对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(授课教案课件)Chapter 12 Customer Profitability Analysis and Loan Pricing

卧的贸易孝 1951 Chapter 12 Customer Profitability Analysis and Loan Pricing

Chapter 12 Chapter 12 Customer Profitability Customer Profitability Analysis and Loan Analysis and Loan Pricing Pricing

Customer profitability analysis The analysis procedure compels banks to be aware of the full range of services purchased by each customer and to generate meaningful cost estimates for providing each service. The applicability of customer profitability analysis has been questioned in recent years with the move toward unbundling services. 的资5土号

Customer profitability Customer profitability analysis analysis The analysis procedure compels banks to be aware of the full range of services purchased by each customer and to generate meaningful cost estimates for providing each service. The applicability of customer profitability analysis has been questioned in recent years with the move toward unbundling services

Account analysis framework Customer profitability analysis is used to evaluate whether net revenue from an account meets a bank's profit objectives. Account Revenue≤≥ Account Expenses Target Profit 的资5土号

Account analysis framework Account analysis framework Customer profitability analysis is used to evaluate whether net revenue from an account meets a bank’s profit objectives. Account Revenue ≤ ≥ Account Expenses + Target Profit

Identify the full list of services used by a customer Transactions account activity ▣Extension of credit Security safekeeping,and Related items such as: ■Vire transfers ■Safety deposit boxes ■Letters of credit I Trust accounts 制卧所贸易大考

Identify the full list of services Identify the full list of services used by a customer used by a customer Transactions account activity Extension of credit Security safekeeping, and Related items such as: Wire transfers Safety deposit boxes Letters of credit Trust accounts

Expense components ▣Noncredit services ▣Credit Services ■Cost of funds ■Loan administration ■Default risk expense 麓行黄事大孝

Expense components Expense components Noncredit services Credit Services Cost of funds Loan administration Default risk expense

Non-credit services Aggregate cost estimates for noncredit services are obtained by multiplying the unit cost of each service by the corresponding activity level. 目 Example: it costs $7 to facilitate a wire transfer and the customer authorizes eight such transfers,the total periodic wire transfer expense to the bank is $16 for that account. 目 These costs include the interest cost of financing the loan,loan administration costs,and risk expense associated with potential default. 行贺影小号

Non-credit services credit services Aggregate cost estimates for noncredit services are obtained by multiplying the unit cost of each service by the corresponding activity level. Example: it costs $7 to facilitate a wire transfer and the customer authorizes eight such transfers, the total periodic wire transfer expense to the bank is $16 for that account. These costs include the interest cost of financing the loan, loan administration costs, and risk expense associated with potential default

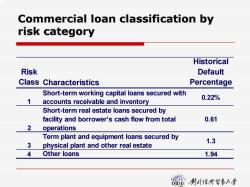

Credit services Cost of Funds ..the cost of funds estimate may be a bank's weighted marginal cost of pooled debt or its weighted marginal cost of capital at the time the loan was made. 目 Loan Administration ...loan administration expense is the cost of a loan's credit analysis and execution. 目 Default Risk Expense . the actual risk expense measure equals the historical default percentage for loans in that risk class times the outstanding loan balance. 行贺影小号

Credit services Credit services Cost of Funds …the cost of funds estimate may be a bank’s weighted marginal cost of pooled debt or its weighted marginal cost of capital at the time the loan was made. Loan Administration …loan administration expense is the cost of a loan’s credit analysis and execution. Default Risk Expense …the actual risk expense measure equals the historical default percentage for loans in that risk class times the outstanding loan balance

Commercial loan classification by risk category Historical Risk Default Class Characteristics Percentage Short-term working capital loans secured with 0.22% 1 accounts receivable and inventory Short-term real estate loans secured by facility and borrower's cash flow from total 0.61 2 operations Term plant and equipment loans secured by 1.3 3 physical plant and other real estate 4 Other loans 1.94 麓的贫香小手

Commercial loan classification by Commercial loan classification by risk category risk category Risk Class C haracteris tics Historical D efa ult P e rcent age 1 Shor t - t e r m w o r king capi tal l oans secur e d wit h accounts receivabl e and i nventor y 0.22% 2 Shor t - t e r m real estate l oans secur ed by facility and bor r o w e r’s cash flow fr o m t o t al oper a tions 0.61 3 Ter m plan t and equipment l oans secur ed by physical plant and other real estat e 1. 3 4 O ther l oans 1.94

Target profit The target profit is then based on a minimum required return to shareholders per account. Equity Targetreturn to Target profit= (Loan amount) Total assets shareholders 爸封强的黄香+孝

Target profit Target profit The target profit is then based on a minimum required return to shareholders per account. ( ) Loanamount shareholders Target return to Total assets Equity Targetprofit = ⎟ ⎟ ⎠ ⎞ ⎜ ⎜ ⎝ ⎛ ⎟ ⎠ ⎞ ⎜ ⎝ ⎛

Revenue components Banks generate three types of revenue from customer accounts: 1.investment income from the customer's deposit balance held at the bank 2.fee income from services 3.interest income on loans 麓的黄事+孝

Revenue components Revenue components Banks generate three types of revenue from customer accounts: 1. investment income from the customer’s deposit balance held at the bank 2. fee income from services 3. interest income on loans

按次数下载不扣除下载券;

注册用户24小时内重复下载只扣除一次;

顺序:VIP每日次数-->可用次数-->下载券;

- 对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(授课教案课件)Chapter 11 Evaluating Consumer Loans.pdf

- 对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(授课教案课件)Chapter 10 Evaluating Commercial Loan Requests.pdf

- 对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(授课教案课件)Chapter 09 Overview of Credit Policy and Loan Characteristics.pdf

- 对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(授课教案课件)Chapter 08 Liquidity Planning and Managing Cash Assets.pdf

- 对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(授课教案课件)Chapter 07 The Effective Use of Capital.pdf

- 对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(授课教案课件)Chapter 06 Managing Liabilities.pdf

- 对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(授课教案课件)Chapter 05 Managing Interest Rate Risk:Duration Gap and Market Value of Equity.pdf

- 对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(授课教案课件)Chapter 04 Managing Interest Rate Risk:Gap and Earnings Sensitivity Sensitivity.pdf

- 对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(授课教案课件)Chapter 03 Managing Noninterest Income and Noninterest Expense.pdf

- 对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(授课教案课件)Chapter 02 Analyzing Bank Performance.pdf

- 对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(授课教案课件)Chapter 01 Fundamental Forces of Change in Banking.pdf

- 对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(试题)期末考试试卷(B卷)答案.pdf

- 对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(试题)期末考试试卷(B卷)试题.pdf

- 对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(试题)期末考试试卷(A卷)答案.pdf

- 对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(试题)期末考试试卷(A卷)试题.pdf

- 对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(作业习题).pdf

- 对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(教学大纲).pdf

- 对外经济贸易大学:《国际运输与物流管理》课程教学课件(授课教案)第十章 国际物流.pdf

- 对外经济贸易大学:《国际运输与物流管理》课程教学课件(授课教案)第八章 采购与供应管理.pdf

- 对外经济贸易大学:《国际运输与物流管理》课程教学课件(授课教案)第九章 分拨管理.pdf

- 对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(授课教案课件)Chapter 13 The Investment Portfolio and Policy Guidelines.pdf

- 对外经济贸易大学:《国际商法 International Business Law》课程教学资源(教学大纲,沈四宝).pdf

- 对外经济贸易大学:《国际商法 International Business Law》课程教学资源(作业习题)第一章 绪论(沈四宝).pdf

- 对外经济贸易大学:《国际商法 International Business Law》课程教学资源(作业习题)第二章 代理法.pdf

- 对外经济贸易大学:《国际商法 International Business Law》课程教学资源(作业习题)第三章 合伙企业法.pdf

- 对外经济贸易大学:《国际商法 International Business Law》课程教学资源(作业习题)第五章 外商投资企业法.pdf

- 对外经济贸易大学:《国际商法 International Business Law》课程教学资源(作业习题)第四章 公司法.pdf

- 对外经济贸易大学:《国际商法 International Business Law》课程教学资源(作业习题)第七章 买卖法.pdf

- 对外经济贸易大学:《国际商法 International Business Law》课程教学资源(作业习题)第六章 合同法.pdf

- 对外经济贸易大学:《国际商法 International Business Law》课程教学资源(作业习题)第九章 票据法.pdf

- 对外经济贸易大学:《国际商法 International Business Law》课程教学资源(作业习题)第八章 产品责任法.pdf

- 对外经济贸易大学:《国际商法 International Business Law》课程教学资源(作业习题)第十章 商事仲裁.pdf

- 对外经济贸易大学:《国际商法 International Business Law》课程教学资源(授课教案)第一章 绪论(沈四宝).pdf

- 对外经济贸易大学:《国际商法 International Business Law》课程教学资源(授课教案)第二章 代理法.pdf

- 对外经济贸易大学:《国际商法 International Business Law》课程教学资源(授课教案)第三章 合伙企业法.pdf

- 对外经济贸易大学:《国际商法 International Business Law》课程教学资源(授课教案)第四章 公司法.pdf

- 对外经济贸易大学:《国际商法 International Business Law》课程教学资源(授课教案)第五章 外商投资企业法.pdf

- 对外经济贸易大学:《国际商法 International Business Law》课程教学资源(授课教案)第六章 合同法.pdf

- 对外经济贸易大学:《国际商法 International Business Law》课程教学资源(授课教案)第七章 买卖法.pdf

- 对外经济贸易大学:《国际商法 International Business Law》课程教学资源(授课教案)第九章 票据法.pdf