017 SPRING SJTU 3

8.1 Using Present Value Formulas to value Known Flows You have been offered the opportunity to purchase a mortgage.It was originally part of a creative financing package where the original owner financed the buyer The remaining life of the mortgage is 60 months,with payment of S400.Your required rate of return is 1.5%month THE COURSE OF FINANCE 2017 SPRING SJTU

8.1 Using Present Value Formulas to Value Known Flows You have been offered the opportunity to purchase a mortgage. It was originally part of a creative financing package where the original owner financed the buyer The remaining life of the mortgage is 60 months, with payment of $400. Your required rate of return is 1.5% / month THE COURSE OF FINANCE 2017 SPRING SJTU 4

Calculation Using the present value of an annuity formula discussed in chapter 4,you will pay no more than 四1-(j - 60 0.015 =$15,752.11 THE COURSE OF FINANCE 2017 SPRING SJTU

Calculation Using the present value of an annuity formula discussed in chapter 4, you will pay no more than THE COURSE OF FINANCE 2017 SPRING SJTU 5 $ 15 ,752 . 11 1 . 015 1 1 0 . 015 400 1 1 1 60 n i i pmt PV

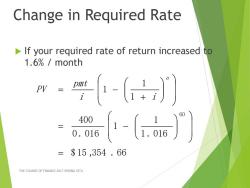

Change in Required Rate If your required rate of return increased to 1.6%month PV 二 g a 60 400 0.016 =$15,354.66 THE COURSE OF FINANCE 2017 SPRING SJTU

Change in Required Rate If your required rate of return increased to 1.6% / month THE COURSE OF FINANCE 2017 SPRING SJTU 6 $ 15 ,354 . 66 1 . 016 1 1 0 . 016 400 1 1 1 60 n i i pmt PV

Using Present Value Formulas to Value Known Cash Flows Observe that the maximum you would pay for the bond has decreased -(〕 -+ 60 架-s门 -0.016 -i 400 =$15,752.11 =$15,354.66 Conclusion i PV THE COURSE OF FINANCE 2017 SPRING SJTU

Using Present Value Formulas to Value Known Cash Flows Observe that the maximum you would pay for the bond has decreased THE COURSE OF FINANCE 2017 SPRING SJTU 7 $15,752.11 1.015 1 1 0.015 400 1 1 1 60 n i i pmt PV $15,354.66 1.016 1 1 0.016 400 1 1 1 60 n i i pmt PV Conclusion : i PV

Coupon Bonds Definition A coupon bond obligates the issuer to make periodic payments of interest to the bond holder until the bond matures at which time the face value of the bond is also paid to the bond holder and the contract is satisfied THE COURSE OF FINANCE 2017 SPRING SJTU

Coupon Bonds Definition : A coupon bond obligates the issuer to make periodic payments of interest to the bond holder until the bond matures at which time the face value of the bond is also paid to the bond holder and the contract is satisfied THE COURSE OF FINANCE 2017 SPRING SJTU 8

Characteristics of Coupon Bonc Par value (face value or principal) Coupon rate(interest rate) It is the interest rate applied to the face value to compute the coupon payment Maturity (years) Current yield (coupon/bond price) Yield to Maturity (or discount rate which is also called Yield.If we have the price of the coupon bond,and the timing and magnitude of its future cash flows,so we can determine its YTM or yield. THE COURSE OF FINANCE 2017 SPRING SJTU

Characteristics of Coupon Bond Par value (face value or principal) Coupon rate(interest rate) It is the interest rate applied to the face value to compute the coupon payment Maturity (years) Current yield (coupon/bond price) Yield to Maturity (or discount rate ) which is also called Yield. If we have the price of the coupon bond, and the timing and magnitude of its future cash flows, so we can determine its YTM or yield. THE COURSE OF FINANCE 2017 SPRING SJTU 9

Cash Flows from Coupon Bond 1)Coupon Interests(known) 2)Principal or Par Value or Face Value(known) 1 1 I3+Par 1 2 3 THE COURSE OF FINANCE 2017 SPRING SJTU

Cash Flows from Coupon Bond 1) Coupon Interests(known) 2) Principal or Par Value or Face Value(known) THE COURSE OF FINANCE 2017 SPRING SJTU 10 I1 I2 I3+Par 0 1 2 3

按次数下载不扣除下载券;

注册用户24小时内重复下载只扣除一次;

顺序:VIP每日次数-->可用次数-->下载券;

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 07 Principles of Market Valuation.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 06 The Analysis of Investment projects(capital budgeting).ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 05 Household Saving and Investment Decisions.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 04 Allocating Resources Over Time.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 03 Managing Financial Health and Performance.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 02 Financial Markets and Institutions.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 01 Introduction of Financial Economics(唐宗明).ppt

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Fourteen Forward and Futures Markets.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Thirteen Capital Market Equilibrium.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Twelve Portfolio Opportunities and Choice.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Eleven Hedging, Insuring, and Diversifying.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Ten Principles of Risk Management.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Nine Valuation of Common Stocks.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Eight Valuation of Known Cash Flows:Bonds.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Seven Principles of Market Valuation.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Six The Analysis of Investment Projects.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Five Household Savings and Investment Decisions.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Four Allocating Resources Over Time.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Three Managing Financial Health and Performance.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Two Financial Markets and Institutions.pdf

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 09 Valuation of Common Stocks.pdf

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 09 Valuation of Common Stocks.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 10 Principles of Risk Management.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 12 Portfolio Opportunities and Choice.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 13 Capital Market Equilibrium.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 14 Forward and Futures Markets.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 11 Hedging, Insuring, and Diversifying.ppt

- 上海交通大学:《金融学原理》教学资源(重点难点)前五章的重点难点.docx

- 上海交通大学:《金融学原理》教学资源(重点难点)金融学原理重点和难点.docx

- 对外经济贸易大学:《宏微观经济学 Microeconomics》课程教学资源(教学大纲,共十三章).pdf

- 对外经济贸易大学:《宏微观经济学 Microeconomics》课程教学资源(授课教案,共十四章).pdf

- 对外经济贸易大学:《会计学原理 Introduction to Financial Accounting》课程教学资源(教学大纲).pdf

- 对外经济贸易大学:《会计学原理 Introduction to Financial Accounting》课程教学资源(授课教案,共十二章).pdf

- 对外经济贸易大学:《中国经济概论 Introduction to Chinese Economy》课程教学资源(教学大纲).pdf

- 对外经济贸易大学:《中国经济概论 Introduction to Chinese Economy》课程教学资源(授课教案).pdf

- 对外经济贸易大学:《成本管理会计 Cost and Management Accounting》课程教学资源(教学大纲).pdf

- 对外经济贸易大学:《成本管理会计 Cost and Management Accounting》课程教学资源(授课教案).pdf

- 对外经贸大学:《高级经贸文章选读》课程教学资源(电子教案)第一单元 The New Economy.doc

- 对外经贸大学:《高级经贸文章选读》课程教学资源(电子教案)第二单元 China in the Market Place.doc

- 对外经贸大学:《高级经贸文章选读》课程教学资源(电子教案)第三单元 The Economic Scene:A Global Perspective.doc