中南财经政法大学:《金融计量学》课程教学课件(双语讲稿)Chapter 09 Instrumental Variable Regression

■ Financial Econometrics Chapter 9.Instrumental Variable Regression Jin Ling School of Finance,Zhongnan University of Economics and Law

Financial Econometrics Chapter 9. Instrumental Variable Regression Jin Ling School of Finance, Zhongnan University of Economics and Law 1

Outline The Instrumental Variable The Estimation for Instrumental Variable Regression The application for Instrumental Variable Regression 2

• The Instrumental Variable • The Estimation for Instrumental Variable Regression • The Application for Instrumental Variable Regression 2 Outline

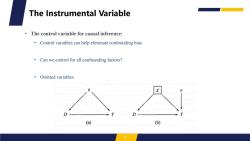

The Instrumental Variable The control variable for causal inference: Control variables can help eliminate confounding bias. Can we control for all confounding factors? 。Omitted variables. D (a) (b) 3

• The control variable for causal inference: • Control variables can help eliminate confounding bias. • Can we control for all confounding factors? • Omitted variables. 3 The Instrumental Variable

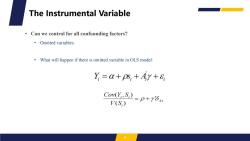

The Instrumental Variable Can we control for all confounding factors? 。Omitted variables. What will happen if there is omitted variable in OLS model: Y=a+ps;+Ay+8 Cov(YS)=p+r8x V(S,)

• Can we control for all confounding factors? • Omitted variables. • What will happen if there is omitted variable in OLS model: 4 The Instrumental Variable

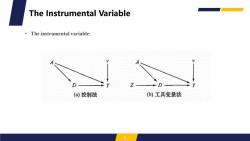

The Instrumental Variable The instrumental variable: (a)控制法 (b)工具变量法 5

• The instrumental variable: 5 The Instrumental Variable

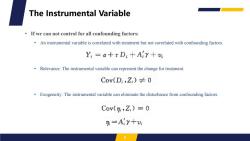

The Instrumental Variable If we can not control for all confounding factors: An instrumental variable is correlated with treatment but not correlated with confounding factors. Yi=a+rDi+Aiy+vi Relevance:The instrumental variable can represent the change for treatment. Cov(D,Z,)≠0 Exogeneity:The instrumental variable can eliminate the disturbance from confounding factors. Cov(7,Z,)=0 n=A:Y+v 6

• If we can not control for all confounding factors: • An instrumental variable is correlated with treatment but not correlated with confounding factors. • Relevance: The instrumental variable can represent the change for treatment. • Exogeneity: The instrumental variable can eliminate the disturbance from confounding factors. 6 The Instrumental Variable

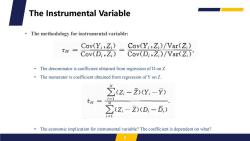

The Instrumental Variable The methodology for instrumental variable: The correlation between instrumental variable and potential outcome: Cov(Yi,Z;)=Cov(a,Z,)+rCov(D,Z)+Cov(n:,2,) a is constant,so Cov(a,Z)=0. Exogeneity:Cov(n,Z)=0 ·Relevance:Cov(D,Z,)≠0 Cov(Y,Z)Cov(Y:,Z:)/Var(Z) Cov(D:,Zi) Cov(Di,Z;)/Var(Z:)

• The methodology for instrumental variable: • The correlation between instrumental variable and potential outcome: • α is constant, so . • Exogeneity: . • Relevance: . 7 The Instrumental Variable

The Instrumental Variable The methodology for instrumental variable: v二 Cov(Y,Z)Cov(Y:,Z:)/Var(Z) Cov(D:,Zi) Cov(D:,Z;)/Var(Zi) The denominator is coefficient obtained from regression of D on Z The numerator is coefficient obtained from regression of Y on Z. 之(z,-2Y-Y) iN= =』 (2-2)(D,-B.) The economic implication for instrumental variable?The coefficient is dependent on what?

• The methodology for instrumental variable: • The denominator is coefficient obtained from regression of D on Z. • The numerator is coefficient obtained from regression of Y on Z. • The economic implication for instrumental variable? The coefficient is dependent on what? 8 The Instrumental Variable

The Instrumental Variable How to choose instrumental variable: Institutional background:Real estate market. Financial Theory:Fund distance. Exogenous shock:Bank deregulation. 9

• How to choose instrumental variable: • Institutional background: Real estate market. • Financial Theory: Fund distance. • Exogenous shock: Bank deregulation. 9 The Instrumental Variable

The Instrumental Variable Instrumental variable for causal inference: Correlation in different situation. ·Z=0→Z=1 ·Do=0andD1=0 ·Do=0andD1=1 ·Do=1andD1=1 ·Do=1andD,=0 D:=Do:十(D:一Do)Z=xo十r1Z:十e 0=E[Doi],D-Doi,E;=Doi-E[Doi] 10

• Instrumental variable for causal inference: • Correlation in different situation. • Z = 0→Z = 1 • D0 = 0 and D1 = 0 • D0 = 0 and D1 = 1 • D0 = 1 and D1 = 1 • D0 = 1 and D1 = 0 10 The Instrumental Variable

按次数下载不扣除下载券;

注册用户24小时内重复下载只扣除一次;

顺序:VIP每日次数-->可用次数-->下载券;

- 中南财经政法大学:《金融计量学》课程教学课件(双语讲稿)Chapter 08 Difference-in-difference Model 2.pdf

- 中南财经政法大学:《金融计量学》课程教学课件(双语讲稿)Chapter 07 Difference-in-difference Model 1.pdf

- 中南财经政法大学:《金融计量学》课程教学课件(双语讲稿)Chapter 06 Control Variable and Fixed Effect.pdf

- 中南财经政法大学:《金融计量学》课程教学课件(双语讲稿)Chapter 05 Mediation Effect and Moderating Effect.pdf

- 中南财经政法大学:《金融计量学》课程教学课件(双语讲稿)Chapter 04 Causal Inference framework 2.pdf

- 中南财经政法大学:《金融计量学》课程教学课件(双语讲稿)Chapter 03 Causal Inference framework 1.pdf

- 中南财经政法大学:《金融计量学》课程教学课件(双语讲稿)Chapter 02 Statistical Foundations Overview of OLS.pdf

- 中南财经政法大学:《金融计量学》课程教学课件(双语讲稿)Chapter 14 Application Financial Market.pdf

- 中南财经政法大学:《金融计量学》课程教学课件(双语讲稿)Chapter 13 Application Corporate Finance.pdf

- 中南财经政法大学:《金融计量学》课程教学课件(双语讲稿)Chapter 12 Application Policy Evaluation.pdf

- 中南财经政法大学:《金融计量学》课程教学课件(双语讲稿)Chapter 11 Regression Discontinuity Design.pdf

- 中南财经政法大学:《金融计量学》课程教学课件(双语讲稿)Chapter 10 Propensity Score Matching.pdf

- 中南财经政法大学:《金融计量学》课程教学课件(双语讲稿)Chapter 01 Introduction to Financial Econometrics.pdf

- 中南财经政法大学:《中级计量经济学》课程教学课件(PPT讲稿)week 13 限值因变量模型和样本选择纠正.pptx

- 中南财经政法大学:《中级计量经济学》课程教学课件(PPT讲稿)week 11 高深的面板数据.pptx

- 中南财经政法大学:《中级计量经济学》课程教学课件(PPT讲稿)week 10 独立混合横截面数据.pptx

- 《中级计量经济学》课程教学资源(书籍文献)James H. Stock, Mark W. Watson - Introduction to Econometrics, Global Edition-Pearson Education Limited(2020).pdf

- 《中级计量经济学》课程教学资源(书籍文献)工具变量IV - IV paper-Acemoglu-ColonialOriginsComparative-2001.pdf

- 中南财经政法大学:《中级计量经济学》课程教学课件(PPT讲稿)week 9 工具变量估计与两阶段最小二乘法.pptx

- 中南财经政法大学:《中级计量经济学》课程教学课件(PPT讲稿)week 8 模型设定误差和数据问题.pptx

- 《马克思主义政治经济学》课程教学课件(PPT讲稿)第一章 导论.ppt

- 《马克思主义政治经济学》课程教学课件(PPT讲稿)第七章 经济全球化与当代资本主义.ppt

- 《马克思主义政治经济学》课程教学课件(PPT讲稿)第三章 剩余价值理论.ppt

- 《马克思主义政治经济学》课程教学课件(PPT讲稿)第二章 马克思与劳动价值论.ppt

- 《马克思主义政治经济学》课程教学课件(PPT讲稿)第五章 资本社会化与资本主义所有制.ppt

- 《马克思主义政治经济学》课程教学课件(PPT讲稿)第八章 资本主义的未来.ppt

- 《马克思主义政治经济学》课程教学课件(PPT讲稿)第六讲 资本主义市场经济体制与资本主义经济的发展.ppt

- 《马克思主义政治经济学》课程教学课件(PPT讲稿)第四章 本积累和资本主义分配制度.ppt

- 重庆工商大学:《会计学》教学大纲 ACCOUNTING A.pdf

- 重庆工商大学:《会计学》课程授课教案(讲义).pdf

- 重庆工商大学:《会计学》课程教学实验指导书.doc

- 重庆工商大学:《会计学》课程教学课件(PPT讲稿)第一章 总论.ppt

- 重庆工商大学:《会计学》课程教学课件(PPT讲稿)第三章 主要经济业务的核算.ppt

- 重庆工商大学:《会计学》课程教学课件(PPT讲稿)第二章 复式记账法.pptx

- 重庆工商大学:《会计学》课程教学课件(PPT讲稿)第五章 信息化背景下的会计核算.pptx

- 重庆工商大学:《会计学》课程教学课件(PPT讲稿)第六章 会计信息的应用与决策支持.ppt

- 重庆工商大学:《会计学》课程教学课件(PPT讲稿)第四章 财务会计报告的编制与分析.ppt

- 重庆工商大学:《贸易经济学》课程教学大纲 Economics of Trade.doc

- 重庆工商大学:《贸易经济学》课程授课教案(讲义,授课教师:陈淑祥).doc

- 《贸易经济学》课程教学课件(PPT讲稿)零售贸易.ppt