上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 04 Allocating Resources Over Time

Lecture 4: Allocating Resources Over Time (textbook Ch.4 referencebook ch.5) Objective Explain the concept of compounding and discounting Know how these concepts are applied in financial decision THE COURSE OF FINANCE 2017 SPRING STTU

Lecture 4: Allocating Resources Over Time (textbook Ch.4\referencebook ch.5) THE COURSE OF FINANCE 2017 SPRING SJTU 1 Objective u Explain the concept of compounding and discounting u Know how these concepts are applied in financial decision

Chapter 4 Contents 4.1 compounding 4.6 annuities 4.2 the frequency of 4.7 perpetual annuities compounding 4.8 loan amortization 4.3 present value and 4.9 exchange rates and discounting time value of money 4.4 alternative 4.10 inflation and discounted cash flow discounted cash flow decision rules analysis 4.5 multiple cash flows 4.11 taxes and investment decision THE COURSE OF FINANCE 2017 SPRING STTU

Chapter 4 Contents 4.1 compounding 4.2 the frequency of compounding 4.3 present value and discounting 4.4 alternative discounted cash flow decision rules 4.5 multiple cash flows 4.6 annuities 4.7 perpetual annuities 4.8 loan amortization 4.9 exchange rates and time value of money 4.10 inflation and discounted cash flow analysis 4.11 taxes and investment decision THE COURSE OF FINANCE 2017 SPRING SJTU •2

Selected Contents FV PV Compounding interest;simple interest Discounting and DCF approach Annuity,perpetuity,preferred stock Using Excel functions of FV,PV,PMT,RATE,and NPER to compute time value of money THE COURSE OF FINANCE 2017 SPRING STTU 3

Selected Contents FV, PV Compounding interest; simple interest Discounting and DCF approach Annuity, perpetuity, preferred stock Using Excel functions of FV, PV, PMT, RATE, and NPER to compute time value of money THE COURSE OF FINANCE 2017 SPRING SJTU 3

Introduction:Time Value of Money (TVM) $1 today is worth more than the expectation of $1 tomorrow because: a bank would pay interest on the $1 inflation makes tomorrows s1 less valuable than today's uncertainty of receiving tomorrow's $1 THE COURSE OF FINANCE 2017 SPRING STTU

Introduction: Time Value of Money (TVM) $1 today is worth more than the expectation of $1 tomorrow because: a bank would pay interest on the $1 inflation makes tomorrows $1 less valuable than today’s uncertainty of receiving tomorrow’s $1 THE COURSE OF FINANCE 2017 SPRING SJTU 4

Two methods to offer interest Simple interest Compound interest THE COURSE OF FINANCE 2017 SPRING STTU 5

Two methods to offer interest Simple interest Compound interest THE COURSE OF FINANCE 2017 SPRING SJTU 5

Simple Interest Interest is earned only on principal. Example:Compute simple interest on $100 invested at 6%per year for three years. 1st year interest is S6.00 2nd yearinterest is S6.00 3rd year interest is $6.00 Total interest earned:$18.00 THE COURSE OF FINANCE 2017 SPRING SJTU 6-6

Simple Interest Interest is earned only on principal. Example: Compute simple interest on $100 invested at 6% per year for three years. 1st year interest is $6.00 2nd yearinterest is $6.00 3rd year interest is $6.00 Total interest earned: $18.00 THE COURSE OF FINANCE 2017 SPRING SJTU 6-6

Compound Interest Compounding is when interest paid on an investment during the first period is added to the principal;then, during the second period,interest is earned on the new sum (that includes the principal and interest earned so far). THE COURSE OF FINANCE 2017 SPRING STTU 6-7

Compound Interest Compounding is when interest paid on an investment during the first period is added to the principal; then, during the second period, interest is earned on the new sum (that includes the principal and interest earned so far). THE COURSE OF FINANCE 2017 SPRING SJTU 6-7

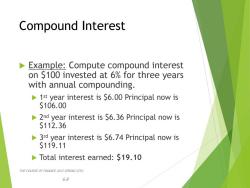

Compound Interest Example:Compute compound interest on $100 invested at 6%for three years with annual compounding. 1st year interest is $6.00 Principal now is $106.00 2nd year interest is S6.36 Principal now is $112.36 3rd year interest is $6.74 Principal now is S119.11 Total interest earned:S19.10 THE COURSE OF FINANCE 2017 SPRING SJTU 6-8

Compound Interest Example: Compute compound interest on $100 invested at 6% for three years with annual compounding. 1st year interest is $6.00 Principal now is $106.00 2nd year interest is $6.36 Principal now is $112.36 3rd year interest is $6.74 Principal now is $119.11 Total interest earned: $19.10 THE COURSE OF FINANCE 2017 SPRING SJTU 6-8

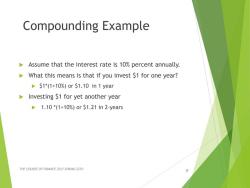

Compounding Example Assume that the interest rate is 10%percent annually. What this means is that if you invest $1 for one year? DS1*(1+10%)or$1.10in1year Investing $1 for yet another year 1.10*(1+10%)orS1.21in2-years THE COURSE OF FINANCE 2017 SPRING STTU 9

Compounding Example Assume that the interest rate is 10% percent annually. What this means is that if you invest $1 for one year? $1*(1+10%) or $1.10 in 1 year Investing $1 for yet another year 1.10 *(1+10%) or $1.21 in 2-years THE COURSE OF FINANCE 2017 SPRING SJTU 9

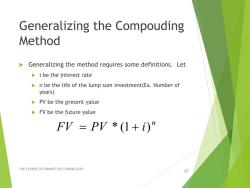

Generalizing the Compouding Method Generalizing the method requires some definitions.Let i be the interest rate n be the life of the lump sum investment(Ex.Number of years) PV be the present value FV be the future value FV=PV*(1+i)” THE COURSE OF FINANCE 2017 SPRING STTU 10

Generalizing the Compouding Method Generalizing the method requires some definitions. Let i be the interest rate n be the life of the lump sum investment(Ex. Number of years) PV be the present value FV be the future value THE COURSE OF FINANCE 2017 SPRING SJTU 10 n FV PV * (1 i)

按次数下载不扣除下载券;

注册用户24小时内重复下载只扣除一次;

顺序:VIP每日次数-->可用次数-->下载券;

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 03 Managing Financial Health and Performance.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 02 Financial Markets and Institutions.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 01 Introduction of Financial Economics(唐宗明).ppt

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Fourteen Forward and Futures Markets.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Thirteen Capital Market Equilibrium.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Twelve Portfolio Opportunities and Choice.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Eleven Hedging, Insuring, and Diversifying.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Ten Principles of Risk Management.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Nine Valuation of Common Stocks.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Eight Valuation of Known Cash Flows:Bonds.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Seven Principles of Market Valuation.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Six The Analysis of Investment Projects.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Five Household Savings and Investment Decisions.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Four Allocating Resources Over Time.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Three Managing Financial Health and Performance.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter Two Financial Markets and Institutions.pdf

- 上海交通大学:《金融学原理》课程教学资源(练习与答案)Chapter One Financial Economics.pdf

- 上海交通大学:《国际政治经济学的源与流》选修课程PPT教学课件_自由主义.ppt

- 上海交通大学:《国际政治经济学的源与流》选修课程PPT教学课件_课程简介与绪论(陈鹏).ppt

- 上海交通大学:《国际政治经济学的源与流》选修课程PPT教学课件_现实主义(下).ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 05 Household Saving and Investment Decisions.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 06 The Analysis of Investment projects(capital budgeting).ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 07 Principles of Market Valuation.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 08 Valuation of Known Cash Flows:Bonds.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 09 Valuation of Common Stocks.pdf

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 09 Valuation of Common Stocks.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 10 Principles of Risk Management.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 12 Portfolio Opportunities and Choice.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 13 Capital Market Equilibrium.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 14 Forward and Futures Markets.ppt

- 上海交通大学:《金融学原理 Financial Economics》教学资源(课程讲义PPT)Lecture 11 Hedging, Insuring, and Diversifying.ppt

- 上海交通大学:《金融学原理》教学资源(重点难点)前五章的重点难点.docx

- 上海交通大学:《金融学原理》教学资源(重点难点)金融学原理重点和难点.docx

- 对外经济贸易大学:《宏微观经济学 Microeconomics》课程教学资源(教学大纲,共十三章).pdf

- 对外经济贸易大学:《宏微观经济学 Microeconomics》课程教学资源(授课教案,共十四章).pdf

- 对外经济贸易大学:《会计学原理 Introduction to Financial Accounting》课程教学资源(教学大纲).pdf

- 对外经济贸易大学:《会计学原理 Introduction to Financial Accounting》课程教学资源(授课教案,共十二章).pdf

- 对外经济贸易大学:《中国经济概论 Introduction to Chinese Economy》课程教学资源(教学大纲).pdf

- 对外经济贸易大学:《中国经济概论 Introduction to Chinese Economy》课程教学资源(授课教案).pdf

- 对外经济贸易大学:《成本管理会计 Cost and Management Accounting》课程教学资源(教学大纲).pdf