对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(授课教案课件)Chapter 11 Evaluating Consumer Loans

對酥竹贸易木学 1951 Chapter 11 Evaluating Consumer Loans

Chapter 11 Chapter 11 Evaluating Consumer Evaluating Consumer Loans

Recent trends in consumer lending ▣Credit scoring more lenders use statistical models to predict which individuals are good and bad credit risks. Rapid consolidation of the credit card business ■ at year-end 1997,for example,the 10 largest bank card issuers held approximately 85%of all credit card loans. 碰封酥价贸易大孝

Recent trends in consumer Recent trends in consumer lending lending Credit scoring more lenders use statistical models to predict which individuals are good and bad credit risks. Rapid consolidation of the credit card business at year-end 1997, for example, the 10 largest bank card issuers held approximately 85% of all credit card loans

Evaluating consumer loans When evaluating consumer loan requests,an analyst addresses the same issues discussed with commercial loans: the use of loan proceeds, the amount needed, the primary and secondary source of repayment. 麓的贫香小手

Evaluating consumer loans Evaluating consumer loans When evaluating consumer loan requests, an analyst addresses the same issues discussed with commercial loans: the use of loan proceeds, the amount needed, the primary and secondary source of repayment

Installment loans Installment loans require the periodic payment of principal and interest. Installment loans may be either direct or indirect loans. A direct loan is negotiated between the bank and the ultimate user of the funds. An indirect loan is funded by a bank through a separate retailer that sells merchandise to a customer. 麓的贫香小手

Installment loans Installment loans Installment loans require the periodic payment of principal and interest. Installment loans may be either direct or indirect loans. A direct loan is negotiated between the bank and the ultimate user of the funds. An indirect loan is funded by a bank through a separate retailer that sells merchandise to a customer

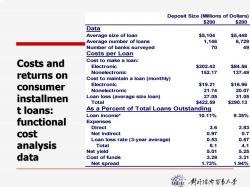

Deposit Size(Millions of Dollars) $200 $200 Data Average size of loan $5,104 $5,448 Average number of loans 1,146 6,729 Number of banks surveyed 70 49 Costs per Loan Costs and Cost to make a loan: Electronic $202.42 $84.56 returns on Nonelectronic 152.17 137.49 Cost to maintain a loan(monthly) consumer Electronic $19.21 $16.96 Nonelectronic 21.74 20.07 installmen Loan loss (average size loan) 27.05 31.05 Total $422.59 $290.13 t loans: As a Percent of Total Loans Outstanding Loan income* 10.11% 9.35% functional Expenses Direct 3.6 2.83 cost Net indirect 0.97 0.7 Loan loss rate(3-year average) 0.53 0.57 analysis Total 5.1 4.1 Net yield 5.01 5.25 data Cost of funds 3.28 3.31 Net spread 1.73% 1.94% 制委价贸易土孝

$200 $200 Da t a Average si z e o f l oan $5, 104 $5,448 Average number of l oans 1,146 6,729 N u m ber o f banks surveyed 70 49 C o s ts per Loa n C ost t o make a l oan: Elect r o nic $202.42 $84.56 N onelect r o nic 152. 1 7 137.49 C o s t t o m ain t ain a lo a n ( m o n t hly) Elect r o nic $19.21 $16.96 N onelect r o nic 21.74 20.07 L o a n l oss (average si z e l oan) 27.05 31.05 T o tal $422.59 $290.13 As a Percent of T o t al Loa n s O u t s t anding L o a n i nco m e * 10.11% 9.35% Expenses Di r e c t 3.6 2.8 3 N e t indi r ect 0.97 0. 7 Loan l o s s r a t e ( 3-yea r a v e r age) 0.5 3 0.5 7 T o tal 5. 1 4.1 N e t yiel d 5.0 1 5.2 5 C ost of funds 3.2 8 3.3 1 N e t spread 1.73% 1.94% De posit Si z e (Millio n s o f D olla r s) Costs and Costs and returns on returns on consumer consumer installmen installmen t loans: t loans: functional functional cost analysis analysis data

Credit cards and other revolving credit Credit cards and over-lines tied to checking accounts are the two most popular forms of revolving credit agreements. In 2001 consumers charged almost $650 billion on credit cards. Most operate as franchises of MasterCard and/or Visa. 猫的资6+孝

Credit cards and other Credit cards and other revolving credit revolving credit Credit cards and over-lines tied to checking accounts are the two most popular forms of r evolving credit agreements. In 2001 consumers charged almost $650 billion on credit cards. Most operate as franchises of MasterCard and/or Visa

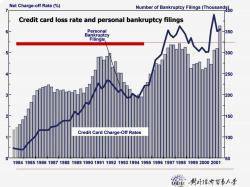

Net Charge-off Rate(%) Number of Bankruptcy Filings(Thousands) 460 Credit card loss rate and personal bankruptcy filings 6 Personal 350 Bankruptcy Filings 5 300 250 200 2 150 Credit Card Charge-Off Rates 100 0 50 198419851986198719881989199019911992199319941995199619971998199920002001 碰制卧委价贸易大孝

Net Charge-off Rate (%) Number of Bankruptcy Filings (Thousands) Personal Bankruptcy Filings Credit Card Charge-Off Rates 7 6 5 4 3 2 1 0 400 350 300 250 200 150 100 50 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 Credit card loss rate and personal bankruptcy filings Credit card loss rate and personal bankruptcy filings

Credit cards Card issuers earn income from three sources: ■ card holders annual fees, ■ interest on outstanding loan balances, and ■ discounting the charges that merchants accept on purchases. 麓的贫香小手

Credit cards Credit cards Card issuers earn income from three sources: card holders annual fees, interest on outstanding loan balances, and discounting the charges that merchants accept on purchases

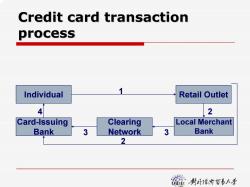

Credit card transaction process Individual Retail Outlet 4 2 Card-Issuing Clearing Local Merchant Bank 3 Network 3 Bank 2 猫f的贺6号

Credit card transaction Credit card transaction process process Individual Card-Issuing Bank Clearing Network Local Merchant Bank Retail Outlet 1 4 2 3 3 2

Debit cards,smart cards,and prepaid cards Debit cards are widely available when an individual uses the card,thein balance is immediately debited. they have lower processing costs to the bank A smart card is an extension of debit and credit cards contains a memory chip which can manipulate information 的资5土号

Debit cards, smart cards, and Debit cards, smart cards, and prepaid cards prepaid cards Debit cards are widely available when an individual uses the card, their balance is immediately debited. they have lower processing costs to the bank A smart card is an extension of debit and credit cards contains a memory chip which can manipulate information

按次数下载不扣除下载券;

注册用户24小时内重复下载只扣除一次;

顺序:VIP每日次数-->可用次数-->下载券;

- 对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(授课教案课件)Chapter 10 Evaluating Commercial Loan Requests.pdf

- 对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(授课教案课件)Chapter 09 Overview of Credit Policy and Loan Characteristics.pdf

- 对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(授课教案课件)Chapter 08 Liquidity Planning and Managing Cash Assets.pdf

- 对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(授课教案课件)Chapter 07 The Effective Use of Capital.pdf

- 对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(授课教案课件)Chapter 06 Managing Liabilities.pdf

- 对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(授课教案课件)Chapter 05 Managing Interest Rate Risk:Duration Gap and Market Value of Equity.pdf

- 对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(授课教案课件)Chapter 04 Managing Interest Rate Risk:Gap and Earnings Sensitivity Sensitivity.pdf

- 对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(授课教案课件)Chapter 03 Managing Noninterest Income and Noninterest Expense.pdf

- 对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(授课教案课件)Chapter 02 Analyzing Bank Performance.pdf

- 对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(授课教案课件)Chapter 01 Fundamental Forces of Change in Banking.pdf

- 对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(试题)期末考试试卷(B卷)答案.pdf

- 对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(试题)期末考试试卷(B卷)试题.pdf

- 对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(试题)期末考试试卷(A卷)答案.pdf

- 对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(试题)期末考试试卷(A卷)试题.pdf

- 对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(作业习题).pdf

- 对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(教学大纲).pdf

- 对外经济贸易大学:《国际运输与物流管理》课程教学课件(授课教案)第十章 国际物流.pdf

- 对外经济贸易大学:《国际运输与物流管理》课程教学课件(授课教案)第八章 采购与供应管理.pdf

- 对外经济贸易大学:《国际运输与物流管理》课程教学课件(授课教案)第九章 分拨管理.pdf

- 对外经济贸易大学:《国际运输与物流管理》课程教学课件(授课教案)第七章 库存管理.pdf

- 对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(授课教案课件)Chapter 12 Customer Profitability Analysis and Loan Pricing.pdf

- 对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(授课教案课件)Chapter 13 The Investment Portfolio and Policy Guidelines.pdf

- 对外经济贸易大学:《国际商法 International Business Law》课程教学资源(教学大纲,沈四宝).pdf

- 对外经济贸易大学:《国际商法 International Business Law》课程教学资源(作业习题)第一章 绪论(沈四宝).pdf

- 对外经济贸易大学:《国际商法 International Business Law》课程教学资源(作业习题)第二章 代理法.pdf

- 对外经济贸易大学:《国际商法 International Business Law》课程教学资源(作业习题)第三章 合伙企业法.pdf

- 对外经济贸易大学:《国际商法 International Business Law》课程教学资源(作业习题)第五章 外商投资企业法.pdf

- 对外经济贸易大学:《国际商法 International Business Law》课程教学资源(作业习题)第四章 公司法.pdf

- 对外经济贸易大学:《国际商法 International Business Law》课程教学资源(作业习题)第七章 买卖法.pdf

- 对外经济贸易大学:《国际商法 International Business Law》课程教学资源(作业习题)第六章 合同法.pdf

- 对外经济贸易大学:《国际商法 International Business Law》课程教学资源(作业习题)第九章 票据法.pdf

- 对外经济贸易大学:《国际商法 International Business Law》课程教学资源(作业习题)第八章 产品责任法.pdf

- 对外经济贸易大学:《国际商法 International Business Law》课程教学资源(作业习题)第十章 商事仲裁.pdf

- 对外经济贸易大学:《国际商法 International Business Law》课程教学资源(授课教案)第一章 绪论(沈四宝).pdf

- 对外经济贸易大学:《国际商法 International Business Law》课程教学资源(授课教案)第二章 代理法.pdf

- 对外经济贸易大学:《国际商法 International Business Law》课程教学资源(授课教案)第三章 合伙企业法.pdf

- 对外经济贸易大学:《国际商法 International Business Law》课程教学资源(授课教案)第四章 公司法.pdf

- 对外经济贸易大学:《国际商法 International Business Law》课程教学资源(授课教案)第五章 外商投资企业法.pdf

- 对外经济贸易大学:《国际商法 International Business Law》课程教学资源(授课教案)第六章 合同法.pdf

- 对外经济贸易大学:《国际商法 International Business Law》课程教学资源(授课教案)第七章 买卖法.pdf