同济大学:《货币金融学》课程电子教案(课件讲稿)Chapter 3 Credit and Financial Instrument

同将大学 经济与管理学院 TONGJI UNIVERSITY SCHOOL OF ECONOMICS MANAGEMENT Chapter 3 Credit and Financial Instrument 色ANK CREDIT Sc0RE□ 私B VISA

Chapter 3 Credit and Financial Instrument

The Economics of Money and Banking Chapter 3 Credit and Financial Instrument 》Agenda ● Credit:History and Types ● Financial Instrument:Functions and Types 2 GUO YING SEM TONGJI UNIVERSITY

The Economics of Money and Banking 2 GUO YING SEM TONGJI UNIVERSITY Credit: History and Types Financial Instrument: Functions and Types Chapter 3 Credit and Financial Instrument Agenda

The Economics of Money and Banking Chapter 3 Credit and Financial Instrument >>>What is Credit 1 from Latin credere,to believe Credit: Credit is a contractual agreement in which a borrower receives something of value now and agrees to repay the lender at some date in History and Types the future,generally with interest. nature of Credit The relationship of credit is that between creditors and debtors ▣ Credit is a special form of movement of value ▣ Credit is the behavior of borrowing and lending with the condition of repayment of principals with interest 3 GUO YING SEM TONGJI UNIVERSITY

The Economics of Money and Banking 3 GUO YING SEM TONGJI UNIVERSITY 1 What is Credit nature of Credit The relationship of credit is that between creditors and debtors Credit is a special form of movement of value Credit is the behavior of borrowing and lending with the condition of repayment of principals with interest from Latin credere, to believe Credit is a contractual agreement in which a borrower receives something of value now and agrees to repay the lender at some date in the future, generally with interest. Chapter 3 Credit and Financial Instrument Credit: History and Types

The Economics of Money and Banking Chapter 3 Credit and Financial Instrument >>Elements of Credit 1 Debtor and creditor Credit:History and Types Repayment period Credit instruments Interest rate 4 GUO YING SEM TONGJI UNIVERSITY

The Economics of Money and Banking 4 GUO YING SEM TONGJI UNIVERSITY 1 Elements of Credit Chapter 3 Credit and Financial Instrument Credit: History and Types Debtor and creditor Repayment period Credit instruments Interest rate

The Economics of Money and Banking Chapter 3 Credit and Financial Instrument >>Forms of Credit 1 A:Commercial Credit Credit: Commercial credit is the credit that is provides mutually between enterprises and is linked directly to goods exchange.Usually History commercial credit is provided in the form of either sale of goods on credit or payment of goods in advance. and Types Characteristics of Commercial Credit Subject:enterprises non-financial enterprises) Object:commodity ▣ Most convenient way to solve the buyer's inadequate circulation ▣ Keep with economic activities 5 GUO YING SEM TONGJI UNIVERSITY

The Economics of Money and Banking 5 GUO YING SEM TONGJI UNIVERSITY 1 Forms of Credit Chapter 3 Credit and Financial Instrument Credit: History and Types A: Commercial Credit Commercial credit is the credit that is provides mutually between enterprises and is linked directly to goods exchange. Usually commercial credit is provided in the form of either sale of goods on credit or payment of goods in advance. Characteristics of Commercial Credit Subject: enterprises ( non-financial enterprises) Object: commodity Most convenient way to solve the buyer’s inadequate circulation Keep with economic activities

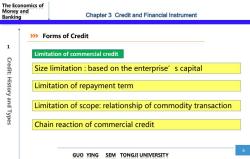

The Economics of Money and Banking Chapter 3 Credit and Financial Instrument >>Forms of Credit 1 Limitation of commercial credit Credit:History and Types Size limitation based on the enterprise's capital Limitation of repayment term Limitation of scope:relationship of commodity transaction Chain reaction of commercial credit 6 GUO YING SEM TONGJI UNIVERSITY

The Economics of Money and Banking 6 GUO YING SEM TONGJI UNIVERSITY 1 Chapter 3 Credit and Financial Instrument Credit: History and Types Size limitation : based on the enterprise’s capital Limitation of repayment term Limitation of scope: relationship of commodity transaction Chain reaction of commercial credit Limitation of commercial credit Forms of Credit

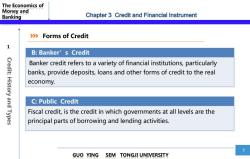

The Economics of Money and Banking Chapter 3 Credit and Financial Instrument >>Forms of Credit 1 B:Banker's Credit Credit: Banker credit refers to a variety of financial institutions,particularly banks,provide deposits,loans and other forms of credit to the real economy. History and Types C:Public Credit Fiscal credit,is the credit in which governments at all levels are the principal parts of borrowing and lending activities. 7 GUO YING SEM TONGJI UNIVERSITY

The Economics of Money and Banking 7 GUO YING SEM TONGJI UNIVERSITY 1 Chapter 3 Credit and Financial Instrument Credit: History and Types B: Banker’s Credit Banker credit refers to a variety of financial institutions, particularly banks, provide deposits, loans and other forms of credit to the real economy. Forms of Credit C: Public Credit Fiscal credit, is the credit in which governments at all levels are the principal parts of borrowing and lending activities

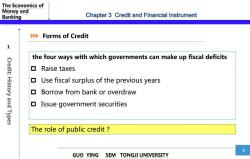

The Economics of Money and Banking Chapter 3 Credit and Financial Instrument >>Forms of Credit 1 the four ways with which governments can make up fiscal deficits Raise taxes Credit:History and Types ▣ Use fiscal surplus of the previous years ▣ Borrow from bank or overdraw ▣ Issue government securities The role of public credit 8 GUO YING SEM TONGJI UNIVERSITY

The Economics of Money and Banking 8 GUO YING SEM TONGJI UNIVERSITY 1 Chapter 3 Credit and Financial Instrument Credit: History and Types the four ways with which governments can make up fiscal deficits Raise taxes Use fiscal surplus of the previous years Borrow from bank or overdraw Issue government securities The role of public credit ? Forms of Credit

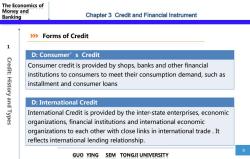

The Economics of Money and Banking Chapter 3 Credit and Financial Instrument >>Forms of Credit 1 D:Consumer's Credit Credit: Consumer credit is provided by shops,banks and other financial institutions to consumers to meet their consumption demand,such as History and Types installment and consumer loans D:International Credit International Credit is provided by the inter-state enterprises,economic organizations,financial institutions and international economic organizations to each other with close links in international trade.It reflects international lending relationship. 9 GUO YING SEM TONGJI UNIVERSITY

The Economics of Money and Banking 9 GUO YING SEM TONGJI UNIVERSITY 1 Chapter 3 Credit and Financial Instrument Credit: History and Types D: Consumer’s Credit Consumer credit is provided by shops, banks and other financial institutions to consumers to meet their consumption demand, such as installment and consumer loans Forms of Credit D: International Credit International Credit is provided by the inter-state enterprises, economic organizations, financial institutions and international economic organizations to each other with close links in international trade . It reflects international lending relationship

The Economics of Money and Banking Chapter 3 Credit and Financial Instrument 》》 Financial Instrument ¥5 2 Definition The written legal obligation of one party to transfer something of value, Financial usually money,to another party at some future date,under certain conditions. Instrument Uses of financial instruments Means of payment:Purchase of goods or services Store of value:Transfer of purchasing power into the future Transfer of risk:Transfer of risk from one person or company to another 10 GUO YING SEM TONGJI UNIVERSITY

The Economics of Money and Banking 10 GUO YING SEM TONGJI UNIVERSITY 2 Financial Instrument Chapter 3 Credit and Financial Instrument Financial Instrument Definition The written legal obligation of one party to transfer something of value, usually money, to another party at some future date, under certain conditions. Uses of financial instruments Means of payment: Purchase of goods or services Store of value: Transfer of purchasing power into the future Transfer of risk: Transfer of risk from one person or company to another

按次数下载不扣除下载券;

注册用户24小时内重复下载只扣除一次;

顺序:VIP每日次数-->可用次数-->下载券;

- 同济大学:《货币金融学》课程电子教案(课件讲稿)Chapter 2 Money and Monetary System.pdf

- 同济大学:《货币金融学》课程电子教案(课件讲稿)Chapter 1 Introduction(负责人:郭英).pdf

- 同济大学:《货币金融学》课程教学资源(试卷习题)Answers for Test Sample(参考答案)Chapter 1-10.docx

- 同济大学:《货币金融学》课程教学资源(试卷习题)Chapter 9 Money and Inflation.docx

- 同济大学:《货币金融学》课程教学资源(试卷习题)Chapter 8 Money Supply and Money Demand.docx

- 同济大学:《货币金融学》课程教学资源(试卷习题)Chapter 7 Financial Markets.docx

- 同济大学:《货币金融学》课程教学资源(试卷习题)Chapter 6 Central Banks.docx

- 同济大学:《货币金融学》课程教学资源(试卷习题)Chapter 5 Commercial Banks.docx

- 同济大学:《货币金融学》课程教学资源(试卷习题)Chapter 4 The Economics of Financial Intermediary.docx

- 同济大学:《货币金融学》课程教学资源(试卷习题)Chapter 3 Interest and Interest Rate.docx

- 同济大学:《货币金融学》课程教学资源(试卷习题)Chapter 2 Credit and Financial Instruments.docx

- 同济大学:《货币金融学》课程教学资源(试卷习题)Chapter 1 Money and Monetary System.docx

- 同济大学:《货币金融学》课程教学资源(大纲教案)教学大纲 The Economics of Money and Banking.pdf

- 吉林大学:《财政学》课程教学资源(试卷习题)远程教育考试样卷(无答案).doc

- 吉林大学:《经济法》课程电子教案(PPT教学课件,共十三章,授课对象:远程教育,授课教师:孙凤英).ppt

- 《财务管理》课程教学资源(专项报告)南宁市宾阳县生猪现代农业产业园实施方案(简版).pdf

- 《财务管理》课程教学资源(专项报告)存栏1120头商品猪养殖小区可行性研究报告(简版).pdf

- 《财务管理》课程教学资源(专项报告)存栏2000头祖代原种猪场可行性研究报告(简版).pdf

- 《财务管理》课程教学资源(专项报告)存栏3000头曾祖代原种猪场环保生态养殖综合开发项目可研报告(简版).pdf

- 《财务管理》课程教学资源(专项报告)存栏5000头基础母猪现代化生猪养殖场可行性研究报告(简版).pdf

- 同济大学:《货币金融学》课程电子教案(课件讲稿)Chapter 4 Interest and Interest Rate.pdf

- 同济大学:《货币金融学》课程电子教案(课件讲稿)Chapter 5 Financial Institutions.pdf

- 同济大学:《货币金融学》课程电子教案(课件讲稿)Chapter 6 Commercial Banks.pdf

- 同济大学:《货币金融学》课程电子教案(课件讲稿)Chapter 7 Central Banks.pdf

- 同济大学:《货币金融学》课程电子教案(课件讲稿)Chapter 8 Financial Markets.pdf

- 同济大学:《货币金融学》课程电子教案(课件讲稿)Chapter 10 Monetary Policy.pdf

- 同济大学:《货币金融学》课程电子教案(课件讲稿)Chapter 9 Money Demand and Money Supply.pdf

- 同济大学:《货币金融学》课程电子教案(课件讲稿)Chapter 11 Inflation and Deflation.pdf

- 吉林大学:《会计学》课程电子教案(PPT课件)第一章 绪论(负责人:孙烨).ppt

- 吉林大学:《会计学》课程电子教案(PPT课件)第二章 帐户与复式记帐.ppt

- 吉林大学:《会计学》课程电子教案(PPT课件)第三章 分录与记帐.ppt

- 吉林大学:《会计学》课程电子教案(PPT课件)第四章 试算与调整.ppt

- 吉林大学:《会计学》课程电子教案(PPT课件)第十章 无形资产与其他资产.ppt

- 吉林大学:《会计学》课程电子教案(PPT课件)第十一章 负债.ppt

- 吉林大学:《会计学》课程电子教案(PPT课件)第十二章 所有者权益.ppt

- 吉林大学:《会计学》课程电子教案(PPT课件)第五章 结帐与编表.ppt

- 吉林大学:《会计学》课程电子教案(PPT课件)第六章 货币资金与应收帐款.ppt

- 吉林大学:《会计学》课程电子教案(PPT课件)第七章 存货.ppt

- 吉林大学:《会计学》课程电子教案(PPT课件)第八章 投资.ppt

- 吉林大学:《会计学》课程电子教案(PPT课件)第九章 固定资产.ppt