《船舶采购、销售和运营 Ship Purchase, Sales and Operations》课程教学资源(资料)Capital Asset Pricing Model

15.401 Recitation 7:CAPM

15.401 Recitation 7: CAPM

Learning Objectives Review of Concepts O CAPM O Beta and SML O Alpha ▣Examples O The frontier O CML and SML 2010/Yichuan Liu 2

Learning Objectives R i ev ew of Concepts oCAPM oBeta and SML oAlpha Examples oThe frontier oCML and SML 2010 / Yichuan Liu 2

Review:efficient frontier From Portfolio Choice... The CML is tangent to the efficient frontier at the tangency portfolio. The tangency portfolio is the portfolio of risky assets that maximizes the Sharpe ratio. The slope of the CML is the maximum Sharpe ratio. Rational investors always hold a combination of the tangency portfolio and the risk-free asset.The proportion depends on investors'risk preferences. 2010/Yichuan Liu 3

‐ Review: efficient frontier From Portfolio Portfolio Choice… Choice… The CML is tangent to the efficient frontier at the tangency portfolio. The tangency portfolio is the portfolio of risky assets that maximizes the Sharpe ratio. The slope of the CML is the maximum Sharpe ratio. Rational investors always hold a combination of the tangency tangency portfolio portfolio and the risk‐free asset. The proportion depends on investors’ risk preferences. 2010 / Yichuan Liu 3

Review:CAPM Since each investor holds the tangency portfolio as part of his/her overall portfolio,the market portfolio must coincide with the tangency portfolio. Idea of CAPM:the contribution of a single risky asset to the risk of the market portfolio must be proportional to its risk premium. In other words,investors are compensated for exposure to systematic risk. ldiosyncratic risk is not compensated because they can be diversified away. 2010/Yichuan Liu

Review: CAPM Since each investor investor holds the tangency tangency portfolio portfolio as part of his/her overall portfolio, the market portfolio must coincide with the tangency portfolio. Idea of CAPM: the contribution of a single risky asset to the risk of the market portfolio must be proportional proportional to its risk premium premium. In other words, investors are compensated for exposure to systematic risk. Idiosyncratic risk is not compensated because they can be diversified away. 2010 / Yichuan Liu 4

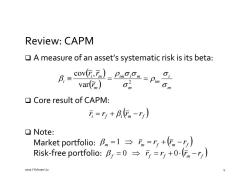

Review:CAPM A measure of an asset's systematic risk is its beta: Cov(mcon-pw var(tm) ▣Core result of CAPM: 万=r5+B,m-r) ▣Note: Market portfolio:Bnm=1→万n=ry+(m-r) Risk-free portfolio:B=0=+0.") 2010/Yichuan Liu

Review: CAPM A measure measure of an asset’s systematic systematic risk is its beta: ~ cov~ ri , rm im i m i i 2 im var~ rm m m Core result of CAPM: ri rf irm rf Note: Market portfolio: 1 r r r rf m m f m Risk‐free portfolio: f 0 rf rf 0 rm rf f 2010 / Yichuan Liu 5

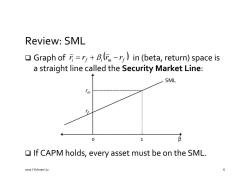

Review:SML Graph of=r+-r,)in (beta,return)space is a straight line called the Security Market Line: SML 0 1 If CAPM holds,every asset must be on the SML. 2010/Yichuan Liu 6

, Review: SML Graph of ri rf irm rf Graph in (beta, return) return) space is a straight line called the Security Market Line: SML rm rf 0 1 β If CAPM holds, every asset must be on the SML. 2010 / Yichuan Liu 6

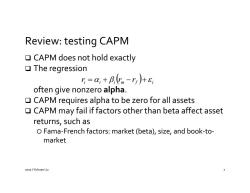

Review:testing CAPM CAPM does not hold exactly ▣The regression =a,+B,(m-r)+E often give nonzero alpha. CAPM requires alpha to be zero for all assets CAPM may fail if factors other than beta affect asset returns,such as O Fama-French factors:market(beta),size,and book-to- market 2010/Yichuan Liu

f Review: testing CAPM CAPM does not hold exactly exactly The regression ri i irm rf i often give nonzero alpha. CAPM requires alpha to be zero for all assets CAPM may f i al if f t ac ors other than b t e a affect asset returns, such as oFama‐French factors: factors: market (beta), (beta), size, and book‐to‐ market 2010 / Yichuan Liu 7

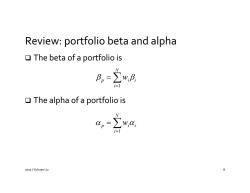

Review:portfolio beta and alpha The beta of a portfolio is B,=立A The alpha of a portfolio is ap=∑w,a i-1 2010/Yichuan Liu 8

Review: portfolio beta and alpha The beta of a portfolio portfolio is N p wii i1 The alpha of a portfolio is N p wii i1 2010 / Yichuan Liu 8

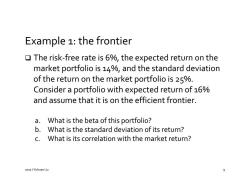

Example 1:the frontier The risk-free rate is 6%,the expected return on the market portfolio is 14%,and the standard deviation of the return on the market portfolio is 25%. Consider a portfolio with expected return of 16% and assume that it is on the efficient frontier. a. What is the beta of this portfolio? b.What is the standard deviation of its return? c.What is its correlation with the market return? 2010/Yichuan Liu

Example 1: the frontier The risk‐free rate is 6%, the expected expected return on the market portfolio is 14%, and the standard deviation of the return on the market portfolio is 25%. Consider a portfolio with expected return of 16% and assume that it is on the efficient frontier. a. What is the beta of this portfolio? b. What is the standard deviation of its return? c. What is its correlation with the market return? 2010 / Yichuan Liu 9

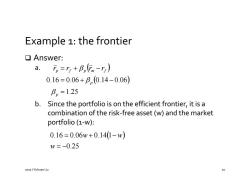

Example 1:the frontier ▣Answer: a.To=I+Bp(Fa-r) 0.16=0.06+Bn(0.14-0.06) B。=1.25 b.Since the portfolio is on the efficient frontier,it is a combination of the risk-free asset(w)and the market portfolio (1-w): 0.16=0.06w+0.141-w) w=-0.25 2010/Yichuan Liu 10

Example 1: the frontier Answer: a. rp rf p rm rf 0.16 0.06 0.14 0.06 p 1.25 p b. Since the portfolio is on the efficient frontier, it is a combination of the risk‐free asset (w) and the market portfolio (1‐w): 0.16 0.06w 0.141 w w 0.25 2010 / Yichuan Liu 10

按次数下载不扣除下载券;

注册用户24小时内重复下载只扣除一次;

顺序:VIP每日次数-->可用次数-->下载券;

- 《船舶采购、销售和运营 Ship Purchase, Sales and Operations》课程教学资源(资料)SHIPPING MARKET OUTLOOK.pdf

- 《船舶采购、销售和运营 Ship Purchase, Sales and Operations》课程教学资源:Identifying the dynamic relationship between tanker freight rates and oil prices:In the perspective of multiscale relevance.pdf

- 《船舶工程》:船舶贸易与经营——如何进行船舶报价.pdf

- 《船舶贸易与经营》课程教学资源:The Clarkson SHIPPING REVIEW & OUTLOOK.pdf

- 上海交通大学:《物流地理学 Geography of Logistics》课程教学资源(PPT课件)第四章 航空物流地理.ppt

- 上海交通大学:《物流地理学 Geography of Logistics》课程教学资源(PPT课件)第六章 国际能源物流地理.ppt

- 上海交通大学:《物流地理学 Geography of Logistics》课程教学资源(PPT课件)第八章 GIS地理信息系统.ppt

- 上海交通大学:《物流地理学 Geography of Logistics》课程教学资源(PPT课件)第五章 国际贸易与物流地理.ppt

- 上海交通大学:《物流地理学 Geography of Logistics》课程教学资源(PPT课件)第二章 国际水运物流地理(水路国际物流地理).ppt

- 上海交通大学:《物流地理学 Geography of Logistics》课程教学资源(PPT课件)第三章 陆路物流地理.ppt

- 上海交通大学:《物流地理学 Geography of Logistics》课程教学资源(PPT课件)第七章 大宗干散货和集装箱物流地理.ppt

- 上海交通大学:《物流地理学 Geography of Logistics》课程教学资源(PPT课件)第一章 国际物流地理(绪论).ppt

- 上海交通大学:《物流地理学 Geography of Logistics》课程教学资源(教学资料)The transport geography of logistics and freight distribution.pdf

- 上海交通大学:《物流地理学 Geography of Logistics》课程教学资源(教学资料)The complex network of global cargo ship movements.pdf

- 上海交通大学:《物流地理学 Geography of Logistics》课程教学资源(教学资料)Global city regions and the location of logistics activity.pdf

- 上海交通大学:《物流地理学 Geography of Logistics》课程教学资源(教学资料)Empirical analysis of the worldwide maritime transportation network.pdf

- 上海交通大学:《物流地理学 Geography of Logistics》课程教学资源(教学资料)Emerging inter-industry partnerships between shipping lines and stevedores.pdf

- 上海交通大学:《物流地理学 Geography of Logistics》课程教学资源(教学资料)A REVIEW OF THE MARITIME CONTAINER SHIPPING INDUSTRY AS A COMPLEX ADAPTIVE SYSTEM.pdf

- 上海交通大学:《物流地理学 Geography of Logistics》课程教学资源(教学资料)1 THE WORLDWIDE MARITIME NETWORK OF CONTAINER SHIPPING:SPATIAL STRUCTURE AND REGIONAL DYNAMICS.pdf

- 上海交通大学:《物流地理学 Geography of Logistics》课程教学资源(教学资料)The hub network design problem.pdf

- 上海交通大学:《船舶采购、销售和运营 Ship Purchase, Sales and Operations》课程教学资源(PPT讲稿)Shipping Market Outlook.ppt

- 《船舶采购、销售和运营 Ship Purchase, Sales and Operations》课程教学资源(资料)Investment timing and trading strategies in the sale and purchase market for ships.pdf

- 《船舶采购、销售和运营 Ship Purchase, Sales and Operations》课程教学资源(资料)MEMORANDUM OF AGREEMENT.pdf

- 《船舶采购、销售和运营 Ship Purchase, Sales and Operations》课程教学资源(资料)QUANTITATIVE METHODS IN SHIPPING:A SURVEY OF CURRENT USE AND FUTURE TRENDS.pdf

- 《船舶采购、销售和运营 Ship Purchase, Sales and Operations》课程教学资源(资料)Return and volatility spillovers between china and world oil markets.pdf

- 《船舶采购、销售和运营 Ship Purchase, Sales and Operations》课程教学资源(资料)Systemic risk and causality dynamics of the world international shipping market.pdf

- 《船舶采购、销售和运营 Ship Purchase, Sales and Operations》课程教学资源(资料)The dynamics between freight volatility and fleet size growth in dry bulk shipping markets.pdf

- 《船舶采购、销售和运营 Ship Purchase, Sales and Operations》课程教学资源(资料)Materials to read for 2014-2015_SRO_Autumn_2008_SHIPPING MARKET OUTLOOK.pdf

- 《船舶采购、销售和运营 Ship Purchase, Sales and Operations》课程教学资源(PPT讲稿)Ruling Ship Sale & Purchase(NSF93).pptx

- 《船舶采购、销售和运营 Ship Purchase, Sales and Operations》课程教学资源(资料)Understanding on Clause 6 and 11.pptx

- 《船舶采购、销售和运营 Ship Purchase, Sales and Operations》课程教学资源(PPT讲稿)The NSF 93 Items 船舶贸易.ppt

- 上海交通大学:《船舶采购、销售和运营 Ship Purchase, Sales and Operations》课程教学资源(PPT讲稿)Shipping Index.ppt

- 上海交通大学:《船舶采购、销售和运营 Ship Purchase, Sales and Operations》课程教学资源(PPT讲稿)第一章 Shipping Market Outlook.ppt

- 上海交通大学:《船舶采购、销售和运营 Ship Purchase, Sales and Operations》课程教学资源(PPT讲稿)第七章 航运指数介绍.ppt

- 上海交通大学:《船舶采购、销售和运营 Ship Purchase, Sales and Operations》课程教学资源(PPT讲稿)第三章 船价的详细估算.ppt

- 上海交通大学:《船舶采购、销售和运营 Ship Purchase, Sales and Operations》课程教学资源(PPT讲稿)第九章 船舶贸易谈判及合同履约.ppt

- 上海交通大学:《船舶采购、销售和运营 Ship Purchase, Sales and Operations》课程教学资源(PPT讲稿)第二章 船舶建造工程报价 第二节 造船成本的组成及其估算(2/2)、第三节 船价的组成.ppt

- 上海交通大学:《船舶采购、销售和运营 Ship Purchase, Sales and Operations》课程教学资源(PPT讲稿)第二章 船舶建造工程报价 第一节 报价的原则和程序、第二节 造船成本的组成及其估算(1/2).ppt

- 上海交通大学:《船舶采购、销售和运营 Ship Purchase, Sales and Operations》课程教学资源(PPT讲稿)第五章 二手船及废船交易.ppt

- 上海交通大学:《船舶采购、销售和运营 Ship Purchase, Sales and Operations》课程教学资源(PPT讲稿)第八章 二手船买卖标准合同.ppt