同济大学:《经济学》课程教学资源(教案讲义)Ch13 Money Market Equilibrium

0 Ch13 Money Market Equilibrium Economics ECONOMICS MANAGEMENT SCHOOL,TONGJI UNIVERSITY

Economics ECONOMICS & MANAGEMENT SCHOOL, TONGJI UNIVERSITY Ch13 Money Market Equilibrium

1907 16-2 13.1 Money Supply Money is the set of assets in an economy that people regularly use to buy goods and services from other people. Money has three functions in the economy: Medium of exchange Unit of account -Store of value Economics ECONOMICS MANAGEMENT SCHOOL,TONGJI UNIVERSITY

Economics ECONOMICS & MANAGEMENT SCHOOL, TONGJI UNIVERSITY 16-2 13.1 Money Supply • Money is the set of assets in an economy that people regularly use to buy goods and services from other people. • Money has three functions in the economy: – Medium of exchange – Unit of account – Store of value

16-3 Three Primary Functions of the Central Bank -Regulates banks to ensure they follow federal laws intended to promote safe and sound banking practices Acts as a banker's bank,making loans to banks and as a lender of last resort. Conducts monetary policy by controlling the money supply Economics ECONOMICS MANAGEMENT SCHOOL,TONGJI UNIVERSITY

Economics ECONOMICS & MANAGEMENT SCHOOL, TONGJI UNIVERSITY 16-3 The Federal Open Market Committee • Three Primary Functions of the Central Bank – Regulates banks to ensure they follow federal laws intended to promote safe and sound banking practices. – Acts as a banker’s bank, making loans to banks and as a lender of last resort. – Conducts monetary policy by controlling the money supply

190 16-4 BANKS AND THE MONEY SUPPLY Banks can influence the quantity of demand deposits in the economy and the money supply. Reserves are deposits that banks have received but have not loaned out. ·Reserve ratio The reserve ratio is the fraction of deposits that banks hold as reserves. In a fractional-reserve banking system,banks hold a fraction of the money deposited as reserves and lend out the rest. Economics ECONOMICS MANAGEMENT SCHOOL,TONGJI UNIVERSITY

Economics ECONOMICS & MANAGEMENT SCHOOL, TONGJI UNIVERSITY 16-4 BANKS AND THE MONEY SUPPLY • Banks can influence the quantity of demand deposits in the economy and the money supply. • Reserves are deposits that banks have received but have not loaned out. • Reserve Ratio – The reserve ratio is the fraction of deposits that banks hold as reserves. • In a fractional-reserve banking system, banks hold a fraction of the money deposited as reserves and lend out the rest

16-5 Banks'role in the money supply The money supply equals currency plus deposits: M=C+D Since the money supply includes deposits,the banking system plays an important role. Economics ECONOMICS MANAGEMENT SCHOOL,TONGJI UNIVERSITY

Economics ECONOMICS & MANAGEMENT SCHOOL, TONGJI UNIVERSITY 16-5 Banks’ role in the money supply • The money supply equals currency plus deposits: M = C + D • Since the money supply includes deposits, the banking system plays an important role

1907 16-6 Money Creation When a bank makes a loan from its reserves,the money supply increases. -The money supply is affected by the amount deposited in banks and the amount that banks loan. Deposits into a bank are recorded as both assets and liabilities. The fraction of total deposits that a bank has to keep as reserves is called the reserve ratio. Loans become an asset to the bank Economics ECONOMICS MANAGEMENT SCHOOL,TONGJI UNIVERSITY

Economics ECONOMICS & MANAGEMENT SCHOOL, TONGJI UNIVERSITY 16-6 Money Creation – When a bank makes a loan from its reserves, the money supply increases. – The money supply is affected by the amount deposited in banks and the amount that banks loan. • Deposits into a bank are recorded as both assets and liabilities. • The fraction of total deposits that a bank has to keep as reserves is called the reserve ratio. • Loans become an asset to the bank

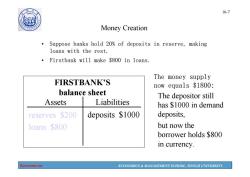

16-7 Money Creation Suppose banks hold 20%of deposits in reserve,making loans with the rest. Firstbank will make $800 in loans. The money supply FIRSTBANK'S now equals $1800: balance sheet The depositor still Assets Liabilities has $1000 in demand reserves $200 deposits $1000 deposits, loans $800 but now the borrower holds $800 in currency. Economics ECONOMICS MANAGEMENT SCHOOL,TONGJI UNIVERSITY

Economics ECONOMICS & MANAGEMENT SCHOOL, TONGJI UNIVERSITY 16-7 The money supply now equals $1800: The depositor still has $1000 in demand deposits, but now the borrower holds $800 in currency. FIRSTBANK’S balance sheet Assets Liabilities deposits $1000 • Suppose banks hold 20% of deposits in reserve, making loans with the rest. • Firstbank will make $800 in loans. reserves $1000 reserves $200 loans $800 Money Creation

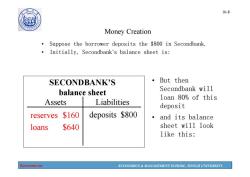

1907 16-8 Money Creation Suppose the borrower deposits the $800 in Secondbank. Initially,Secondbank's balance sheet is: SECONDBANK'S ·But then balance sheet Secondbank will loan 80%of this Assets Liabilities deposit reserves $160 deposits $800 and its balance loans $640 sheet will look like this: Economics ECONOMICS MANAGEMENT SCHOOL,TONGJI UNIVERSITY

Economics ECONOMICS & MANAGEMENT SCHOOL, TONGJI UNIVERSITY 16-8 • But then Secondbank will loan 80% of this deposit • and its balance sheet will look like this: SECONDBANK’S balance sheet Assets Liabilities reserves $800 loans $0 deposits $800 • Suppose the borrower deposits the $800 in Secondbank. • Initially, Secondbank’s balance sheet is: reserves $160 loans $640 Money Creation

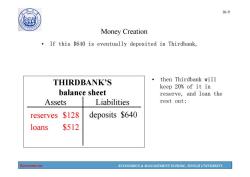

16-9 0 Money Creation If this $640 is eventually deposited in Thirdbank, THIRDBANK'S ·then Thirdbank will keep 20%of it in balance sheet reserve,and loan the Assets Liabilities rest out: reserves $128 deposits $640 loans $512 Economics ECONOMICS MANAGEMENT SCHOOL,TONGJI UNIVERSITY

Economics ECONOMICS & MANAGEMENT SCHOOL, TONGJI UNIVERSITY 16-9 THIRDBANK’S balance sheet Assets Liabilities reserves $640 loans $0 deposits $640 • If this $640 is eventually deposited in Thirdbank, reserves $128 loans $512 • then Thirdbank will keep 20% of it in reserve, and loan the rest out: Money Creation

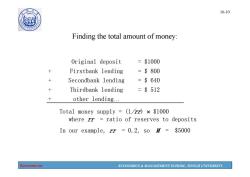

1907 16-10 Finding the total amount of money: Original deposit =$1000 Firstbank lending =$800 Secondbank lending =$640 Thirdbank lending =$512 other lending... Total money supply (1rr)x $1000 where rr ratio of reserves to deposits In our example,rr =0.2,so M=$5000 Economics ECONOMICS MANAGEMENT SCHOOL,TONGJI UNIVERSITY

Economics ECONOMICS & MANAGEMENT SCHOOL, TONGJI UNIVERSITY 16-10 Finding the total amount of money: Original deposit = $1000 + Firstbank lending = $ 800 + Secondbank lending = $ 640 + Thirdbank lending = $ 512 + other lending… Total money supply = (1/rr) $1000 where rr = ratio of reserves to deposits In our example, rr = 0.2, so M = $5000

按次数下载不扣除下载券;

注册用户24小时内重复下载只扣除一次;

顺序:VIP每日次数-->可用次数-->下载券;

- 同济大学:《经济学》课程教学资源(教案讲义)Ch12-2 The Determination of Equilibrium Output.pdf

- 同济大学:《经济学》课程教学资源(教案讲义)Ch12-1 Consumption and Investment.pdf

- 同济大学:《经济学》课程教学资源(教案讲义)Ch11 National Income Accounting.pdf

- 同济大学:《经济学》课程教学资源(教案讲义)Ch09 Externalities and Public Goods.pdf

- 同济大学:《经济学》课程教学资源(教案讲义)Ch10 Overview of Macroeconomics.pdf

- 同济大学:《经济学》课程教学资源(教案讲义)Ch08 Market For Factors of Production.pdf

- 同济大学:《经济学》课程教学资源(教案讲义)Ch07 General Equilibrium and Economic Efficiency.pdf

- 同济大学:《经济学》课程教学资源(教案讲义)Ch06-2 Imperfect Competition.pdf

- 同济大学:《经济学》课程教学资源(教案讲义)Ch06-1 Analysis of Perfectly Competitive Markets.pdf

- 同济大学:《经济学》课程教学资源(教案讲义)Ch05 Analysis of Cost.pdf

- 同济大学:《经济学》课程教学资源(教案讲义)Ch04 Producer Behavior.pdf

- 同济大学:《经济学》课程教学资源(教案讲义)Ch03 Demand and Consumer Behavior.pdf

- 同济大学:《经济学》课程教学资源(教案讲义)Ch02-2 Applications of Supply and Demand.pdf

- 同济大学:《经济学》课程教学资源(教案讲义)Ch02-1 Supply and Demand.pdf

- 同济大学:《经济学》课程教学资源(教案讲义)Ch01 The Fundamentals of Economics(负责人:李永).pdf

- 同济大学:《经济学》课程教学资源(试卷习题)期终考试试卷(B卷)答案.pdf

- 同济大学:《经济学》课程教学资源(试卷习题)期终考试试卷(B卷)试题.pdf

- 同济大学:《经济学》课程教学资源(试卷习题)期终考试试卷(A卷)答案.pdf

- 同济大学:《经济学》课程教学资源(试卷习题)期终考试试卷(A卷)试题.pdf

- 安徽科技学院:《会计信息系统》课程教学资源(PPT课件)第七章 ERP应用概述.ppt

- 同济大学:《经济学》课程教学资源(教案讲义)Ch14 Outputs and Money Market - IS-LM Model.pdf

- 同济大学:《经济学》课程教学资源(教案讲义)Ch15 Aggregate Demand And Supply.pdf

- 同济大学:《经济学》课程教学资源(教案讲义)Ch16 Economic Growth.pdf

- 吉林大学:《中央银行业务管理》课程教学资源(PPT课件)第一章 中央银行制度的形成和发展.ppt

- 吉林大学:《中央银行业务管理》课程教学资源(PPT课件)第七章 中央银行的其他业务.ppt

- 吉林大学:《中央银行业务管理》课程教学资源(PPT课件)第三章 中央银行业务活动的法规原则与资产负债表.ppt

- 吉林大学:《中央银行业务管理》课程教学资源(PPT课件)第九章 中央银行货币政策的目标与工具.ppt

- 吉林大学:《中央银行业务管理》课程教学资源(PPT课件)第二章 中央银行在现代经济体系中的地位与作用.ppt

- 吉林大学:《中央银行业务管理》课程教学资源(PPT课件)第五章 中央银行的资产业务.ppt

- 吉林大学:《中央银行业务管理》课程教学资源(PPT课件)第八章 中央银行货币政策概述.ppt

- 吉林大学:《中央银行业务管理》课程教学资源(PPT课件)第六章 中央银行的支付清算业务.ppt

- 吉林大学:《中央银行业务管理》课程教学资源(PPT课件)第十一章 中央银行的金融监管.ppt

- 吉林大学:《中央银行业务管理》课程教学资源(PPT课件)第十二章 中央银行与外汇管理.ppt

- 吉林大学:《中央银行业务管理》课程教学资源(PPT课件)第十章 货币政策的作用机制.ppt

- 吉林大学:《中央银行业务管理》课程教学资源(PPT课件)第四章 中央银行的负债业务.ppt

- 吉林大学:《中央银行业务管理》课程教学资源(PPT课件)中央银行学课程总结与辅导(共十二章,负责人:齐艺莹).ppt

- 吉林大学:《宏观经济学》课程j电子教案(PPT课件)第一章 宏观经济学导论(负责人:赵静杰).ppt

- 吉林大学:《宏观经济学》课程j电子教案(PPT课件)古典宏观经济模型.ppt

- 吉林大学:《宏观经济学》课程j电子教案(PPT课件)第二章 国民收入核算.ppt

- 吉林大学:《宏观经济学》课程j电子教案(PPT课件)第五章 通货膨胀理论.ppt