同济大学:《货币金融学》课程电子教案(课件讲稿)Chapter 1 Introduction(负责人:郭英)

9 同济大学 经济与管理学院 TONGJI UNIVERSITY SCHOOL OF ECONOMICS MANAGEMENT Chapter I Introduction WHAT WHY HOW

WHAT WHY HOW Chapter 1 Introduction

The Economics of Money and Banking Chapter1 Introduction 》Agenda ■ Motivation ● ● ■ Outline of the Course Administration of the Course 3 GUO YING SEM TONGJI UNIVERSITY

The Economics of Money and Banking 3 GUO YING SEM TONGJI UNIVERSITY Motivation Outline of the Course Administration of the Course Chapter1 Introduction Agenda

The Economics of Money and Banking Chapter1 Introduction Where industry treads,finance will follow. : ------Joan Robinson,famous female economist : : The success of other market reform depends on the health of the financial system. ● : ------World Bank,World Development Report,1996 : The Word Bank ● Group 4 GUO YING SEM T TONGJI UNIVERSITY

The Economics of Money and Banking 4 GUO YING SEM TONGJI UNIVERSITY Where industry treads, finance will follow. ------Joan Robinson, famous female economist The success of other market reform depends on the health of the financial system. ------World Bank, World Development Report, 1996 Chapter1 Introduction

The Economics of Money and Banking Chapter1 Introduction What is finance? ↓ Currency or fund The study of funds management,or the allocation of assets and liabilities over time Financial instruments under conditions of certainty and uncertainty. Financial institutions -----wiki Financial markets Regulatory agencies Central banks 5

The Economics of Money and Banking 5 GUO YING SEM TONGJI UNIVERSITY What is finance? Chapter1 Introduction The study of funds management, or the allocation of assets and liabilities over time under conditions of certainty and uncertainty. -----wiki Currency or fund Financial instruments Financial institutions Financial markets Central banks Regulatory agencies

The Economics of Money and Banking Chapter1 Introduction 》》》 Why Study Money and Banking? 1 A basic course for the majors in economics Motivation Provide a solid foundation for further study or employment in the financial service industry Activities in financial markets have direct effects on individual's wealth,the behavior of business,and the efficiency of our economy Monetary policy may affect the job prospects and the prices of good in the future Be able to understand many of the things announced in the media and comment on them 6 GUO YING SEM TONGJI UNIVERSITY

The Economics of Money and Banking 6 GUO YING SEM TONGJI UNIVERSITY Motivation 1 Chapter1 Introduction Why Study Money and Banking? Provide a solid foundation for further study or employment in the financial service industry Activities in financial markets have direct effects on individual’s wealth, the behavior of business, and the efficiency of our economy Monetary policy may affect the job prospects and the prices of good in the future Be able to understand many of the things announced in the media and comment on them A basic course for the majors in economics

The Economics of Money and Banking Chapter1 Introduction >>Course Description 2 The course is the bilingual course on the economics of money,banking and financial markets.It examines concepts and practices of money and banking in the real world.Various aspects of finance are discussed including currency, Outline of the course monetary system,financial instruments,financial institutions,financial markets and financial supervision system,etc. China's experience and lessons of money and banking will be highlighted in the course.How China's financial system grew and how the current financial issue came into people's attention will be addressed.Of course the international comparison in these issues are very important in this course, which broadening the students'global vision from diversified angles and deepening the understanding of financial system in different nations. GUO YING SEM TONGJI UNIVERSITY

The Economics of Money and Banking 7 GUO YING SEM TONGJI UNIVERSITY Outline of the course 2 Chapter1 Introduction Course Description The course is the bilingual course on the economics of money, banking and financial markets. It examines concepts and practices of money and banking in the real world. Various aspects of finance are discussed including currency, monetary system, financial instruments, financial institutions, financial markets and financial supervision system, etc. China’s experience and lessons of money and banking will be highlighted in the course. How China’s financial system grew and how the current financial issue came into people’s attention will be addressed. Of course the international comparison in these issues are very important in this course, which broadening the students’ global vision from diversified angles and deepening the understanding of financial system in different nations

The Economics of Money and Banking Chapter1 Introduction 》》( Course Objectives 2 The course is structured to provide the students with an integrated perspective on the economics of money and banking especially in China.It Outline of the course outlines those elements of the subject that: What are the functions of currency and monetary system? How do credit and interest rate work in the real world What are the roles of financial institutions and markets in the financial system? How does monetary policy work in the real world? How and why did China go onto a new path of financial reform? What is the future for China's financial system? GUO YING SEM TONGJI UNIVERSITY 8

The Economics of Money and Banking 8 GUO YING SEM TONGJI UNIVERSITY Outline of the course 2 Chapter1 Introduction Course Objectives The course is structured to provide the students with an integrated perspective on the economics of money and banking especially in China. It outlines those elements of the subject that: What are the functions of currency and monetary system? How do credit and interest rate work in the real world ? What are the roles of financial institutions and markets in the financial system? How does monetary policy work in the real world? How and why did China go onto a new path of financial reform? What is the future for China’s financial system?

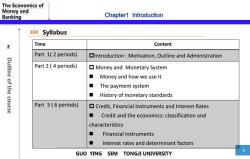

The Economics of Money and Banking Chapter1 Introduction >>>Syllabus 2 Time Content Part 1(2 periods) Introduction Motivation,Outline and Administration Part 2(4 periods) Outline of the course Money and Monetary System ■ Money and how we use it ■ The payment system ■ History of monetary standards Part 3(6 periods) Credit,Financial Instruments and Interest Rates ■ Credit and the economics:classification and characteristics ■ Financial instruments ■ Interest rates and determinant factors 9 GUO YING SEM TONGJI UNIVERSITY

The Economics of Money and Banking 9 GUO YING SEM TONGJI UNIVERSITY Outline of the course 2 Chapter1 Introduction Syllabus Time Content Part 1( 2 periods) Introduction : Motivation, Outline and Administration Part 2 ( 4 periods) Money and Monetary System Money and how we use it The payment system History of monetary standards Part 3 ( 6 periods) Credit, Financial Instruments and Interest Rates Credit and the economics: classification and characteristics Financial instruments Interest rates and determinant factors

The Economics of Money and Banking Chapter1 Introduction >>>Syllabus 2 Time Content Part 4(16 periods) Financial Institutions Outline of the course The economics of financial intermediation Financial Industry structure Depository institutions:banks and bank management Central banks and regulating the financial system Part 5(8 periods) ▣Financial Markets Functions of financial markets Money market and main instruments Capital market and main instruments Derivative market:future,options and swaps GUO YING SEM TONGJI UNIVERSITY 10

The Economics of Money and Banking 10 GUO YING SEM TONGJI UNIVERSITY Outline of the course 2 Chapter1 Introduction Syllabus Time Content Part 4 (16 periods) Financial Institutions The economics of financial intermediation Financial Industry structure Depository institutions: banks and bank management Central banks and regulating the financial system Part 5( 8 periods) Financial Markets Functions of financial markets Money market and main instruments Capital market and main instruments Derivative market : future, options and swaps

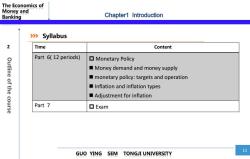

The Economics of Money and Banking Chapter1 Introduction 》 Syllabus 2 Time Content Part 6(12 periods) ▣Monetary Policy Outline of the course Money demand and money supply monetary policy:targets and operation Inflation and inflation types Adjustment for inflation Part 7 ▣Exam GUO YING SEM 11 TONGJI UNIVERSITY

The Economics of Money and Banking 11 GUO YING SEM TONGJI UNIVERSITY Outline of the course 2 Chapter1 Introduction Syllabus Time Content Part 6( 12 periods) Monetary Policy Money demand and money supply monetary policy: targets and operation Inflation and inflation types Adjustment for inflation Part 7 Exam

按次数下载不扣除下载券;

注册用户24小时内重复下载只扣除一次;

顺序:VIP每日次数-->可用次数-->下载券;

- 同济大学:《货币金融学》课程教学资源(试卷习题)Answers for Test Sample(参考答案)Chapter 1-10.docx

- 同济大学:《货币金融学》课程教学资源(试卷习题)Chapter 9 Money and Inflation.docx

- 同济大学:《货币金融学》课程教学资源(试卷习题)Chapter 8 Money Supply and Money Demand.docx

- 同济大学:《货币金融学》课程教学资源(试卷习题)Chapter 7 Financial Markets.docx

- 同济大学:《货币金融学》课程教学资源(试卷习题)Chapter 6 Central Banks.docx

- 同济大学:《货币金融学》课程教学资源(试卷习题)Chapter 5 Commercial Banks.docx

- 同济大学:《货币金融学》课程教学资源(试卷习题)Chapter 4 The Economics of Financial Intermediary.docx

- 同济大学:《货币金融学》课程教学资源(试卷习题)Chapter 3 Interest and Interest Rate.docx

- 同济大学:《货币金融学》课程教学资源(试卷习题)Chapter 2 Credit and Financial Instruments.docx

- 同济大学:《货币金融学》课程教学资源(试卷习题)Chapter 1 Money and Monetary System.docx

- 同济大学:《货币金融学》课程教学资源(大纲教案)教学大纲 The Economics of Money and Banking.pdf

- 吉林大学:《财政学》课程教学资源(试卷习题)远程教育考试样卷(无答案).doc

- 吉林大学:《经济法》课程电子教案(PPT教学课件,共十三章,授课对象:远程教育,授课教师:孙凤英).ppt

- 《财务管理》课程教学资源(专项报告)南宁市宾阳县生猪现代农业产业园实施方案(简版).pdf

- 《财务管理》课程教学资源(专项报告)存栏1120头商品猪养殖小区可行性研究报告(简版).pdf

- 《财务管理》课程教学资源(专项报告)存栏2000头祖代原种猪场可行性研究报告(简版).pdf

- 《财务管理》课程教学资源(专项报告)存栏3000头曾祖代原种猪场环保生态养殖综合开发项目可研报告(简版).pdf

- 《财务管理》课程教学资源(专项报告)存栏5000头基础母猪现代化生猪养殖场可行性研究报告(简版).pdf

- 《财务管理》课程教学资源(专项报告)山西灵空山国家级自然保护区2016年林业国家级自然保护区补助资金建设项目可行性研究报告(简版).pdf

- 《财务管理》课程教学资源(专项报告)森林康养度假建设项目可行性研究报告(简版).pdf

- 同济大学:《货币金融学》课程电子教案(课件讲稿)Chapter 2 Money and Monetary System.pdf

- 同济大学:《货币金融学》课程电子教案(课件讲稿)Chapter 3 Credit and Financial Instrument.pdf

- 同济大学:《货币金融学》课程电子教案(课件讲稿)Chapter 4 Interest and Interest Rate.pdf

- 同济大学:《货币金融学》课程电子教案(课件讲稿)Chapter 5 Financial Institutions.pdf

- 同济大学:《货币金融学》课程电子教案(课件讲稿)Chapter 6 Commercial Banks.pdf

- 同济大学:《货币金融学》课程电子教案(课件讲稿)Chapter 7 Central Banks.pdf

- 同济大学:《货币金融学》课程电子教案(课件讲稿)Chapter 8 Financial Markets.pdf

- 同济大学:《货币金融学》课程电子教案(课件讲稿)Chapter 10 Monetary Policy.pdf

- 同济大学:《货币金融学》课程电子教案(课件讲稿)Chapter 9 Money Demand and Money Supply.pdf

- 同济大学:《货币金融学》课程电子教案(课件讲稿)Chapter 11 Inflation and Deflation.pdf

- 吉林大学:《会计学》课程电子教案(PPT课件)第一章 绪论(负责人:孙烨).ppt

- 吉林大学:《会计学》课程电子教案(PPT课件)第二章 帐户与复式记帐.ppt

- 吉林大学:《会计学》课程电子教案(PPT课件)第三章 分录与记帐.ppt

- 吉林大学:《会计学》课程电子教案(PPT课件)第四章 试算与调整.ppt

- 吉林大学:《会计学》课程电子教案(PPT课件)第十章 无形资产与其他资产.ppt

- 吉林大学:《会计学》课程电子教案(PPT课件)第十一章 负债.ppt

- 吉林大学:《会计学》课程电子教案(PPT课件)第十二章 所有者权益.ppt

- 吉林大学:《会计学》课程电子教案(PPT课件)第五章 结帐与编表.ppt

- 吉林大学:《会计学》课程电子教案(PPT课件)第六章 货币资金与应收帐款.ppt

- 吉林大学:《会计学》课程电子教案(PPT课件)第七章 存货.ppt