同济大学:《货币金融学》课程电子教案(课件讲稿)Chapter 6 Commercial Banks

同濟大学 经济与管理学院 TONGJI UNIVERSITY SCHOOL OF ECONOMICS MANAGEMENT Chapter 6 Commercial Banks 5 OMUFJ citipankis 日联银行 银行 銀行 ns 比利时联合银行 大 上汽分行16楼

Chapter 6 Commercial Banks

The Economics of Money and Banking Chapter 6 Commercial Banks >>>Agenda Emergence and Development of Commercial Banks Types and Structure of Commercial Banks Business of Commercial Banks Money Creation by Commercial Banks Commercial Bank Management ● 2 GUO YING SEM TONGJI UNIVERSITY

The Economics of Money and Banking 2 GUO YING SEM TONGJI UNIVERSITY Emergence and Development of Commercial Banks Types and Structure of Commercial Banks Business of Commercial Banks Money Creation by Commercial Banks Commercial Bank Management Chapter 6 Commercial Banks Agenda

The Economics of Money and Banking Chapter 6 Commercial Banks 》》 Emergence and Development of Commercial Banks 1 Commercial banks are profit-maximizing financial institutions that Commercial Banks Emergence engage in taking in deposits,granting loans,making exchanges and remittances.etc. The name bank derives from the Italian word banco "desk/bench", and Development of used during the Renaissance era by Florentine bankers,who used to make their transactions above a desk covered by a green tablecloth. The banks developed from usurious houses The banks developed from the share holding banks 3 GUO YING SEM TONGJI UNIVERSITY

The Economics of Money and Banking 3 GUO YING SEM TONGJI UNIVERSITY 1 Emergence and Development of Commercial Banks The name bank derives from the Italian word banco "desk/bench", used during the Renaissance era by Florentine bankers, who used to make their transactions above a desk covered by a green tablecloth. Commercial Banks Emergence and Development of Chapter 6 Commercial Banks The banks developed from usurious houses The banks developed from the share holding banks Commercial banks are profit-maximizing financial institutions that engage in taking in deposits, granting loans , making exchanges and remittances.etc

The Economics of Money and Banking Chapter 6 Commercial Banks >>>The Essence and Features of Commercial Banks 1 Commercial banks are special financial enterprises Commercial Banks Emergence and Development of Commercial banks are enterprises:profit-maximizing Commercial banks are financial enterprises:managing monetary business Commercial banks are special financial enterprises:create money and play a dominant role in financial intermediaries and are main body of the financial system 4 GUO YING SEM TONGJI UNIVERSITY

The Economics of Money and Banking 4 GUO YING SEM TONGJI UNIVERSITY 1 Commercial banks are enterprises: profit-maximizing The Essence and Features of Commercial Banks Chapter 6 Commercial Banks Commercial Banks Emergence and Development of Commercial banks are special financial enterprises Commercial banks are financial enterprises: managing monetary business Commercial banks are special financial enterprises: create money and play a dominant role in financial intermediaries and are main body of the financial system

The Economics of Money and Banking Chapter 6 Commercial Banks >>Types of Commercial Banks 2 Bank The segregated banking system is a high degree of specialization, under which certain banks are limited to some banking business. Types and Structure of Commercial Great Depression in the 1930s;Glass-Steagall Art The universal banking system is a system under which commercial banks are allowed to conduct all kinds of financial business,in another word,banks are allowed to conduct the concurrent business of banking,securities,trust and so on. 5 GUO YING SEM TONGJI UNIVERSITY

The Economics of Money and Banking 5 GUO YING SEM TONGJI UNIVERSITY 2 Types of Commercial Banks The segregated banking system is a high degree of specialization, under which certain banks are limited to some banking business. Great Depression in the 1930s; Glass-Steagall Art Chapter 6 Commercial Banks Banks Types and Structure of Commercial The universal banking system is a system under which commercial banks are allowed to conduct all kinds of financial business, in another word, banks are allowed to conduct the concurrent business of banking, securities, trust and so on

The Economics of Money and Banking Chapter 6 Commercial Banks >>Structure of Commercial Banks 2 A:Unit Banking Bank A system under which banking businesses are conducted only by Types and Structure of Commercial independent banks without any branches. B:Branch Banking A system under which branch banks are established and controlled by a single parent bank or head office 6 GUO YING SEM TONGJI UNIVERSITY

The Economics of Money and Banking 6 GUO YING SEM TONGJI UNIVERSITY 2 Structure of Commercial Banks A system under which banking businesses are conducted only by independent banks without any branches. Banks Types and Structure of Commercial A: Unit Banking Chapter 6 Commercial Banks A system under which branch banks are established and controlled by a single parent bank or head office B: Branch Banking

The Economics of Money and Banking Chapter 6 Commercial Banks >>Structure of Commercial Banks 2 C:Correspondent Banking Bank Types and Structure A system under which two banks sign an agreement to entrust the counterpart with the assigned or designated business on each other's behalf D:Bank holding Banking It is a device by which two or more individual banks are controlled by of Commercial the company that has the voting right. 7 GUO YING SEM TONGJI UNIVERSITY

The Economics of Money and Banking 7 GUO YING SEM TONGJI UNIVERSITY 2 Structure of Commercial Banks A system under which two banks sign an agreement to entrust the counterpart with the assigned or designated business on each other’s behalf Banks Types and Structure of Commercial C: Correspondent Banking Chapter 6 Commercial Banks It is a device by which two or more individual banks are controlled by the company that has the voting right. D: Bank holding Banking

The Economics of Money and Banking Chapter 6 Commercial Banks >>>Liabilities of Commercial Banks 3 Bank liabilities refer to the sources of funds of commercial banks, Business of Commercial Banks which include two parts: ◆ The capital of banks'own capital The funds received from the sources other than commercial banks 8 GUO YING SEM TONGJI UNIVERSITY

The Economics of Money and Banking 8 GUO YING SEM TONGJI UNIVERSITY 3 The capital of banks’ own capital The funds received from the sources other than commercial banks Liabilities of Commercial Banks Chapter 6 Commercial Banks Business of Commercial Banks Bank liabilities refer to the sources of funds of commercial banks, which include two parts:

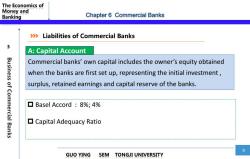

The Economics of Money and Banking Chapter 6 Commercial Banks >>Liabilities of Commercial Banks 3 A:Capital Account Commercial banks'own capital includes the owner's equity obtained Business of Commercial Banks when the banks are first set up,representing the initial investment, surplus,retained earnings and capital reserve of the banks. ▣Basel Accord:8%;4% Capital Adequacy Ratio 9 GUO YING SEM TONGJI UNIVERSITY

The Economics of Money and Banking 9 GUO YING SEM TONGJI UNIVERSITY 3 Basel Accord : 8%; 4% Capital Adequacy Ratio Liabilities of Commercial Banks Chapter 6 Commercial Banks Business of Commercial Banks Commercial banks’ own capital includes the owner’s equity obtained when the banks are first set up, representing the initial investment , surplus, retained earnings and capital reserve of the banks. A: Capital Account

The Economics of Money and Banking Chapter 6 Commercial Banks >>Liabilities of Commercial Banks 3 B:Deposits ▣Demand deposits Business of Commercial Banks ▣Saving deposits ▣Time deposits 10 GUO YING SEM TONGJI UNIVERSITY

The Economics of Money and Banking 10 GUO YING SEM TONGJI UNIVERSITY 3 Demand deposits Saving deposits Time deposits Liabilities of Commercial Banks Chapter 6 Commercial Banks Business of Commercial Banks B: Deposits

按次数下载不扣除下载券;

注册用户24小时内重复下载只扣除一次;

顺序:VIP每日次数-->可用次数-->下载券;

- 同济大学:《货币金融学》课程电子教案(课件讲稿)Chapter 5 Financial Institutions.pdf

- 同济大学:《货币金融学》课程电子教案(课件讲稿)Chapter 4 Interest and Interest Rate.pdf

- 同济大学:《货币金融学》课程电子教案(课件讲稿)Chapter 3 Credit and Financial Instrument.pdf

- 同济大学:《货币金融学》课程电子教案(课件讲稿)Chapter 2 Money and Monetary System.pdf

- 同济大学:《货币金融学》课程电子教案(课件讲稿)Chapter 1 Introduction(负责人:郭英).pdf

- 同济大学:《货币金融学》课程教学资源(试卷习题)Answers for Test Sample(参考答案)Chapter 1-10.docx

- 同济大学:《货币金融学》课程教学资源(试卷习题)Chapter 9 Money and Inflation.docx

- 同济大学:《货币金融学》课程教学资源(试卷习题)Chapter 8 Money Supply and Money Demand.docx

- 同济大学:《货币金融学》课程教学资源(试卷习题)Chapter 7 Financial Markets.docx

- 同济大学:《货币金融学》课程教学资源(试卷习题)Chapter 6 Central Banks.docx

- 同济大学:《货币金融学》课程教学资源(试卷习题)Chapter 5 Commercial Banks.docx

- 同济大学:《货币金融学》课程教学资源(试卷习题)Chapter 4 The Economics of Financial Intermediary.docx

- 同济大学:《货币金融学》课程教学资源(试卷习题)Chapter 3 Interest and Interest Rate.docx

- 同济大学:《货币金融学》课程教学资源(试卷习题)Chapter 2 Credit and Financial Instruments.docx

- 同济大学:《货币金融学》课程教学资源(试卷习题)Chapter 1 Money and Monetary System.docx

- 同济大学:《货币金融学》课程教学资源(大纲教案)教学大纲 The Economics of Money and Banking.pdf

- 吉林大学:《财政学》课程教学资源(试卷习题)远程教育考试样卷(无答案).doc

- 吉林大学:《经济法》课程电子教案(PPT教学课件,共十三章,授课对象:远程教育,授课教师:孙凤英).ppt

- 《财务管理》课程教学资源(专项报告)南宁市宾阳县生猪现代农业产业园实施方案(简版).pdf

- 《财务管理》课程教学资源(专项报告)存栏1120头商品猪养殖小区可行性研究报告(简版).pdf

- 同济大学:《货币金融学》课程电子教案(课件讲稿)Chapter 7 Central Banks.pdf

- 同济大学:《货币金融学》课程电子教案(课件讲稿)Chapter 8 Financial Markets.pdf

- 同济大学:《货币金融学》课程电子教案(课件讲稿)Chapter 10 Monetary Policy.pdf

- 同济大学:《货币金融学》课程电子教案(课件讲稿)Chapter 9 Money Demand and Money Supply.pdf

- 同济大学:《货币金融学》课程电子教案(课件讲稿)Chapter 11 Inflation and Deflation.pdf

- 吉林大学:《会计学》课程电子教案(PPT课件)第一章 绪论(负责人:孙烨).ppt

- 吉林大学:《会计学》课程电子教案(PPT课件)第二章 帐户与复式记帐.ppt

- 吉林大学:《会计学》课程电子教案(PPT课件)第三章 分录与记帐.ppt

- 吉林大学:《会计学》课程电子教案(PPT课件)第四章 试算与调整.ppt

- 吉林大学:《会计学》课程电子教案(PPT课件)第十章 无形资产与其他资产.ppt

- 吉林大学:《会计学》课程电子教案(PPT课件)第十一章 负债.ppt

- 吉林大学:《会计学》课程电子教案(PPT课件)第十二章 所有者权益.ppt

- 吉林大学:《会计学》课程电子教案(PPT课件)第五章 结帐与编表.ppt

- 吉林大学:《会计学》课程电子教案(PPT课件)第六章 货币资金与应收帐款.ppt

- 吉林大学:《会计学》课程电子教案(PPT课件)第七章 存货.ppt

- 吉林大学:《会计学》课程电子教案(PPT课件)第八章 投资.ppt

- 吉林大学:《会计学》课程电子教案(PPT课件)第九章 固定资产.ppt

- 吉林大学:《会计学》课程电子教案(PPT课件)第十三章 营业收入.ppt

- 吉林大学:《会计学》课程电子教案(PPT课件)第十四章 资产负债表与利润表.ppt

- 吉林大学:《会计学》课程电子教案(PPT课件)第十五章 现金流量表.ppt