中南财经政法大学:《金融计量学》课程教学课件(双语讲稿)Chapter 08 Difference-in-difference Model 2

Financial Econometrics Chapter 8.Difference-in-difference Model 2 Jin Ling School of Finance,Zhongnan University of Economics and Law

Financial Econometrics Chapter 8. Difference-in-difference Model 2 Jin Ling School of Finance, Zhongnan University of Economics and Law 1

The DID Model The model specification: 因果效应 D】 yD.o Yoo T=0 T-1 2

• The model specification: 2 The DID Model

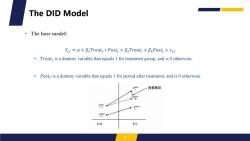

The DID Model 。The base model: Yit a+BTreati Postt +B2Treati+B3Postt+Eit Treat;is a dummy variable that equals 1 for treatment group,and is 0 otherwise. Postt is a dummy variable that equals I for period after treatment,and is 0 otherwise. 因果效应 Y Y T-0 7-l 3

• The base model: 𝑌𝑖,𝑡 = 𝛼 + 𝛽1𝑇𝑟𝑒𝑎𝑡𝑖 ∗ 𝑃𝑜𝑠𝑡𝑡 + 𝛽2𝑇𝑟𝑒𝑎𝑡𝑖 + 𝛽3𝑃𝑜𝑠𝑡𝑡 + 𝜀𝑖,𝑡 • 𝑇𝑟𝑒𝑎𝑡𝑖 is a dummy variable that equals 1 for treatment group, and is 0 otherwise. • 𝑃𝑜𝑠𝑡𝑡 is a dummy variable that equals 1 for period after treatment, and is 0 otherwise. 3 The DID Model

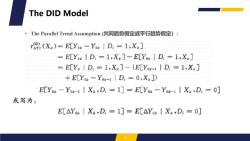

The DID Model ·The Parallel Trend Assumption(共同趋势假定或平行趋势假定): (X E[Yis -YouI D.=1,X] =E[YIR I D:=1,X ]-E[Yo D;=1,X.] E[Y&D:=1,X2]-(E[Yo-1 D:=1,X2 +E[Ym-Ya-1|D,=0,X]} E[Yoit-You-1X D;=1]E[Yo-Yo-1Xi,D=0] 或写为: E[△Yoa|X。,D,=1]=E[△Yai Xa,D:=0]

• The Parallel Trend Assumption (共同趋势假定或平行趋势假定): 4 The DID Model

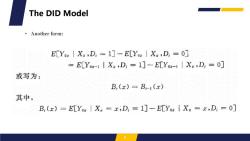

The DID Model 。Another form: ECYo X ,D;=1]-E[YoXi,D;=0] =E[Yo-1X,D;=1]-E[YoiXD;=0] 或写为: B,(x)=B-1(x) 其中, B,(x)=E[Yoa|X。=x;D,=1]-E[Yoa{X。=x,D,=0]

• Another form: 5 The DID Model

The DID Model The problem in the applications for base DID model: The treatment period is different for different groups. The treatment group is not precise. The Parallel Trend Assumption is hard to satisfy. 6

• The problem in the applications for base DID model: • The treatment period is different for different groups. • The treatment group is not precise. • The Parallel Trend Assumption is hard to satisfy. 6 The DID Model

Outline ·Staggered DID Model DID Model without strict treatment group Difference-in-Difference-in-Difference Model

• Staggered DID Model • DID Model without strict treatment group • Difference-in-Difference-in-Difference Model 7 Outline

Staggered DID Model The prevalence of staggered DID model in all DID model: Use of DiD and Staggered DiD in Finance and Accounting:2000-2019. (1) (2) (3) DiD Staggered DiD Staggered All ( Journal of Finance 52 30 57.6% Journal of Financial Economics 163 85 52.1% Review of Financial Studies 138 75 54.3% Review of Finance 27 14 51.8% Journal of Financial and Quantitative Analysis 51 32 62.7% Finance 431 236 54.7% Journal of Accounting Research 52 24 46.1% Journal of Accounting and Economics 6 38 60.3% The Accounting Review 110 63 572% Review of Accounting Studies 47 28 59.5% Contemporary Accounting Research 4 43.9% Accounting 313 171 54.6% Finance and Accounting 744 407 54.7% 9

• The prevalence of staggered DID model in all DID model: 8 Staggered DID Model

Staggered DID Model The characteristic for treatment: A single treatment period;Static treatment effects. Yit a+BTreati Postt B2Treati+B3Postt+it A single treatment period;Dynamic treatment effects. Yit a+BTreatCit B2Treati+B3Postt +it Staggered timing of treatment;Static treatment effects.The model? Short-selling;Capital market liberalization. 9

• The characteristic for treatment: • A single treatment period; Static treatment effects. 𝑌𝑖,𝑡 = 𝛼 + 𝛽1𝑇𝑟𝑒𝑎𝑡𝑖 ∗ 𝑃𝑜𝑠𝑡𝑡 + 𝛽2𝑇𝑟𝑒𝑎𝑡𝑖 + 𝛽3𝑃𝑜𝑠𝑡𝑡 + 𝜀𝑖,𝑡 • A single treatment period; Dynamic treatment effects. 𝑌𝑖,𝑡 = 𝛼 + 𝛽1𝑇𝑟𝑒𝑎𝑡𝐶𝑖,𝑡 + 𝛽2𝑇𝑟𝑒𝑎𝑡𝑖 + 𝛽3𝑃𝑜𝑠𝑡𝑡 + 𝜀𝑖,𝑡 • Staggered timing of treatment; Static treatment effects. The model? • Short-selling; Capital market liberalization. 9 Staggered DID Model

Staggered DID Model The model specification: Yit a BiTreatit +8i+8t+8it Why we control for 6;(Individual-fixed effect)and ot(Time-fixed effect) If we control for Treati and Postt,what will happen? Is the staggered DID model more convincing?The Parallel Trend Assumption is more likely to satisfy? 10

• The model specification: 𝑌𝑖,𝑡 = 𝛼 + 𝛽1𝑇𝑟𝑒𝑎𝑡𝑖,𝑡 + 𝛿𝑖 + 𝛿𝑡 + 𝜀𝑖,𝑡 • Why we control for 𝛿𝑖 (Individual-fixed effect) and 𝛿𝑡 (Time-fixed effect) • If we control for 𝑇𝑟𝑒𝑎𝑡𝑖 and 𝑃𝑜𝑠𝑡𝑡 , what will happen? • Is the staggered DID model more convincing? The Parallel Trend Assumption is more likely to satisfy? 10 Staggered DID Model

按次数下载不扣除下载券;

注册用户24小时内重复下载只扣除一次;

顺序:VIP每日次数-->可用次数-->下载券;

- 中南财经政法大学:《金融计量学》课程教学课件(双语讲稿)Chapter 07 Difference-in-difference Model 1.pdf

- 中南财经政法大学:《金融计量学》课程教学课件(双语讲稿)Chapter 06 Control Variable and Fixed Effect.pdf

- 中南财经政法大学:《金融计量学》课程教学课件(双语讲稿)Chapter 05 Mediation Effect and Moderating Effect.pdf

- 中南财经政法大学:《金融计量学》课程教学课件(双语讲稿)Chapter 04 Causal Inference framework 2.pdf

- 中南财经政法大学:《金融计量学》课程教学课件(双语讲稿)Chapter 03 Causal Inference framework 1.pdf

- 中南财经政法大学:《金融计量学》课程教学课件(双语讲稿)Chapter 02 Statistical Foundations Overview of OLS.pdf

- 中南财经政法大学:《金融计量学》课程教学课件(双语讲稿)Chapter 14 Application Financial Market.pdf

- 中南财经政法大学:《金融计量学》课程教学课件(双语讲稿)Chapter 13 Application Corporate Finance.pdf

- 中南财经政法大学:《金融计量学》课程教学课件(双语讲稿)Chapter 12 Application Policy Evaluation.pdf

- 中南财经政法大学:《金融计量学》课程教学课件(双语讲稿)Chapter 11 Regression Discontinuity Design.pdf

- 中南财经政法大学:《金融计量学》课程教学课件(双语讲稿)Chapter 10 Propensity Score Matching.pdf

- 中南财经政法大学:《金融计量学》课程教学课件(双语讲稿)Chapter 01 Introduction to Financial Econometrics.pdf

- 中南财经政法大学:《中级计量经济学》课程教学课件(PPT讲稿)week 13 限值因变量模型和样本选择纠正.pptx

- 中南财经政法大学:《中级计量经济学》课程教学课件(PPT讲稿)week 11 高深的面板数据.pptx

- 中南财经政法大学:《中级计量经济学》课程教学课件(PPT讲稿)week 10 独立混合横截面数据.pptx

- 《中级计量经济学》课程教学资源(书籍文献)James H. Stock, Mark W. Watson - Introduction to Econometrics, Global Edition-Pearson Education Limited(2020).pdf

- 《中级计量经济学》课程教学资源(书籍文献)工具变量IV - IV paper-Acemoglu-ColonialOriginsComparative-2001.pdf

- 中南财经政法大学:《中级计量经济学》课程教学课件(PPT讲稿)week 9 工具变量估计与两阶段最小二乘法.pptx

- 中南财经政法大学:《中级计量经济学》课程教学课件(PPT讲稿)week 8 模型设定误差和数据问题.pptx

- 中南财经政法大学:《中级计量经济学》课程教学课件(PPT讲稿)week 6 异方差性(主讲:刘玲).pptx

- 中南财经政法大学:《金融计量学》课程教学课件(双语讲稿)Chapter 09 Instrumental Variable Regression.pdf

- 《马克思主义政治经济学》课程教学课件(PPT讲稿)第一章 导论.ppt

- 《马克思主义政治经济学》课程教学课件(PPT讲稿)第七章 经济全球化与当代资本主义.ppt

- 《马克思主义政治经济学》课程教学课件(PPT讲稿)第三章 剩余价值理论.ppt

- 《马克思主义政治经济学》课程教学课件(PPT讲稿)第二章 马克思与劳动价值论.ppt

- 《马克思主义政治经济学》课程教学课件(PPT讲稿)第五章 资本社会化与资本主义所有制.ppt

- 《马克思主义政治经济学》课程教学课件(PPT讲稿)第八章 资本主义的未来.ppt

- 《马克思主义政治经济学》课程教学课件(PPT讲稿)第六讲 资本主义市场经济体制与资本主义经济的发展.ppt

- 《马克思主义政治经济学》课程教学课件(PPT讲稿)第四章 本积累和资本主义分配制度.ppt

- 重庆工商大学:《会计学》教学大纲 ACCOUNTING A.pdf

- 重庆工商大学:《会计学》课程授课教案(讲义).pdf

- 重庆工商大学:《会计学》课程教学实验指导书.doc

- 重庆工商大学:《会计学》课程教学课件(PPT讲稿)第一章 总论.ppt

- 重庆工商大学:《会计学》课程教学课件(PPT讲稿)第三章 主要经济业务的核算.ppt

- 重庆工商大学:《会计学》课程教学课件(PPT讲稿)第二章 复式记账法.pptx

- 重庆工商大学:《会计学》课程教学课件(PPT讲稿)第五章 信息化背景下的会计核算.pptx

- 重庆工商大学:《会计学》课程教学课件(PPT讲稿)第六章 会计信息的应用与决策支持.ppt

- 重庆工商大学:《会计学》课程教学课件(PPT讲稿)第四章 财务会计报告的编制与分析.ppt

- 重庆工商大学:《贸易经济学》课程教学大纲 Economics of Trade.doc

- 重庆工商大学:《贸易经济学》课程授课教案(讲义,授课教师:陈淑祥).doc