对外经济贸易大学:《公司理财 CORPORATE FINANCIAL CORPORATE FINANCIAL》课程教学资源(试题)QUIZ 4

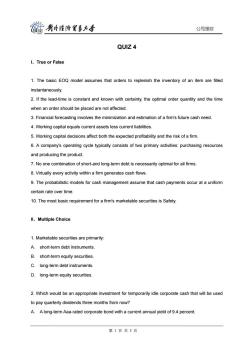

旋剥经降贸墨去号 公司理财 QUIZ 4 I.True or False 1.The basic EOQ model assumes that orders to replenish the inventory of an item are filled instantaneously. 2.If the lead-time is constant and known with certainty,the optimal order quantity and the time when an order should be placed are not affected. 3.Financial forecasting involves the minimization and estimation of a firm's future cash need. 4.Working capital equals current assets less current liabilities. 5.Working capital decisions affect both the expected profitability and the risk of a firm. 6.A company's operating cycle typically consists of two primary activities:purchasing resources and producing the product. 7.No one combination of short-and long-term debt is necessarily optimal for all firms. 8.Virtually every activity within a firm generates cash flows. 9.The probabilistic models for cash management assume that cash payments occur at a uniform certain rate over time. 10.The most basic requirement for a firm's marketable securities is Safety. ll.Multiple Choice 1.Marketable securities are primarily: A.short-term debt instruments B.short-term equity securities. C.long-term debt instruments. D.long-term equity securities. 2.Which would be an appropriate investment for temporarily idle corporate cash that will be used to pay quarterly dividends three months from now? A.A long-term Aaa-rated corporate bond with a current annual yield of 9.4 percent. 第1页共3页

公司理财 QUIZ 4 I.True or False 1. The basic EOQ model assumes that orders to replenish the inventory of an item are filled instantaneously. 2. If the lead-time is constant and known with certainty, the optimal order quantity and the time when an order should be placed are not affected. 3. Financial forecasting involves the minimization and estimation of a firm's future cash need. 4. Working capital equals current assets less current liabilities. 5. Working capital decisions affect both the expected profitability and the risk of a firm. 6. A company's operating cycle typically consists of two primary activities: purchasing resources and producing the product. 7. No one combination of short-and long-term debt is necessarily optimal for all firms. 8. Virtually every activity within a firm generates cash flows. 9. The probabilistic models for cash management assume that cash payments occur at a uniform certain rate over time. 10. The most basic requirement for a firm's marketable securities is Safety. II.Multiple Choice 1. Marketable securities are primarily: A. short-term debt instruments. B. short-term equity securities. C. long-term debt instruments. D. long-term equity securities. 2. Which would be an appropriate investment for temporarily idle corporate cash that will be used to pay quarterly dividends three months from now? A. A long-term Aaa-rated corporate bond with a current annual yield of 9.4 percent. 第 1 页 共 3 页

链潮4将置多大号 公司理财 B.A 30-year Treasury bond with a current annual yield of 8.7 percent. C.Ninety-day commercial paper with a current annual yield of 6.2 percent. D.Common stock that has been appreciating in price 8 percent annually,on average,and paying a quarterly dividend that is the equivalent of a 5 percent annual yield. 3.In determining an optimal credit extension policy,which of the following controllable variables should a company's financial manager consider? A.collection effort,credit standards,and multilateral netting B.credit standards,credit terms,and collection effort C.credit terms,credit standards,and inventory cycle D.credit terms,credit standards,and lead time 4.Which of the following is part of the five C's of capital? A.character,capital,and conditions B.capital,conditions,and cash discount C.capital,collateral,and credit period D.None of the above 5.The basic EOQ model makes a number of assumptions,including: A.fluctuating demand B.uncertain lead times C.zero lead-time D.none of the above 6.Wing Corporation's annual carrying costs are 25 percent of the inventory value.The product cost is $65 a unit.The cost of placing an order is $100,and the EOQ is 785 units.If the corporation plans to sell 50,000 units next year,what should be the total annual ordering and carrying costs? A.$12,748 B.$31,882 C.$6,442 D.$2,506,378 第2页共3页

公司理财 B. A 30-year Treasury bond with a current annual yield of 8.7 percent. C. Ninety-day commercial paper with a current annual yield of 6.2 percent. D. Common stock that has been appreciating in price 8 percent annually, on average, and paying a quarterly dividend that is the equivalent of a 5 percent annual yield. 3. In determining an optimal credit extension policy, which of the following controllable variables should a company's financial manager consider? A. collection effort, credit standards, and multilateral netting B. credit standards, credit terms, and collection effort C. credit terms, credit standards, and inventory cycle D. credit terms, credit standards, and lead time 4. Which of the following is part of the five C's of capital? A. character, capital, and conditions B. capital, conditions, and cash discount C. capital, collateral, and credit period D. None of the above 5. The basic EOQ model makes a number of assumptions, including: A. fluctuating demand B. uncertain lead times C. zero lead-time D. none of the above 6. Wing Corporation's annual carrying costs are 25 percent of the inventory value. The product cost is $65 a unit. The cost of placing an order is $100, and the EOQ is 785 units. If the corporation plans to sell 50,000 units next year, what should be the total annual ordering and carrying costs? A. $12,748 B. $31,882 C. $6,442 D. $2,506,378 第 2 页 共 3 页

链典4矮降贸多大 公司理财 7.Large cash balances have made many firms A.poor investments B.attractive takeover targets C.raise their compensating balances D.decrease their float 8.Which of the following is a reason for a firm to hold liquid asset balances? A.transactional motive B.income tax motive C.future requirements D.both a and c 9.Which of the following criteria should be considered when investing in marketable securities? A.default risk B.maturity date C.rate of return D.all of the above 10.If credit terms of"2/10,net 40"are offered,the approximate cost of not taking the discount and paying at the end of the credit period would be closest to which of the following?(Assume a 365-day year.) A.18.6% B.24.3% C.24.8% D.30.0% 第3页共3页

公司理财 7. Large cash balances have made many firms ________. A. poor investments B. attractive takeover targets C. raise their compensating balances D. decrease their float 8. Which of the following is a reason for a firm to hold liquid asset balances? A. transactional motive B. income tax motive C. future requirements D. both a and c 9. Which of the following criteria should be considered when investing in marketable securities? A. default risk B. maturity date C. rate of return D. all of the above 10. If credit terms of "2/10, net 40" are offered, the approximate cost of not taking the discount and paying at the end of the credit period would be closest to which of the following? (Assume a 365-day year.) A. 18.6% B. 24.3% C. 24.8% D. 30.0% 第 3 页 共 3 页

按次数下载不扣除下载券;

注册用户24小时内重复下载只扣除一次;

顺序:VIP每日次数-->可用次数-->下载券;

- 对外经济贸易大学:《公司理财 CORPORATE FINANCIAL CORPORATE FINANCIAL》课程教学资源(试题)QUIZ 3.pdf

- 对外经济贸易大学:《公司理财 CORPORATE FINANCIAL CORPORATE FINANCIAL》课程教学资源(试题)QUIZ 2.pdf

- 对外经济贸易大学:《公司理财 CORPORATE FINANCIAL CORPORATE FINANCIAL》课程教学资源(试题)QUIZ 1.pdf

- 对外经济贸易大学:《公司理财 CORPORATE FINANCIAL CORPORATE FINANCIAL》课程教学资源(试题)EXAM PAPER 2(含答案).pdf

- 对外经济贸易大学:《公司理财 CORPORATE FINANCIAL CORPORATE FINANCIAL》课程教学资源(试题)EXAM PAPER 1(含答案).pdf

- 对外经济贸易大学:《公司理财 CORPORATE FINANCIAL CORPORATE FINANCIAL》课程教学资源(作业)PART VI.pdf

- 对外经济贸易大学:《公司理财 CORPORATE FINANCIAL CORPORATE FINANCIAL》课程教学资源(作业)PART V.pdf

- 对外经济贸易大学:《公司理财 CORPORATE FINANCIAL CORPORATE FINANCIAL》课程教学资源(作业)PART IV.pdf

- 对外经济贸易大学:《公司理财 CORPORATE FINANCIAL CORPORATE FINANCIAL》课程教学资源(作业)PART III.pdf

- 对外经济贸易大学:《公司理财 CORPORATE FINANCIAL CORPORATE FINANCIAL》课程教学资源(作业)PART II.pdf

- 对外经济贸易大学:《公司理财 CORPORATE FINANCIAL CORPORATE FINANCIAL》课程教学资源(作业)PART I.pdf

- 《公司理财》课程教学资源(案例)年产2300吨4%黄霉素预混剂投资项目可行性研究报告(分析附件).pdf

- 《公司理财》课程教学资源(案例)某公司年产2300吨4%黄霉素预混剂项目可行性研究报告.pdf

- 对外经济贸易大学:《公司理财 CORPORATE FINANCIAL CORPORATE FINANCIAL》课程教学资源(案例)The Antaeus licence.pdf

- 对外经济贸易大学:《公司理财 CORPORATE FINANCIAL CORPORATE FINANCIAL》课程教学资源(案例)Coleraine Yachts Ltd.pdf

- 对外经济贸易大学:《公司理财 CORPORATE FINANCIAL CORPORATE FINANCIAL》课程教学资源(案例)The Whinchat deal.pdf

- 对外经济贸易大学:《公司理财 CORPORATE FINANCIAL CORPORATE FINANCIAL》课程教学资源(案例)Kerria Carpets plc.pdf

- 对外经济贸易大学:《中国对外贸易概论》课程教学资源(课件讲稿)第十一章 服务贸易.pdf

- 对外经济贸易大学:《中国对外贸易概论》课程教学资源(课件讲稿)第十章 技术贸易.pdf

- 对外经济贸易大学:《中国对外贸易概论》课程教学资源(课件讲稿)第九章 对外贸易与国际直接投资.pdf

- 对外经济贸易大学:《公司理财 CORPORATE FINANCIAL CORPORATE FINANCIAL》课程教学资源(试题)QUIZ 5.pdf

- 对外经济贸易大学:《公司理财 CORPORATE FINANCIAL CORPORATE FINANCIAL》课程教学资源(授课教案)PART I Introduction.pdf

- 对外经济贸易大学:《公司理财 CORPORATE FINANCIAL CORPORATE FINANCIAL》课程教学资源(授课教案)PART II Determinants of Valuation.pdf

- 对外经济贸易大学:《公司理财 CORPORATE FINANCIAL CORPORATE FINANCIAL》课程教学资源(授课教案)PART III The Capital Investment Decision.pdf

- 对外经济贸易大学:《公司理财 CORPORATE FINANCIAL CORPORATE FINANCIAL》课程教学资源(授课教案)PART IV The Capital Structure and Dividend Policy.pdf

- 对外经济贸易大学:《公司理财 CORPORATE FINANCIAL CORPORATE FINANCIAL》课程教学资源(授课教案)PART V Working Capital Management.pdf

- 对外经济贸易大学:《公司理财 CORPORATE FINANCIAL CORPORATE FINANCIAL》课程教学资源(授课教案)PART VI Advanced Topics.pdf

- 对外经济贸易大学:《公司理财 CORPORATE FINANCIAL CORPORATE FINANCIAL》课程教学资源(授课教案)补充教案.pdf

- 对外经济贸易大学:《公司理财 CORPORATE FINANCIAL CORPORATE FINANCIAL》课程教学资源(授课教案)企业家需要了解的几个问题(张建平).pdf

- 对外经济贸易大学:《国际贸易实务 Practice of International Trade International Trade》课程教学资源(作业)第一章 国际贸易术语.pdf

- 对外经济贸易大学:《国际贸易实务 Practice of International Trade International Trade》课程教学资源(作业)第二章《2000 通则》中的主要贸易术语.pdf

- 对外经济贸易大学:《国际贸易实务 Practice of International Trade International Trade》课程教学资源(作业)第三章《2000 通则》中的其他贸易术语.pdf

- 对外经济贸易大学:《国际贸易实务 Practice of International Trade International Trade》课程教学资源(作业)第四章 贸易术语的运用.pdf

- 对外经济贸易大学:《国际贸易实务 Practice of International Trade International Trade》课程教学资源(作业)第五章 合同的标的物及其质量、数量与包装.pdf

- 对外经济贸易大学:《国际贸易实务 Practice of International Trade International Trade》课程教学资源(作业)第六章 国际货物运输.pdf

- 对外经济贸易大学:《国际贸易实务 Practice of International Trade International Trade》课程教学资源(作业)第七章 国际货物运输保险.pdf

- 对外经济贸易大学:《国际贸易实务 Practice of International Trade International Trade》课程教学资源(作业)第八章 商品的价格.pdf

- 对外经济贸易大学:《国际贸易实务 Practice of International Trade International Trade》课程教学资源(作业)第九章 国际货款的收付.pdf

- 对外经济贸易大学:《国际贸易实务 Practice of International Trade International Trade》课程教学资源(作业)第十章 检验、索赔与定金罚则.pdf

- 对外经济贸易大学:《国际贸易实务 Practice of International Trade International Trade》课程教学资源(作业)第十三章 国际货物买卖合同的订立.pdf