中南财经政法大学:《金融计量学》课程教学课件(双语讲稿)Chapter 06 Control Variable and Fixed Effect

■ Financial Econometrics Chapter 6.Control Variable and Fixed Effect Jin Ling School of Finance,Zhongnan University of Economics and Law 1

Financial Econometrics Chapter 6. Control Variable and Fixed Effect Jin Ling School of Finance, Zhongnan University of Economics and Law 1

Outline Causal Inference and OLS Regression 。Control Variable ·Fixed Effect 2

• Causal Inference and OLS Regression • Control Variable • Fixed Effect 2 Outline

Causal Inference and OLS Regression The methodology for causal inference: Potential outcomes with or without treatment under same condition. Assignment mechanism. Experiment design:Randomized experiment. Testable implication:Mediation Effect and Moderating Effect. 3

• The methodology for causal inference: • Potential outcomes with or without treatment under same condition. • Assignment mechanism. • Experiment design: Randomized experiment. • Testable implication: Mediation Effect and Moderating Effect. 3 Causal Inference and OLS Regression

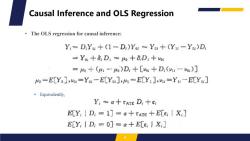

Causal Inference and OLS Regression The OLS regression for causal inference: Yi=DYL+(1-Di)Yoi=Yoi+(Yu-Yoi)D =Yo+6:D:=o十8D:+o =+(h一)D,+[%+D(yh:一%:)] Ho=E[Yo],voi=Yoi-E[Yoi],=E[Y:],v=Yu-E[Yii] ·Equivalently, Yi a+TATE D:+e E[Y;I D:1]=a+TATE +E[e;I X E[Y,I D:=0]=a+ECeX:] 4

• The OLS regression for causal inference: • Equivalently, 4 Causal Inference and OLS Regression

Causal Inference and OLS Regression The OLS regression for causal inference: x=E[Y,ID=1]-E[Y,|D,=0] =tE+E[e:ID:=1]-E[e|D,=0] =xAE+E[h:|D:=1]-E[o:ID,=0] =TATE +E[Yo D,=1]-E[Yor I D;=0] +(1-p)(E[YH-Y{D:=1]-E[Y:-Yo|D,=0]} 全期望公式E[Y]=E[EYIX]] t=EY:-Y]+E[Yo I D,=1]-E[Yo|D,=0]+{1-Pr[D,=1} ATE 选择偏艺 ·{EYi-Y1D,=1]-EY:-Y|D,=0]》 两组因果效应差舞 5

• The OLS regression for causal inference: 5 Causal Inference and OLS Regression

Causal Inference and OLS Regression The OLS regression for causal inference: t E[Y,D:=1]-ECY:D.=0] =ECY D,≈1]-ECY1D=0] =E[Y:-Y1D,=1]+E[Yi|D.=1]-E[Y:ID:=o] ATT 远择纳盐 E[Y;D;1]-ECY,I D=0] =E[Y D,1]-ECYor D,=0] ECYu:-Yoi I D:=0]+ECYu I D:1]-ECY1:I D.=0] ATC 进保编丝 6

• The OLS regression for causal inference: 6 Causal Inference and OLS Regression

Outline Causal Inference and OLS Regression 。Control Variable ·Fixed Effect 7

• Causal Inference and OLS Regression • Control Variable • Fixed Effect 7 Outline

Control Variable ·When we control for X: ·X is a dummy variable Y:=tD,+∑adr+e, dx=1(X,=x) -CovY.D2-EY.Dl(其中D.=D-ED,1X]) Var(D;) E[D:] E[D.E[Y:I D.,X:]]E[D.(ECY:I D:=0.X.]+rxD ) ELD] E[D] ELVar(D0 Var(D,Xi) xx=E[Y,IX,D,=1]-E[Y,|X:,D,=0] 8

• When we control for X: • X is a dummy variable. 8 Control Variable

Control Variable ·When we control for X: If ty indicates a causal effect,we can infer that Tols has a causal effect: cx=E[Y,|X,D,=1]-EY,|X,D,=0] =E[Y X,D;1]-E[Yoi Xi,D=0] =E[Yi -YoiI X.D 1]+E[Yo.I X,D.1]-ECYo I X,D =0] TATTIX,】 选轻编差 =E[Y-Yo X:]+E[Yo I X:,D:=1]-E[Yo I X,D =0] FATE(X) 选韩编忍 +(1-(X))(ECYu-Yo i X,D 1]-ECYi-Yoi I X,D=0]) 两国网果效应编左 E[Y:|X,D=1]=E[Yu|X,D,=0] (Y,Yi)ILD,Xi

• When we control for X: • If 𝜏𝑋 indicates a causal effect, we can infer that 𝜏𝑜𝑙𝑠 has a causal effect: 9 Control Variable

Control Variable When we control for X: Selection bias equals 0: EYo Xi,D;=1]=E[Yoi Xi,D:=0 The difference in treatment effect is 0: E[Y:IX,D:=1]=E[Y|X:,D,=0] ·Unconfoundedness(非混杂性) (Yoi,Yi)IL D,X: 10

• When we control for X: • Selection bias equals 0: • The difference in treatment effect is 0: • Unconfoundedness (非混杂性): 10 Control Variable

按次数下载不扣除下载券;

注册用户24小时内重复下载只扣除一次;

顺序:VIP每日次数-->可用次数-->下载券;

- 中南财经政法大学:《金融计量学》课程教学课件(双语讲稿)Chapter 05 Mediation Effect and Moderating Effect.pdf

- 中南财经政法大学:《金融计量学》课程教学课件(双语讲稿)Chapter 04 Causal Inference framework 2.pdf

- 中南财经政法大学:《金融计量学》课程教学课件(双语讲稿)Chapter 03 Causal Inference framework 1.pdf

- 中南财经政法大学:《金融计量学》课程教学课件(双语讲稿)Chapter 02 Statistical Foundations Overview of OLS.pdf

- 中南财经政法大学:《金融计量学》课程教学课件(双语讲稿)Chapter 14 Application Financial Market.pdf

- 中南财经政法大学:《金融计量学》课程教学课件(双语讲稿)Chapter 13 Application Corporate Finance.pdf

- 中南财经政法大学:《金融计量学》课程教学课件(双语讲稿)Chapter 12 Application Policy Evaluation.pdf

- 中南财经政法大学:《金融计量学》课程教学课件(双语讲稿)Chapter 11 Regression Discontinuity Design.pdf

- 中南财经政法大学:《金融计量学》课程教学课件(双语讲稿)Chapter 10 Propensity Score Matching.pdf

- 中南财经政法大学:《金融计量学》课程教学课件(双语讲稿)Chapter 01 Introduction to Financial Econometrics.pdf

- 中南财经政法大学:《中级计量经济学》课程教学课件(PPT讲稿)week 13 限值因变量模型和样本选择纠正.pptx

- 中南财经政法大学:《中级计量经济学》课程教学课件(PPT讲稿)week 11 高深的面板数据.pptx

- 中南财经政法大学:《中级计量经济学》课程教学课件(PPT讲稿)week 10 独立混合横截面数据.pptx

- 《中级计量经济学》课程教学资源(书籍文献)James H. Stock, Mark W. Watson - Introduction to Econometrics, Global Edition-Pearson Education Limited(2020).pdf

- 《中级计量经济学》课程教学资源(书籍文献)工具变量IV - IV paper-Acemoglu-ColonialOriginsComparative-2001.pdf

- 中南财经政法大学:《中级计量经济学》课程教学课件(PPT讲稿)week 9 工具变量估计与两阶段最小二乘法.pptx

- 中南财经政法大学:《中级计量经济学》课程教学课件(PPT讲稿)week 8 模型设定误差和数据问题.pptx

- 中南财经政法大学:《中级计量经济学》课程教学课件(PPT讲稿)week 6 异方差性(主讲:刘玲).pptx

- 中南财经政法大学:《中级计量经济学》课程教学课件(PPT讲稿)week 5 多元回归分析-深入专题.pptx

- 中南财经政法大学:《中级计量经济学》课程教学课件(PPT讲稿)week 4 多元回归分析-推断.pptx

- 中南财经政法大学:《金融计量学》课程教学课件(双语讲稿)Chapter 07 Difference-in-difference Model 1.pdf

- 中南财经政法大学:《金融计量学》课程教学课件(双语讲稿)Chapter 08 Difference-in-difference Model 2.pdf

- 中南财经政法大学:《金融计量学》课程教学课件(双语讲稿)Chapter 09 Instrumental Variable Regression.pdf

- 《马克思主义政治经济学》课程教学课件(PPT讲稿)第一章 导论.ppt

- 《马克思主义政治经济学》课程教学课件(PPT讲稿)第七章 经济全球化与当代资本主义.ppt

- 《马克思主义政治经济学》课程教学课件(PPT讲稿)第三章 剩余价值理论.ppt

- 《马克思主义政治经济学》课程教学课件(PPT讲稿)第二章 马克思与劳动价值论.ppt

- 《马克思主义政治经济学》课程教学课件(PPT讲稿)第五章 资本社会化与资本主义所有制.ppt

- 《马克思主义政治经济学》课程教学课件(PPT讲稿)第八章 资本主义的未来.ppt

- 《马克思主义政治经济学》课程教学课件(PPT讲稿)第六讲 资本主义市场经济体制与资本主义经济的发展.ppt

- 《马克思主义政治经济学》课程教学课件(PPT讲稿)第四章 本积累和资本主义分配制度.ppt

- 重庆工商大学:《会计学》教学大纲 ACCOUNTING A.pdf

- 重庆工商大学:《会计学》课程授课教案(讲义).pdf

- 重庆工商大学:《会计学》课程教学实验指导书.doc

- 重庆工商大学:《会计学》课程教学课件(PPT讲稿)第一章 总论.ppt

- 重庆工商大学:《会计学》课程教学课件(PPT讲稿)第三章 主要经济业务的核算.ppt

- 重庆工商大学:《会计学》课程教学课件(PPT讲稿)第二章 复式记账法.pptx

- 重庆工商大学:《会计学》课程教学课件(PPT讲稿)第五章 信息化背景下的会计核算.pptx

- 重庆工商大学:《会计学》课程教学课件(PPT讲稿)第六章 会计信息的应用与决策支持.ppt

- 重庆工商大学:《会计学》课程教学课件(PPT讲稿)第四章 财务会计报告的编制与分析.ppt