对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(授课教案课件)Chapter 09 Overview of Credit Policy and Loan Characteristics

卧的贸易孝 1951 Chapter 9 Overview of Credit Policy and Loan Characteristics

Chapter 9 Chapter 9 Overview of Credit Overview of Credit Policy and Loan Policy and Loan Characteristics Characteristics

The credit process The fundamental objective of lending is to make profitable loans with minimal risk. Management should target specific industries or markets in which lending officers have expertise. The somewhat competing goals of loan volume and loan quality must be balanced with the bank's liquidity requirements, capital constraints,and rate of return objectives. 猫行贺影小号

The credit process The credit process The fundamental objective of lending is to make profitable loans with minimal risk. Management should target specific industries or markets in which lending officers have expertise. The somewhat competing goals of loan volume and loan quality must be balanced with the bank’s liquidity requirements, capital constraints, and rate of return objectives

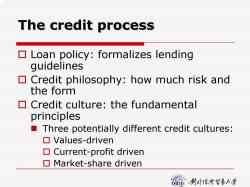

The credit process Loan policy:formalizes lending guidelines Credit philosophy:how much risk and the form Credit culture:the fundamental principles Three potentially different credit cultures: ▣Values-driven Current-profit driven ▣arket-share driven 麓封强的黄香+孝

The credit process The credit process Loan policy: formalizes lending guidelines Credit philosophy: how much risk and the form Credit culture: the fundamental principles Three potentially different credit cultures: Values-driven Current-profit driven Market-share driven

The credit process The credit process includes three functions Business development and credit analysis Underwriting or credit execution and administration ■Credit review 的资5土号

The credit process The credit process The credit process includes three functions Business development and credit analysis Underwriting or credit execution and administration Credit review

Business development and credit analysis ▣Market research Advertising,public relations ▣Office call programs Obtain financial statements,borrowing resolution,credit reports. Financial statement and cash flow analysis 目 Evaluate collateral Line officer makes recommendation on accepting/rejecting loan Five Cs of good credit and five Cs of bad credit 爸封强的黄香+孝

Business development and credit analysis Business development and credit analysis Market research Advertising, public relations Office call programs Obtain financial statements, borrowing resolution, credit reports. Financial statement and cash flow analysis Evaluate collateral Line officer makes recommendation on accepting/rejecting loan Five Cs of good credit and five Cs of bad credit

Recent Trends in Loan Growth and Quality Loans account for more than 60%of the total assets Real estate loans represent the largest single loan category for all banks.(US:61%,CN:10%) The relative importance of consumer loans has increased to 59%by 2004.(In China,10%) Contribution of consumption to GDP (US:69%;CN: 43%) Banks are their only lender Safer(more dispersed) 目 Loan volume and quality vary with the business cycle 爸封强的黄香+孝

Recent Trends in Loan Recent Trends in Loan Growth and Quality Growth and Quality Loans account for more than 60% of the tot al assets Real estate loans represent the largest single loan category for all banks. (US: 61%, CN:10%) The relative importance of consumer loans has increased to 59% by 2004. (In China, 10%) Contribution of consumption to GDP (US: 69%; CN: 43%) Banks are their only lender Safer (more dispersed) Loan volume and quality vary with the business cycle

Trends in Competition of Loan Business Banks face tremendous competition for loan business not only from other banks, but also from non-bank sources. The widespread use of credit scoring by lenders and the securitization of consumer and small business loans puts additional pressure on interest rates. The internet has also led to smaller spreads for the more standardized loan products (e.g.,ALM,automated loan machines). Banks of different size follow different strategies. 碰制卧价贸易大孝

Trends in Competition of Trends in Competition of Loan Business Loan Business Banks face tremendous competition for loan business not only from other banks, but also from non-bank sources. The widespread use of credit scoring by lenders and the securitization of consumer and small business loans puts additional pressure on interest rates. The internet has also led to smaller spreads for the more standardized loan products (e.g., ALM, automated loan machines). Banks of different size follow different strategies

Business development Marketing bank services to existing and potential customers. Get new customers Retain current customers and cross-sell 的贫事大手

Business development Business development Marketing bank services to existing and potential customers. Get new customers Retain current customers and cross-sell

The Credit Analysis and Management Alter Wriston:The fundamental objective of lending is to make profitable loans with minimal risk." Controlling Grasping Risks Opportunities 制爱价贸易上孝

The Credit Analysis and The Credit Analysis and Management Management Grasping Opportunities Controlling Risks Alter Wriston: “The fundamental objective of lending is to make profitable loans with minimal risk.

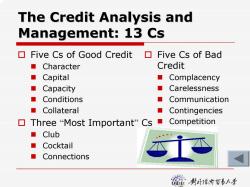

The Credit Analysis and Management:13 Cs ▣Five Cs of Good Credit▣I Five Cs of Bad Character Credit ■ Capital ■ Complacency Capacity Carelessness ■ Conditions Communication ■Collateral Contingencies Three "Most Important"Cs Competition Club ■ Cocktail Connections 麓的贫事大手

The Credit Analysis and The Credit Analysis and Management: 13 Cs Management: 13 Cs Five Cs of Good Credit Character Capital Capacity Conditions Collateral Three “Most Important ” Cs Club Cocktail Connections Five Cs of Bad Credit Complacency Carelessness Communic ation Contingencies Competition

按次数下载不扣除下载券;

注册用户24小时内重复下载只扣除一次;

顺序:VIP每日次数-->可用次数-->下载券;

- 对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(授课教案课件)Chapter 08 Liquidity Planning and Managing Cash Assets.pdf

- 对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(授课教案课件)Chapter 07 The Effective Use of Capital.pdf

- 对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(授课教案课件)Chapter 06 Managing Liabilities.pdf

- 对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(授课教案课件)Chapter 05 Managing Interest Rate Risk:Duration Gap and Market Value of Equity.pdf

- 对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(授课教案课件)Chapter 04 Managing Interest Rate Risk:Gap and Earnings Sensitivity Sensitivity.pdf

- 对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(授课教案课件)Chapter 03 Managing Noninterest Income and Noninterest Expense.pdf

- 对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(授课教案课件)Chapter 02 Analyzing Bank Performance.pdf

- 对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(授课教案课件)Chapter 01 Fundamental Forces of Change in Banking.pdf

- 对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(试题)期末考试试卷(B卷)答案.pdf

- 对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(试题)期末考试试卷(B卷)试题.pdf

- 对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(试题)期末考试试卷(A卷)答案.pdf

- 对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(试题)期末考试试卷(A卷)试题.pdf

- 对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(作业习题).pdf

- 对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(教学大纲).pdf

- 对外经济贸易大学:《国际运输与物流管理》课程教学课件(授课教案)第十章 国际物流.pdf

- 对外经济贸易大学:《国际运输与物流管理》课程教学课件(授课教案)第八章 采购与供应管理.pdf

- 对外经济贸易大学:《国际运输与物流管理》课程教学课件(授课教案)第九章 分拨管理.pdf

- 对外经济贸易大学:《国际运输与物流管理》课程教学课件(授课教案)第七章 库存管理.pdf

- 对外经济贸易大学:《国际运输与物流管理》课程教学课件(授课教案)第六章 仓储管理.pdf

- 对外经济贸易大学:《国际运输与物流管理》课程教学课件(授课教案)第四章 需求预测.pdf

- 对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(授课教案课件)Chapter 10 Evaluating Commercial Loan Requests.pdf

- 对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(授课教案课件)Chapter 11 Evaluating Consumer Loans.pdf

- 对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(授课教案课件)Chapter 12 Customer Profitability Analysis and Loan Pricing.pdf

- 对外经济贸易大学:《银行管理学 Bank Management》课程教学资源(授课教案课件)Chapter 13 The Investment Portfolio and Policy Guidelines.pdf

- 对外经济贸易大学:《国际商法 International Business Law》课程教学资源(教学大纲,沈四宝).pdf

- 对外经济贸易大学:《国际商法 International Business Law》课程教学资源(作业习题)第一章 绪论(沈四宝).pdf

- 对外经济贸易大学:《国际商法 International Business Law》课程教学资源(作业习题)第二章 代理法.pdf

- 对外经济贸易大学:《国际商法 International Business Law》课程教学资源(作业习题)第三章 合伙企业法.pdf

- 对外经济贸易大学:《国际商法 International Business Law》课程教学资源(作业习题)第五章 外商投资企业法.pdf

- 对外经济贸易大学:《国际商法 International Business Law》课程教学资源(作业习题)第四章 公司法.pdf

- 对外经济贸易大学:《国际商法 International Business Law》课程教学资源(作业习题)第七章 买卖法.pdf

- 对外经济贸易大学:《国际商法 International Business Law》课程教学资源(作业习题)第六章 合同法.pdf

- 对外经济贸易大学:《国际商法 International Business Law》课程教学资源(作业习题)第九章 票据法.pdf

- 对外经济贸易大学:《国际商法 International Business Law》课程教学资源(作业习题)第八章 产品责任法.pdf

- 对外经济贸易大学:《国际商法 International Business Law》课程教学资源(作业习题)第十章 商事仲裁.pdf

- 对外经济贸易大学:《国际商法 International Business Law》课程教学资源(授课教案)第一章 绪论(沈四宝).pdf

- 对外经济贸易大学:《国际商法 International Business Law》课程教学资源(授课教案)第二章 代理法.pdf

- 对外经济贸易大学:《国际商法 International Business Law》课程教学资源(授课教案)第三章 合伙企业法.pdf

- 对外经济贸易大学:《国际商法 International Business Law》课程教学资源(授课教案)第四章 公司法.pdf

- 对外经济贸易大学:《国际商法 International Business Law》课程教学资源(授课教案)第五章 外商投资企业法.pdf