上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 11 Hedging, Insuring, and Diversifying

Lecture 11:Hedging,Insuring,and Diversifying refer to Ch.11 THE COURSE OF FINANCE 2017 SPRING SJTU

Lecture 11: Hedging, Insuring, and Diversifying refer to Ch.11 THE COURSE OF FINANCE 2017 SPRING SJTU 1

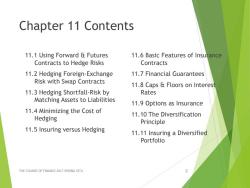

Chapter 11 Contents 11.1 Using Forward Futures 11.6 Basic Features of Insurance Contracts to Hedge Risks Contracts 11.2 Hedging Foreign-Exchange 11.7 Financial Guarantees Risk with Swap Contracts 11.8 Caps Floors on Interest 11.3 Hedging Shortfall-Risk by Rates Matching Assets to Liabilities 11.9 Options as Insurance 11.4 Minimizing the Cost of 11.10 The Diversification Hedging Principle 11.5 Insuring versus Hedging 11.11 Insuring a Diversified Portfolio THE COURSE OF FINANCE 2017 SPRING SJTU

Chapter 11 Contents 11.1 Using Forward & Futures Contracts to Hedge Risks 11.2 Hedging Foreign-Exchange Risk with Swap Contracts 11.3 Hedging Shortfall-Risk by Matching Assets to Liabilities 11.4 Minimizing the Cost of Hedging 11.5 Insuring versus Hedging 11.6 Basic Features of Insurance Contracts 11.7 Financial Guarantees 11.8 Caps & Floors on Interest Rates 11.9 Options as Insurance 11.10 The Diversification Principle 11.11 Insuring a Diversified Portfolio THE COURSE OF FINANCE 2017 SPRING SJTU 2

objectives Know how to use hedging insuring and diversifying to transfer risk Hedging(11.1-11.4) Insuring (11.5-11.9) Diversifying (11.10-11.11) THE COURSE OF FINANCE 2017 SPRING SJTU 3

objectives Know how to use hedging ,insuring and diversifying to transfer risk Hedging (11.1~11.4) Insuring (11.5~11.9) Diversifying (11.10~11.11) THE COURSE OF FINANCE 2017 SPRING SJTU 3

11.1 Using Forward and Futures Contracts to Hedge Risks Forward Contract an agreement between two parties to exchange something at a specified price and time This is an obligation on both parties Distinguish this from a right of a party to exchange something THE COURSE OF FINANCE 2017 SPRING SJTU 4

11.1 Using Forward and Futures Contracts to Hedge Risks Forward Contract an agreement between two parties to exchange something at a specified price and time This is an obligation on both parties Distinguish this from a right of a party to exchange something THE COURSE OF FINANCE 2017 SPRING SJTU 4

Definitions of Terms Forward Price Price (agreed or specified to today)of an item to be purchased,and paid for,at a given future date Spot Price Price of an item to be purchased (and paid for)or for immediate delivery. Face Value 'Quantity of deliverable'times 'forward price' THE COURSE OF FINANCE 2017 SPRING SJTU 5

Definitions of Terms Forward Price Price (agreed or specified to today) of an item to be purchased, and paid for, at a given future date Spot Price Price of an item to be purchased (and paid for) or for immediate delivery. Face Value ‘Quantity of deliverable’ times ‘forward price’ THE COURSE OF FINANCE 2017 SPRING SJTU 5

Definitions of Terms Long Position(多头) The agreement to buy the item (from the person taking the short position) Short Position(空头) The agreement to sell the item (to the person taking the long position) THE COURSE OF FINANCE 2017 SPRING SJTU 6

Definitions of Terms Long Position(多头) The agreement to buy the item (from the person taking the short position) Short Position(空头) The agreement to sell the item (to the person taking the long position) THE COURSE OF FINANCE 2017 SPRING SJTU 6

Using Forward and Futures Contracts to Hedge Risks Traditionally,no payment is made on a forward contract until the settlement date(交割日) If the parties to a forward contract do not trust the other,then add clauses to provide a sureties to a stakeholder periodically render contract valueless by making cash settlement equal to its current market value THE COURSE OF FINANCE 2017 SPRING SJTU

Using Forward and Futures Contracts to Hedge Risks Traditionally, no payment is made on a forward contract until the settlement date(交割日) If the parties to a forward contract do not trust the other, then add clauses to provide a sureties to a stakeholder periodically render contract valueless by making cash settlement equal to its current market value THE COURSE OF FINANCE 2017 SPRING SJTU 7

The Farmer and the Baker (Example) Jamela is a farmer with a wheat crop of about 100,000 bushels,1- month from harvest Mohammed is a baker who will need to restock his inventory of wheat for the coming year THE COURSE OF FINANCE 2017 SPRING SJTU 8

The Farmer and the Baker (Example) Jamela is a farmer with a wheat crop of about 100,000 bushels, 1- month from harvest Mohammed is a baker who will need to restock his inventory of wheat for the coming year THE COURSE OF FINANCE 2017 SPRING SJTU 8

The Farmer and the Baker Jamela and Mohammed wish to reduce price uncertainty because: Jamela has a mortgage to pay on her farm,and is concerned about wheat prices falling in the next month Mohammed wishes to close an agreement with a supermarket to supply bread at a fixed price for the coming year THE COURSE OF FINANCE 2017 SPRING SJTU 9

The Farmer and the Baker Jamela and Mohammed wish to reduce price uncertainty because: Jamela has a mortgage to pay on her farm, and is concerned about wheat prices falling in the next month Mohammed wishes to close an agreement with a supermarket to supply bread at a fixed price for the coming year THE COURSE OF FINANCE 2017 SPRING SJTU 9

The Farmer and the Baker Jamela and Mohammed agree to a forward contract Jamela agrees to deliver 100,000 bushels of wheat at $2.00 a bushel in one month,and Mohammed agrees to pay the $200,000 on delivery in a forward contract market. Assuming the crop doesn't fail,both parties have hedged their obligations THE COURSE OF FINANCE 2017 SPRING SJTU 10

The Farmer and the Baker Jamela and Mohammed agree to a forward contract Jamela agrees to deliver 100,000 bushels of wheat at $2.00 a bushel in one month, and Mohammed agrees to pay the $200,000 on delivery in a forward contract market. Assuming the crop doesn't fail, both parties have hedged their obligations THE COURSE OF FINANCE 2017 SPRING SJTU 10

按次数下载不扣除下载券;

注册用户24小时内重复下载只扣除一次;

顺序:VIP每日次数-->可用次数-->下载券;

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 14 Forward and Futures Markets.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 13 Capital Market Equilibrium.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 12 Portfolio Opportunities and Choice.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 10 Principles of Risk Management.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 09 Valuation of Common Stocks.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 09 Valuation of Common Stocks.pdf

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 08 Valuation of Known Cash Flows:Bonds.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 07 Principles of Market Valuation.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 06 The Analysis of Investment projects(capital budgeting).ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 05 Household Saving and Investment Decisions.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 04 Allocating Resources Over Time.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 03 Managing Financial Health and Performance.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 02 Financial Markets and Institutions.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 01 Introduction of Financial Economics(唐宗明).ppt

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Fourteen Forward and Futures Markets.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Thirteen Capital Market Equilibrium.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Twelve Portfolio Opportunities and Choice.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Eleven Hedging, Insuring, and Diversifying.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Ten Principles of Risk Management.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Nine Valuation of Common Stocks.pdf

- 上海交通大学:《金融学原理》教学资源(重点难点)前五章的重点难点.docx

- 上海交通大学:《金融学原理》教学资源(重点难点)金融学原理重点和难点.docx

- 对外经济贸易大学:《宏微观经济学 Microeconomics》课程教学资源(教学大纲,共十三章).pdf

- 对外经济贸易大学:《宏微观经济学 Microeconomics》课程教学资源(授课教案,共十四章).pdf

- 对外经济贸易大学:《会计学原理 Introduction to Financial Accounting》课程教学资源(教学大纲).pdf

- 对外经济贸易大学:《会计学原理 Introduction to Financial Accounting》课程教学资源(授课教案,共十二章).pdf

- 对外经济贸易大学:《中国经济概论 Introduction to Chinese Economy》课程教学资源(教学大纲).pdf

- 对外经济贸易大学:《中国经济概论 Introduction to Chinese Economy》课程教学资源(授课教案).pdf

- 对外经济贸易大学:《成本管理会计 Cost and Management Accounting》课程教学资源(教学大纲).pdf

- 对外经济贸易大学:《成本管理会计 Cost and Management Accounting》课程教学资源(授课教案).pdf

- 对外经贸大学:《高级经贸文章选读》课程教学资源(电子教案)第一单元 The New Economy.doc

- 对外经贸大学:《高级经贸文章选读》课程教学资源(电子教案)第二单元 China in the Market Place.doc

- 对外经贸大学:《高级经贸文章选读》课程教学资源(电子教案)第三单元 The Economic Scene:A Global Perspective.doc

- 对外经贸大学:《高级经贸文章选读》课程教学资源(电子教案)第四单元 Japan Says No.doc

- 对外经贸大学:《高级经贸文章选读》课程教学资源(电子教案)第五单元 Soft Drink Wars:the Next Battle.doc

- 对外经贸大学:《高级经贸文章选读》课程教学资源(电子教案)第六单元 The Long March.doc

- 对外经贸大学:《高级经贸文章选读》课程教学资源(电子教案)第七单元 M & A:Companies Shopped – Now They’ve Dropped.doc

- 对外经贸大学:《高级经贸文章选读》课程教学资源(电子教案)第八单元 Lessons for Europe from the Quebec Trade Summit.doc

- 对外经贸大学:《世界贸易组织概论》课程教学资源(教学大纲).doc

- 对外经贸大学:《世界贸易组织概论》课程教学资源(PPT授课教案)第一讲 多边贸易体制的产生与发展.ppt