对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(授课教案课件)Chapter 07 The Effective Use of Capital

卧的贸易孝 1951 Chapter 7 The Effective Use of Capital

Chapter 7 Chapter 7 The Effective Use of The Effective Use of Capital Capital

The function of bank capital ▣Reduce bank risk. ▣Three basic ways: A cushion to absorb losses and remain solvent Increases the proportion of allowable problem assets that can default before equity is depleted. A ready access to financial markets and thus guards against liquidity problems Constrains growth and limits risk taking 爸封强的黄香+孝

The function of bank capital The function of bank capital Reduce bank risk. Three basic ways: A cushion to absorb losses and remain solvent Increases the proportion of allowable problem assets that can default before equity is depleted. A ready access to financial markets and thus guards against liquidity problems Constrains growth and limits risk taking

Impact of loan loss on capital Assets Liabilities Loans:60 Deposits:80 Other:40 Borrowings:16 Capital:4 Total:100 Total:100 藏的数香大孝

Impact of loan loss on Impact of loan loss on capital capital Capital : 4 Total :100 Total : 100 Other :40 Borrowings :16 Loans :60 Deposits :80 Assets Liabilities

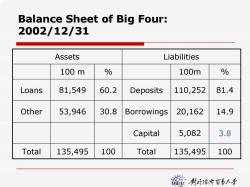

Balance Sheet of Big Four: 2002/12/31 Assets Liabilities 100m % 100m % Loans 81,549 60.2 Deposits 110,252 81.4 Other 53,946 30.8 Borrowings 20,162 14.9 Capital 5,082 3.8 Total 135,495 100 Total 135,495 100 猫剥1隆竹對+号

Balance Sheet of Big Four: Balance Sheet of Big Four: 2002/12/31 2002/12/31 Assets Liabilities 100 m % 100m % Loans 81,549 60.2 Deposits 110,252 81.4 Other 53,946 30.8 Borrowings 20,162 14.9 Capital 5,082 3.8 Total 135,495 100 Total 135,495 100

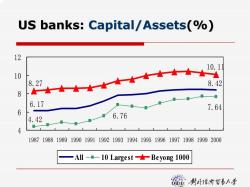

US banks:Capital/Assets(%) 12 10.1 10 8.27 8.42 8 6.17 7.64 6 4.42 6.76 19871988198919901991199219931994199519961997199819992000 -All-10 Largest-Beyong 1000 麓行贺影≠考

US banks: US banks: Capital/Assets Capital/Assets(%) 6.17 8.42 6.76 4.42 7.64 8.27 10.11 4 6 8 10 12 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 All 10 Largest Beyong 1000

Impact of loan loss on capital:1% Assets Liabilities L0ans:59.4←60 Deposits:80 Other:40 Borrowings:16 Capital:3.4←4 Tota:99.6←100 Total:99.6←100 藏的数香大孝

Impact of loan loss on capital: Impact of loan loss on capital: 1% Capital : 3.4 Ã 4 Total :99.6 Ã100 Total :99.6 Ã100 Other :40 Borrowings :16 Loans :59.4 Ã60 Deposits :80 Assets Liabilities

Impact of loan loss on capital:6.7% Assets Liabilities L0ans:56←60 Deposits:80 Other:40 Borrowings:16 Capital.0←4 Total:96←100 Total:96←100 麓行贺影≠考

Impact of loan loss on capital: Impact of loan loss on capital: 6.7% Capital : 0 Ã 4 Total :96 Ã100 Total : 96 Ã100 Other :40 Borrowings :16 Loans :56 Ã60 Deposits :80 Assets Liabilities

Impact of loan loss on capital:10% Assets Liabilities L0ans:54←60 Deposits:80 Other:40 Borrowings:16 Capital:-2←4 Tota.94←100 Total:94←100 麓行贺影≠考

Impact of loan loss on capital: Impact of loan loss on capital: 10% Capital :- 2 Ã 4 Total :94 Ã100 Total :94 Ã100 Other :40 Borrowings :16 Loans :54 Ã60 Deposits :80 Assets Liabilities

Impact of loan loss on capital:10% Assets Liabilities L0ans:54←60 Deposits:80 Loans:8 Deposits: 8 Other:40 Borrowings:16 Capital:-2←4 Tota:102←100 Tota:102←100 麓行贺影≠考

Impact of loan loss on capital: Impact of loan loss on capital: 10% Capital :- 2 Ã 4 Total :102 Ã100 Total :102 Ã100 Other :40 Borrowings :16 Deposits:80 Deposits: 8 Loans:54 Ã60 Loans:8 Assets Liabilities

Ready access to financial markets Adequate bank capital minimizes operating problems by providing ready access to financial markets. As long as a bank's capital exceeds the regulatory minimums,it can stay open and has the potential to generate earnings to cover losses and expand. Failures are tied directly to market values,not accounting values. 行贺影小号

Ready access to financial Ready access to financial markets markets Adequate bank capital minimizes operating problems by providing ready access to financial markets. As long as a bank’s capital exceeds the regulatory minimums, it can stay open and has the potential to generate earnings to cover losses and expand. Failures are tied directly to market values, not accounting values

按次数下载不扣除下载券;

注册用户24小时内重复下载只扣除一次;

顺序:VIP每日次数-->可用次数-->下载券;

- 对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(授课教案课件)Chapter 06 Managing Liabilities.pdf

- 对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(授课教案课件)Chapter 05 Managing Interest Rate Risk:Duration Gap and Market Value of Equity.pdf

- 对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(授课教案课件)Chapter 04 Managing Interest Rate Risk:Gap and Earnings Sensitivity Sensitivity.pdf

- 对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(授课教案课件)Chapter 03 Managing Noninterest Income and Noninterest Expense.pdf

- 对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(授课教案课件)Chapter 02 Analyzing Bank Performance.pdf

- 对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(授课教案课件)Chapter 01 Fundamental Forces of Change in Banking.pdf

- 对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(试题)期末考试试卷(B卷)答案.pdf

- 对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(试题)期末考试试卷(B卷)试题.pdf

- 对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(试题)期末考试试卷(A卷)答案.pdf

- 对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(试题)期末考试试卷(A卷)试题.pdf

- 对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(作业习题).pdf

- 对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(教学大纲).pdf

- 对外经济贸易大学:《国际运输与物流管理》课程教学课件(授课教案)第十章 国际物流.pdf

- 对外经济贸易大学:《国际运输与物流管理》课程教学课件(授课教案)第八章 采购与供应管理.pdf

- 对外经济贸易大学:《国际运输与物流管理》课程教学课件(授课教案)第九章 分拨管理.pdf

- 对外经济贸易大学:《国际运输与物流管理》课程教学课件(授课教案)第七章 库存管理.pdf

- 对外经济贸易大学:《国际运输与物流管理》课程教学课件(授课教案)第六章 仓储管理.pdf

- 对外经济贸易大学:《国际运输与物流管理》课程教学课件(授课教案)第四章 需求预测.pdf

- 对外经济贸易大学:《国际运输与物流管理》课程教学课件(授课教案)第五章 运输战略.pdf

- 对外经济贸易大学:《国际运输与物流管理》课程教学课件(授课教案)第二章 供应链管理与第三方物流.pdf

- 对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(授课教案课件)Chapter 08 Liquidity Planning and Managing Cash Assets.pdf

- 对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(授课教案课件)Chapter 09 Overview of Credit Policy and Loan Characteristics.pdf

- 对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(授课教案课件)Chapter 10 Evaluating Commercial Loan Requests.pdf

- 对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(授课教案课件)Chapter 11 Evaluating Consumer Loans.pdf

- 对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(授课教案课件)Chapter 12 Customer Profitability Analysis and Loan Pricing.pdf

- 对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(授课教案课件)Chapter 13 The Investment Portfolio and Policy Guidelines.pdf

- 对外经济贸易大学:《国际商法 International Business Law》课程教学资源(教学大纲,沈四宝).pdf

- 对外经济贸易大学:《国际商法 International Business Law》课程教学资源(作业习题)第一章 绪论(沈四宝).pdf

- 对外经济贸易大学:《国际商法 International Business Law》课程教学资源(作业习题)第二章 代理法.pdf

- 对外经济贸易大学:《国际商法 International Business Law》课程教学资源(作业习题)第三章 合伙企业法.pdf

- 对外经济贸易大学:《国际商法 International Business Law》课程教学资源(作业习题)第五章 外商投资企业法.pdf

- 对外经济贸易大学:《国际商法 International Business Law》课程教学资源(作业习题)第四章 公司法.pdf

- 对外经济贸易大学:《国际商法 International Business Law》课程教学资源(作业习题)第七章 买卖法.pdf

- 对外经济贸易大学:《国际商法 International Business Law》课程教学资源(作业习题)第六章 合同法.pdf

- 对外经济贸易大学:《国际商法 International Business Law》课程教学资源(作业习题)第九章 票据法.pdf

- 对外经济贸易大学:《国际商法 International Business Law》课程教学资源(作业习题)第八章 产品责任法.pdf

- 对外经济贸易大学:《国际商法 International Business Law》课程教学资源(作业习题)第十章 商事仲裁.pdf

- 对外经济贸易大学:《国际商法 International Business Law》课程教学资源(授课教案)第一章 绪论(沈四宝).pdf

- 对外经济贸易大学:《国际商法 International Business Law》课程教学资源(授课教案)第二章 代理法.pdf

- 对外经济贸易大学:《国际商法 International Business Law》课程教学资源(授课教案)第三章 合伙企业法.pdf